Tips to Master Trading Psychology in Funded Account Trading

Funded account trading refers to a system where traders are provided with capital by a proprietary trading firm to trade in the financial markets. The prop firm covers the trader’s losses up to a certain limit, but also shares in the profits. This type of trading is intrinsically linked to trading psychology because managing someone else’s capital can intensify emotional and psychological pressures. Traders must maintain a strong psychological mindset to handle the unique challenges of funded trading programs effectively.

The importance of psychological preparation in funded trading cannot be overstated. A trader’s ability to manage their emotions and maintain discipline directly impacts their performance and profitability. Without proper mental fortitude, even the best trading strategies can fail. Thus, understanding and mastering trading psychology is crucial for anyone looking to succeed in funded trading.

hTraders in funded account programs often face significant mental challenges. Fear of loss is a common issue, especially when trading with someone else’s money. This fear can lead to hesitation, missed opportunities, and suboptimal trading decisions. On the other hand, greed can drive traders to take excessive risks, hoping for high rewards but often leading to substantial losses.

Emotional burnout is another challenge, resulting from the constant pressure to achieve financial goals and maintain profitability. Doubts about one’s own abilities can further exacerbate these issues, leading to a negative feedback loop where poor performance undermines confidence, which in turn leads to more poor performance. Managing these psychological challenges is essential for long-term success in the trading industry.

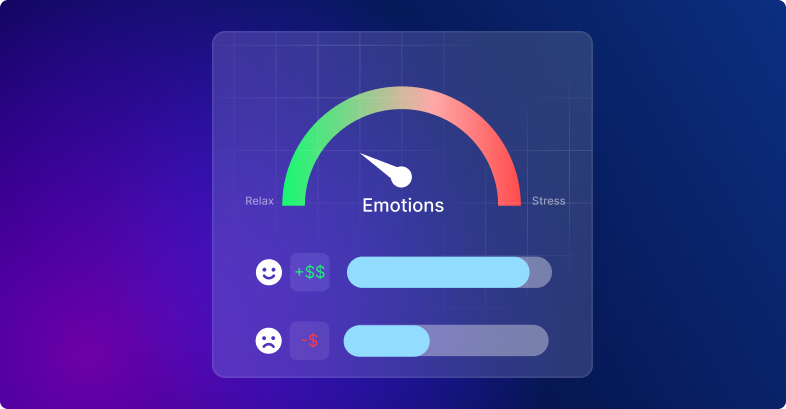

Effective emotion management is key to becoming a successful trader. Techniques such as meditation and breathing exercises can help traders stay calm and focused, reducing stress and improving concentration. Regular practice of these techniques can enhance a trader’s ability to maintain a clear mind during trading sessions, crucial for making rational decisions.

Keeping a trader’s diary is another effective method. By recording daily trading activities and the emotions experienced, traders can identify patterns and triggers for emotional responses. This self-awareness allows for better control over one’s reactions to market fluctuations. Developing emotional intelligence is also vital, as it enables traders to recognize and manage their emotions, leading to better decision-making and improved trading outcomes.

Discipline and self-control are fundamental to successful trading. Following a trading plan and established rules helps traders stay consistent and avoid impulsive decisions. A well-structured trading routine is crucial for maintaining discipline, especially in the fast-paced and often unpredictable financial markets.

Methods to increase self-discipline include setting clear, achievable goals and creating a daily schedule that incorporates regular analysis of trading activities. Regularly reviewing and analyzing your actions helps identify strengths and weaknesses, promoting continuous improvement. This disciplined approach to trading helps mitigate risks and optimize performance, contributing to long-term profitability and success in the trading game.