The Essential Guide to Trading with the 3 Bar Play Pattern

The 3 Bar Play is a concise and powerful pattern in day trading that leverages the momentum and reversal signals inherent in price action. This article breaks down the pattern’s structure, implementation, advantages, limitations, and how it compares to other trading strategies. By understanding and applying the 3 Bar Play, traders can enhance their market strategies, regardless of the trading environment.

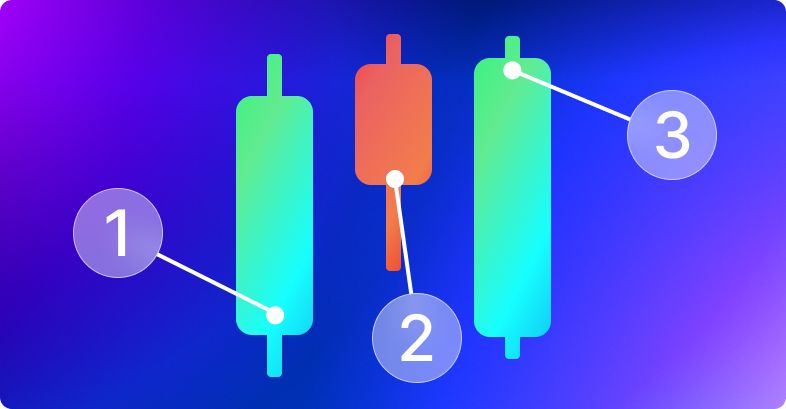

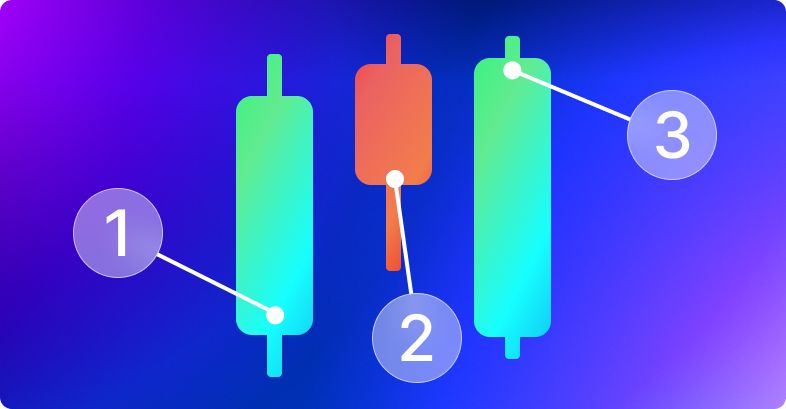

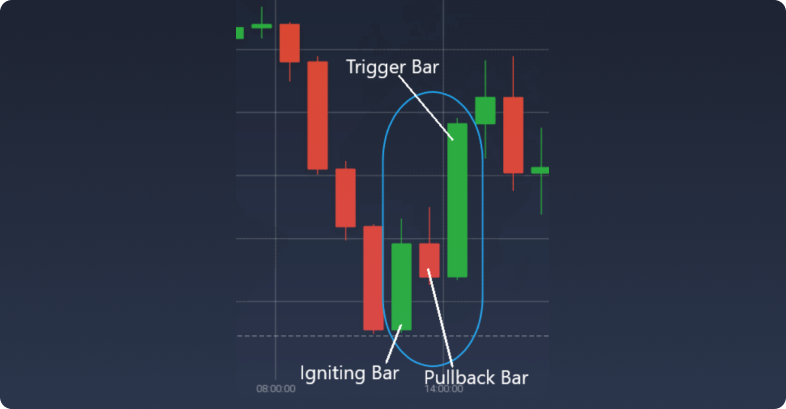

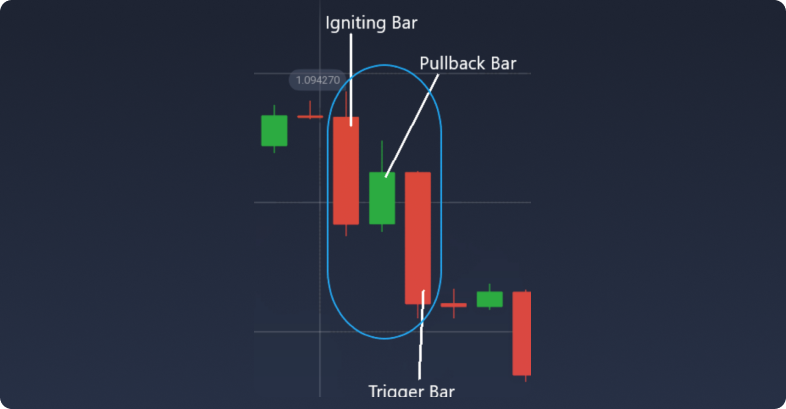

The 3 Bar Play consists of three key components: the Igniting Bar, the Pullback Bar, and the Trigger Bar. The Igniting Bar signals a strong move in a direction, the Pullback Bar indicates a slight reversal or pause in momentum, and the Trigger Bar is the confirmation that the initial momentum is resuming. This pattern is a signal for traders to enter the market with the expectation that the momentum of the Igniting Bar will continue.

To effectively integrate the 3 Bar Play into your trading arsenal, initiate by configuring your chart with a minimal set of indicators to keep the focus on price action. This strategy, recognized for its clarity and impact, emphasizes the significance of the sequence involving the igniting bar, the pullback bar, and what’s known as the 3 bar reversal pattern. The entry point is primarily determined by the closure of the trigger bar, prompting a trade in alignment with the direction initiated by the igniting bar.

Ensure to position your stop loss marginally beyond the pullback bar to safeguard against potential misleading signals. The strategy for exiting a trade is largely influenced by the market’s volatility and momentum, typically aiming for a substantial level of resistance or support lying ahead. This approach is especially potent when identifying the 3 Bar Play in stocks that we’ve chosen as the best candidates for a 3 Bar Play strategy, thanks to their notable price action pattern.

Whether you’re leaning towards a bullish 3 Bar Play for a long position or a bearish scenario for shorting, this pattern serves as a versatile tool in your trading strategy. It’s a popular method among forex traders and stock market participants alike for its ability to signal trend reversal or continuation patterns effectively. Practicing the 3 Bar Play, with its clear rules and recognizable pattern on the chart, prepares traders— from beginners to advanced—to capitalize on these swift market movements, utilizing the 3 bar play indicator and the moving average indicator as complementary tools for enhanced decision-making.

The 3 Bar Play is especially effective in markets with high volatility and liquidity, making it ideal for day trading. It’s best used during the market’s peak trading hours when volume and momentum are highest. However, recognizing the right conditions and market timing is crucial for its success.

Its simplicity and effectiveness make the 3 Bar Play a popular choice among traders. It allows for quick decisions and clear trade setups, which are valuable in the fast-moving day trading environment. Furthermore, it can be adapted to bullish and bearish markets, providing flexibility in strategy.

Despite its benefits, the 3 Bar Play is not foolproof. Its success depends heavily on market conditions, and it can be prone to false signals during periods of low volatility or conflicting market signals. Traders must be aware of these limitations and incorporate risk management strategies to mitigate potential losses.

Selecting the ideal assets for a 3 Bar Play trade is pivotal for its success. High liquidity and volatility are key characteristics to look for in stocks or currency pairs, as they ensure significant price movements for capitalizing on this strategy. Through meticulous market analysis, identify potential candidates that exhibit clear trends and momentum—qualities essential for the 3 Bar Play’s effectiveness.

For instance, in the stock market, tech giants like Apple (AAPL) and Tesla (TSLA) often exhibit the high volatility and liquidity needed for the 3 Bar Play. Their market movements are pronounced, providing clear entry and exit points. In the realm of Forex, pairs such as EUR/USD or GBP/JPY are exemplary due to their substantial volatility and the clear trends they often present, making them suitable for applying the 3 Bar Play.

Examining historical performance is also crucial. Looking at past instances where the 3 Bar Play setup has occurred can offer valuable insights. For example, Nvidia (NVDA) has historically responded well to the 3 Bar Play setup, with significant price movements following the pattern’s emergence. Similarly, in Forex, the USD/JPY pair has shown a propensity for strong trend reversals, making it a prime candidate for this trading strategy.

By focusing on assets with these characteristics and examining their historical reactions to the 3 Bar Play setup, traders can better position themselves to capitalize on this strategy’s benefits. Remember, while these examples serve as a guide, continuous market analysis and vigilance are essential for identifying the most promising opportunities.

The 3 Bar Play can be adapted for both bullish and bearish reversals by identifying the pattern in the context of the prevailing market trend. For bullish reversals, look for the pattern at the end of a downtrend, and for bearish reversals, find it at the peak of an uptrend. The key is in the confirmation of the Trigger Bar, which should convincingly break in the direction of the new trend.

While the 3 Bar Play originated in stock trading, it’s adaptable to the Forex market and other trading instruments. The principle remains the same, but traders should account for the increased volatility and 24-hour trading cycle of the Forex market. This includes adjusting stop loss and exit strategies to accommodate for wider swings in price.

Before diving into live trading with the 3 Bar Play, practice using trading simulators. Simulation trading allows you to familiarize yourself with the pattern’s nuances without financial risk. Gradually transition to real trades, starting with small positions and scaling up as you gain confidence and experience.

Success with the 3 Bar Play requires discipline, continuous learning, and adaptability. Avoid common pitfalls such as overtrading, ignoring risk management, and trading based on emotion. Stay informed about market conditions, and always have a clear plan for each trade.

The best candidates for a 3 Bar Play trade are stocks or currency pairs with high liquidity and volatility. Use market analysis to identify potential candidates, focusing on those with clear trends and momentum. Analyzing historical performance can also provide insights into how certain assets respond to the 3 Bar Play setup.

Successful application of the 3 Bar Play requires an understanding of market conditions and timing. Look for periods of high liquidity and volatility, such as market openings or after major economic announcements. Avoid using the strategy in sideways or choppy markets where the pattern is less reliable.

Incorporate support and resistance levels into your 3 Bar Play strategy to identify potential entry and exit points. These levels can provide additional confirmation for the pattern and help in setting more precise targets and stop-loss orders.

In conclusion, the 3 Bar Play is a versatile and effective pattern for day traders, offering clear entry and exit strategies based on price action. However, its success hinges on the trader’s ability to understand market conditions, apply strict risk management, and remain disciplined. By mastering the 3 Bar Play, traders can potentially capitalize on market momentum, enhancing their trading arsenal.