Ultimate Trading Prop Firm

What you will get

Assessment prep at the PRO Club

Boost your chances of passing the assessment with our advanced training program

-

Extra assessment rounds

Choose a plan with three or twelve assessment accounts instead of just one

-

0 spreads EUR/USD

Lowest spreads in prop trading

-

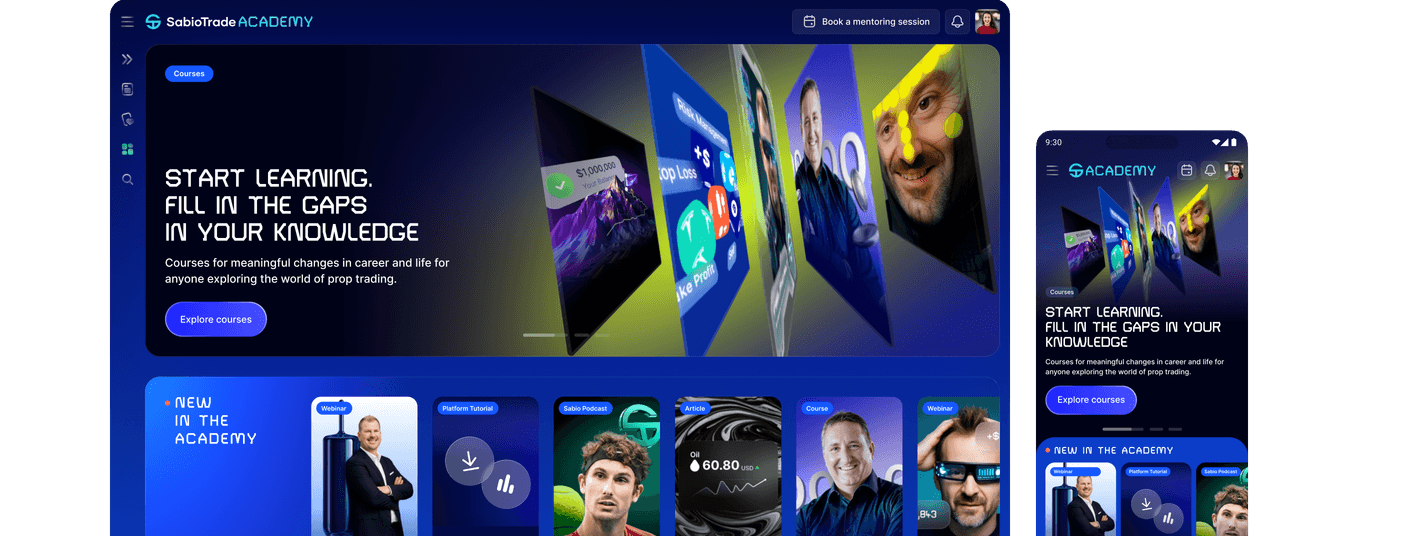

Extended Sabio Academy access

Learn market theory from pro mentors and dive into real-time platform practice.

-

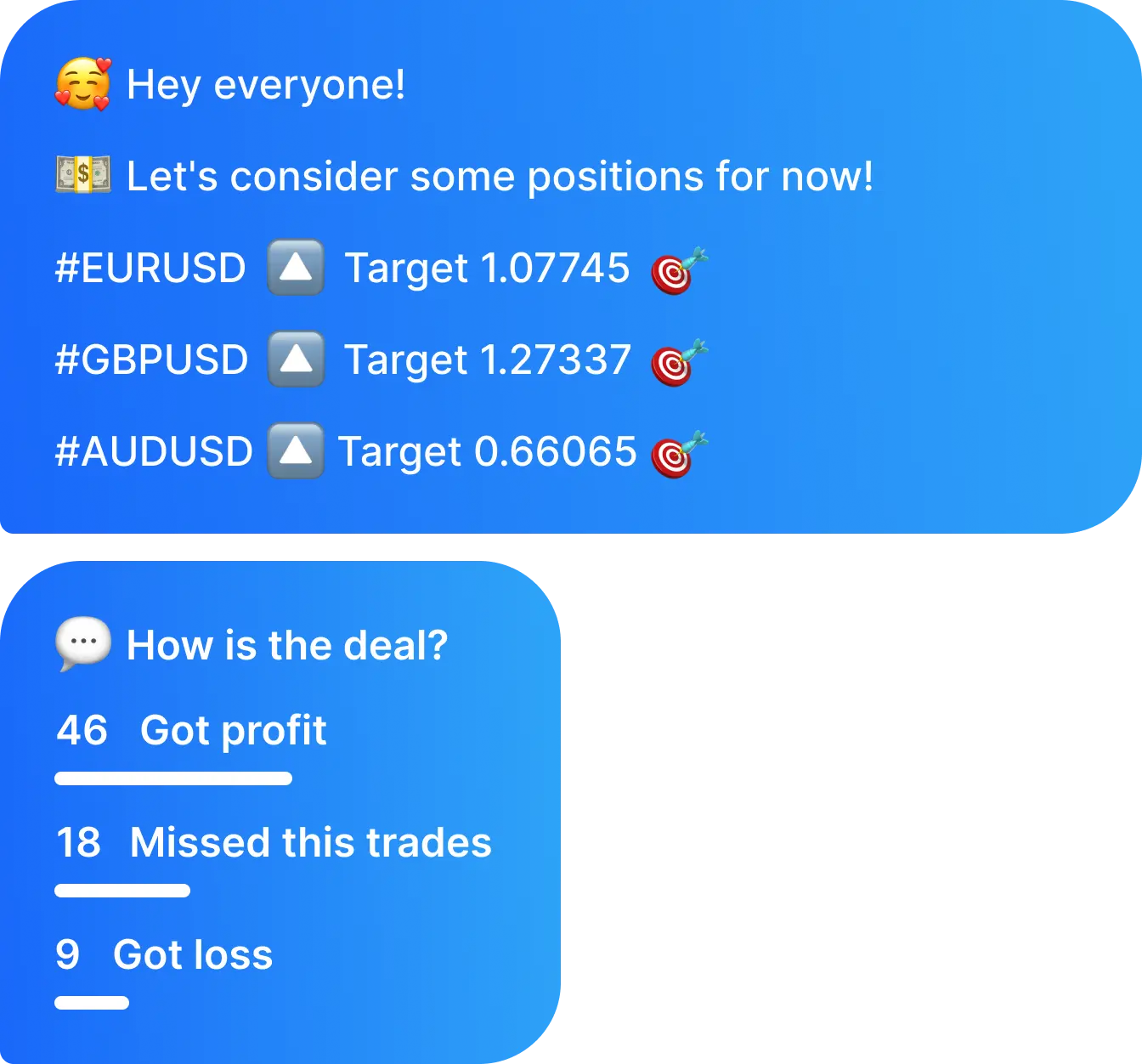

Free signals

Daily drops of market triggers in a secret Telegram channel

-

Webinars

Join them live or catch the recording at your convenience

-

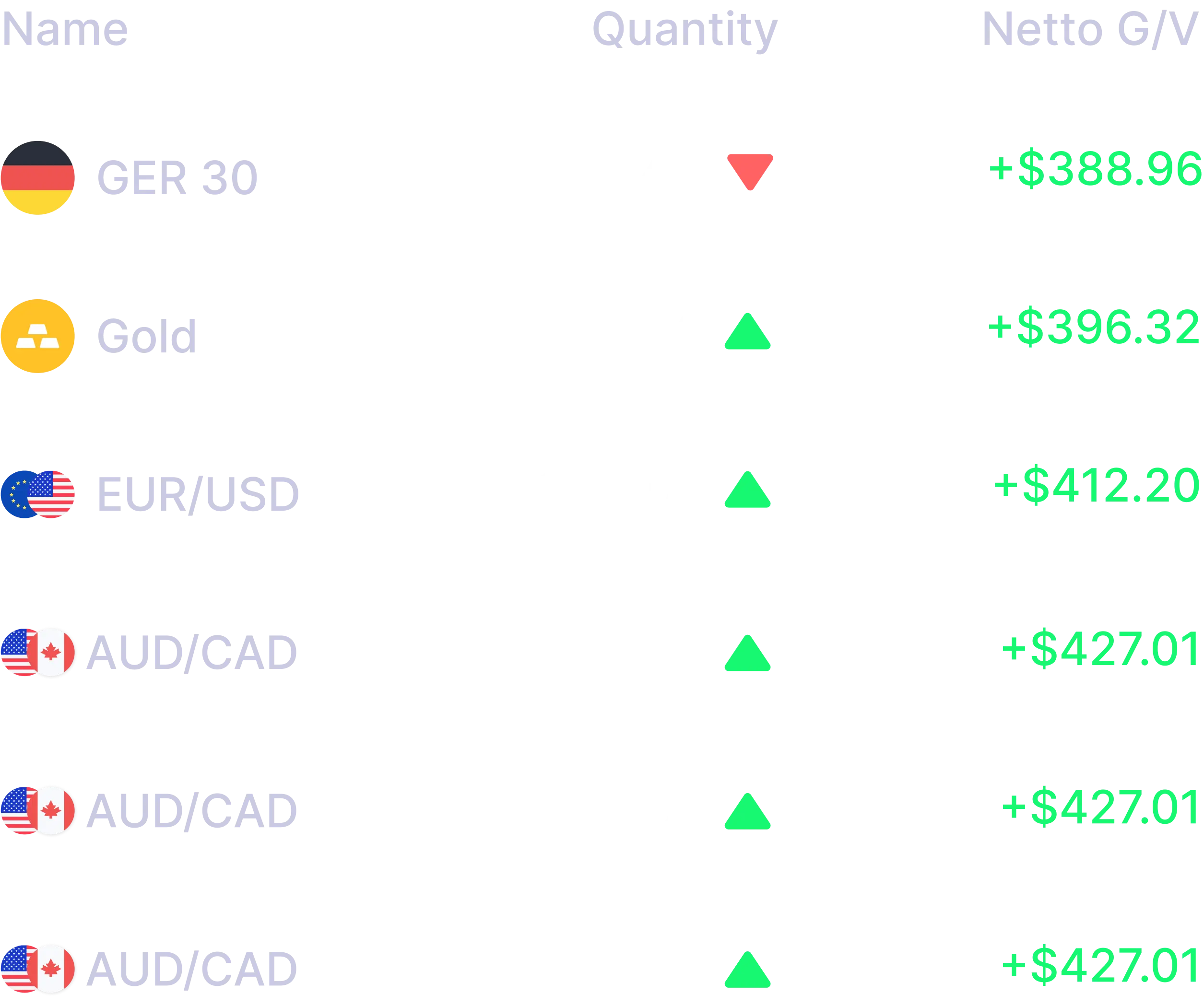

Trade analysis

Get pro insights on your trades and mistakes

Compare PRO and Essential

Get the one that matches your vibe

Swipe for more

*Zero spreads are provided on assessment accounts on specific FX pairs at a specific time

Choose your tariff

Compare tariffs

Get a funded account with Trading Academy

Get a funded account with Trading Academy

A Smarter Way to Train for the Prop Challenge

Built by real pro traders, the SabioTrade Academy is now completely refreshed — clearer, richer, and and designed to get you results. Master proven strategies and uncover insights most traders miss.

Access to the Academy is already included in all plans.

London Trader Show AWARDS 2025

Best Prop Firm 2025

Sabio traders’ voices

Frequently Asked Questions

SabioTrade's rules include a 5% Daily Loss Limit, a 6% Max Trailing Drawdown, and a requirement to place at least one trade every 30 days. These rules are designed to promote responsible trading and effective risk management, helping traders maintain a disciplined approach to their trading activities.

The 5% Daily Loss Limit at SabioTrade is calculated based on the previous day's end-of-day balance. If your balance was $100,000 at the end of the day, you must ensure that your equity does not drop below $95,000 the next day to avoid a hard breach.

The Maximum Trailing Drawdown is a key component of SabioTrade’s risk management system, designed to evaluate traders' ability to preserve capital and manage risk effectively. It is dynamic, meaning it adjusts based on your account’s performance, and it ensures that traders adhere to sustainable trading practices.

Key Components of the System

- High Water Mark (HWM):

The HWM is the highest balance your account has ever reached based on closed trades. It represents your peak trading performance and serves as the reference point for calculating your drawdown limits.

- If you make profits and close trades, the HWM is updated to this new peak.

- If you experience losses, the HWM remains unchanged.

- Maximum Drawdown Limit (Lowest Equity Allowed):

This is the lowest your equity (balance + open trades) can drop before breaching your account. It is calculated as 6% below the HWM.

- Formula: Maximum Drawdown Limit = HWM - (6% of Initial Balance)

- Example: If your HWM is $52,815.90, the Maximum Drawdown Limit is: $52,815.90 - $6,000 = $49,646.95.

- Current Equity and Balance:

- Current Balance: The total value of your account from closed trades.

- Current Equity: The real-time value of your account, including both closed trades and open positions.

Your equity fluctuates with the market, and you must monitor it closely to ensure it stays above the Maximum Drawdown Limit.

Dynamic Adjustments

The system is dynamic, meaning the drawdown limit adjusts whenever your account hits a new HWM. This ensures that:

- Profits are protected as the drawdown threshold rises with your account performance.

- You’re encouraged to manage risk effectively while maintaining capital preservation.

For example:

- If your HWM increases to $102,000, your new Maximum Drawdown Limit is $96,000 ($102,000 - $6,000).

- If your equity drops below this threshold, your account will breach.

Why It’s Important

- Risk Control: The Maximum Trailing Drawdown ensures you manage your trading responsibly by limiting losses to a manageable percentage.

- Profit Preservation: The trailing mechanism protects a portion of your profits, even if trades start moving unfavorably.

- Alignment with Real Markets: This system mirrors real-world trading conditions, where effective risk management is essential for success.

How to Use This Information

- Monitor your Max Trailing Drawdown to understand how close you are to breaching the drawdown limit.

- Use your HWM and Maximum Drawdown Limit as benchmarks for managing risk and preserving your capital.

- Adjust your trading strategy to recover equity and stay within permissible drawdown limits.

By understanding and utilizing this system, you can enhance your trading discipline and ensure sustainable growth on the SabioTrade platform. Take into account that it is possible, and often very common, to breach your account due to exceeding the 6% Maximum Drawdown Limit without exceeding the 5% Daily Loss Limit.

In the funded account, after the first payout has been requested, the equity cannot fall below the initial account balance.

SabioTrade offers leverage that varies by asset class: up to 30:1 for Forex, 20:1 for equities and indices, 25:1 for commodities, and 3:1 for cryptocurrencies. This allows traders to maximize their potential returns while managing risk appropriately.

No, there are no monthly fees for trading at SabioTrade. This ensures a cost-effective trading environment where you can focus on growing your account without worrying about recurring charges

High-Frequency Trading (HFT) is not permitted at SabioTrade. This policy helps maintain a fair and stable trading environment by promoting responsible and sustainable trading practices.

Yes, traders can use their own automated trading software or algorithms. However, SabioTrade does not provide or endorse any specific tools, and traders are responsible for ensuring their proper functionality and compliance with our trading rules.

Overnight trading is allowed, but weekend trading availability depends on the specific account you acquire. Some account packages may not permit holding positions over the weekend. Traders should review their package conditions to understand the restrictions applicable to their accounts. In case weekend trading is not permitted, all positions must be closed by Friday 3:45pm EST. This helps manage risk during periods of potential market volatility.

At SabioTrade, we strive to maintain a trading environment focused on sustainable, transparent, and disciplined strategies. While we understand the appeal of hedging to some traders, it is not permitted on our platform. This policy helps ensure fairness, promotes effective risk management, and aligns with the principles we encourage in our trading community.

We aim to empower traders to grow their skills and succeed through clear strategies and responsible trading practices.

A hard breach, such as violating the Daily Loss Limit or Max Trailing Drawdown, results in account closure. A soft breach, which involves other rule violations, leads to the closure of trades that violated the rule but allows the account to remain active.

No, the assessment at SabioTrade is not time-limited. You can take as long as you need, as long as you place at least one trade every 30 days. If you quickly achieve a 10% profit, such as within a few hours, it is considered a successful assessment, allowing you to receive your funded account. This approach emphasizes evaluating your trading skills and performance without imposing strict time constraints, ensuring you can progress at your own pace.

No, strategies that involve scalping are not permitted on SabioTrade. This restriction is in place to maintain fair trading practices and ensure compliance with our platform’s guidelines.

We encourage traders to focus on sustainable trading strategies that align with long-term risk management and profitability goals. For more information on our trading rules, please refer to our Terms and Conditions.

SabioTrade offers accounts with starting balances up to $200,000 to enhance risk management and provide tailored solutions. Currently, scaling plans are not available. This approach safeguards both traders' earnings and the company's resources, ensuring a secure trading environment.

No, multiple accounts cannot be merged. Each account operates independently to maintain risk management and provide greater control over individual trading strategies.

SabioTrade offers profit splits ranging from 80/20 to 90/10. Payouts are processed within 24 hours, ensuring prompt access to your earnings.

Profits can be withdrawn via bank transfer with no minimum payout amount. However, small amounts may not cover bank fees, so it's advisable to check with your bank.

Traders must provide proof of identity (passport, ID card, or driver’s license) and proof of address (utility bill, bank statement). Additionally, signing the service agreement is required.

The challenge account is received immediately after completing the payment process, allowing traders to start their assessment without delay.

To maintain account activity, traders must place at least one trade every 30 days. This ensures continued assessment of trading skills and account management.

SabioTrade charges a one-time fee for accessing the assessment plan. There are also overnight fees for holding positions, deducted from the account balance.

Traders can hold multiple accounts but are advised not to have two accounts of the same type and balance concurrently to avoid confusion and ensure efficient management.

To download our trading platform, you can follow these steps:

1 - Desktop Application:

*The desktop application can be downloaded by clicking on the button that appears on top of the traderoom loading screen. Simply follow the on-screen instructions to complete the download and installation process.

2 - Mobile app:

* Android: https://sabiotrade.com/storage/SabioTradeAndroidApp.apk

* iOS: https://apps.apple.com/app/sabiotrade/id6499502645

Withdrawals can be requested every 7 days, giving you regular access to your profits. To ensure a smooth and seamless payout process, please make sure the following conditions are met before submitting your request:

- Your account is fully Verified.

- There are no open trades on the account you’re withdrawing from.

- There are no pending withdrawals from your account.

- At least 7 days have passed since your last withdrawal was approved.

- You have completed at least 1 new trade (opened and closed) since your last withdrawal.

These straightforward steps are in place to maintain efficient payouts and help ensure that you can manage your profits with ease. We’re committed to providing a transparent and trader-friendly withdrawal experience!

Day Trading accounts are a new type of assessment account designed for traders who prefer short-term strategies. All positions in these accounts automatically close at the end of the trading day, meaning no trades are carried overnight or across sessions. These accounts also offer higher leverage compared to standard accounts and include full access to Sabio Academy’s training materials.

You can submit a request on the Profit Share section of the SabioDashboard. Your account will be temporarily frozen to withdraw your profit and deduct the profit share. To be eligible to receive a payout from your funded account, your account should meet the following requirements:

1. All open positions in the funded account must be closed.

2. At least 7 days must have passed since your last payout request from that account.

3. Your trading must show consistency: at least 5–7 trades of comparable size and no single trade representing more than 40% of your total profit. Our team may review your trading history to confirm that your approach reflects sustainable trading and proper risk management.

Consistency is key to long-term success and eligibility for payouts. To meet our rules:

1. You should place at least 5–7 trades of similar size before requesting a payout.

2. No single trade can contribute more than 40% of your total profit.

3. Our team may review your trading history and results at any time in order to assess your trading style and risks management strategies.

Remember: these rules are designed to protect both your profits and the company's capital, while encouraging disciplined and sustainable trading habits.

Traders from Europe, the UK, Australia, and Canada can now get a FREE Flash Account — an intraday account with $20,000 balance and 1:100 leverage (all positions close by end of day).

Just post a video review about your experience with SabioTrade and what you think of our platform in Youtube or your Social Media. Send your video link to marketing@sabiotrade.com to claim your Flash Account and start trading! ⚡

Proprietary trading, or prop trading, involves using a firm's capital to trade various financial instruments like stocks, bonds, commodities, and derivatives. SabioTrade leverages traders' expertise and advanced technology to generate profits, offering a supportive environment where traders can focus on executing successful strategies and making informed investment decisions.

Earnings at SabioTrade are directly tied to a trader's skills, strategies, and market conditions. There are no predefined limits on profits, meaning your earning potential is unlimited. With dedication and effective trading approaches, traders have the opportunity to grow their accounts significantly, benefiting from the firm's resources and support.

SabioTrade is recognized for its credibility and commitment to excellence. The company has been featured in prestigious digital magazines, invited to international events, and sponsors young athletes in world-class competitions. These accomplishments highlight SabioTrade's dedication to empowering traders and contributing positively to the industry and community.

To start trading with SabioTrade, visit the website, select a suitable plan, complete the registration and payment process, and begin your trading assessment. The process is straightforward, allowing traders to quickly embark on their journey towards financial independence with the support and resources provided by SabioTrade.

To start trading with SabioTrade, visit the website, select a suitable plan, complete the registration and payment process, and begin your trading assessment. The process is straightforward, allowing traders to quickly embark on their journey towards financial independence with the support and resources provided by SabioTrade.

Traders can hold positions overnight at SabioTrade, with associated fees. However, weekend trading depends on the specific account package. Some packages may not permit holding positions over the weekend. Traders should review their package conditions to understand the restrictions applicable to their accounts.

Yes, SabioTrade offers a free trial account valid for 7 days. This trial allows traders to familiarize themselves with the platform and experience the assessment process without financial risk. It's an excellent opportunity to explore SabioTrade's offerings and assess whether the platform suits your trading goals.

Payouts at SabioTrade are guaranteed, provided that trading activities comply with the company's Terms and Conditions and Service Agreement. This commitment ensures that traders can reliably access their earnings, fostering trust and confidence in SabioTrade's support for their financial goals.

SabioTrade offers a diverse range of trading instruments, including Forex pairs, stocks, commodities, indices, ETFs, and cryptocurrencies. This variety allows traders to build a well-rounded portfolio, apply different strategies, and take advantage of various market opportunities to achieve their trading objectives.

During the assessment phase, the relationship is governed by the Terms and Conditions outlined on the SabioTrade website. Once a trader passes the assessment, they sign a binding Service Agreement, formalizing their status as a funded trader. This agreement sets out the terms and responsibilities for trading with SabioTrade's capital.

Our risk management technology is currently integrated with QuadCode trading platform. When using SabioTrade free trial, assessment, or funded accounts, you will be trading on a QuadCode powered trading platform, directly from your SabioDashboard. You will have everything you need for a pleasant and successful trading experience in the same place.

Yes – and it’s all about making your experience smoother and more cost-effective!

To better support our global trader community, we've introduced a pricing structure to match your local currency, helping you avoid unnecessary conversion fees and making payments even more convenient:

- European countries – pay in EUR

- United Kingdom – pay in GBP

- Rest of the world – pay in USD

This applies only to the purchase of assessment accounts. Your trading experience remains fully in USD:

- Account balances (assessment & funded) stay in USD

Payouts will be deducted from the trading balance in USD. For European and UK clients, payouts will be displayed in both USD and EUR, and paid in Euro.

This change means easier payments, fewer fees, and more clarity, while keeping everything consistent and streamlined where it matters most — in your trading journey and profits.

As a prop trading firm, SabioTrade provides you with simulated capital to trade in a real market environment.

This allows you to demonstrate your skills, strategies, and risk management without putting your personal funds at risk. The capital you see in your account is not real, but it mirrors real trading conditions, giving you the chance to show your performance in a meaningful, data-driven way.

Great question — and here's the exciting part: your profits can still be real!

While you trade with fictitious capital, your performance is tracked in real time. If you manage your account successfully and generate consistent profit, you become eligible for real financial rewards.

This reward is not based on the capital itself, but on the value of your trading data and skillset. SabioTrade recognizes profitable traders by sharing a portion of those results in the form of real payouts.

So even though the capital is virtual, your opportunity to earn real money is 100% real — just prove your strategy, manage risk, and trade like a pro.

We welcome traders from all around the world who are of legal age in their country of residence. Most traders can join us without issue. However, please note that we cannot accept U.S. citizens under any circumstances, even if they live abroad or hold another citizenship. Additionally, there are a few countries where our services are not available — you can find the full list in our Terms & Conditions.