Best Forex Trading Strategies in 2024

Welcome to the “Forex Strategy Mastery 2024”! Stepping into the ever-evolving arena of currency trading requires not just knowledge, but a toolkit of successful forex trading strategies. This comprehensive guide is crafted for both beginner traders exploring the forex market and seasoned veterans aiming for consistent profits. We delve into a wide range of strategies, from the classic trend trading and swing trading to the cutting-edge price action trading and forex trading systems designed for today’s currency pairs dynamics.

As we navigate through 2024, the forex landscape is undoubtedly influenced by global trends, currency fluctuations, and economic indicators. It’s crucial to adapt and refine your trading system, incorporating strategies like the moving average, support and resistance levels, and the strategic use of forex indicators for day trading or position trading. Our guide emphasizes not only the strategies themselves but also the importance of a tailored approach that suits your trading style, whether it involves the fast-paced environment of day traders or the more calculated moves of swing traders.

Moreover, we highlight the significance of a robust forex trading platform that complements your strategy choices, offering the technical support and analytic tools needed for effective trade execution. This guide aims to equip you with a diverse set of trading strategies and insights into selecting the best forex strategy for consistent profits, ensuring you’re prepared to tackle the forex trading strategies that work best for you in 2024.

Embark on your trading journey with confidence, leveraging the insights from popular forex trading strategies and the nuances of successful forex trading systems. Here’s to achieving your trading goals and navigating the forex market with expertise and precision in 2024!

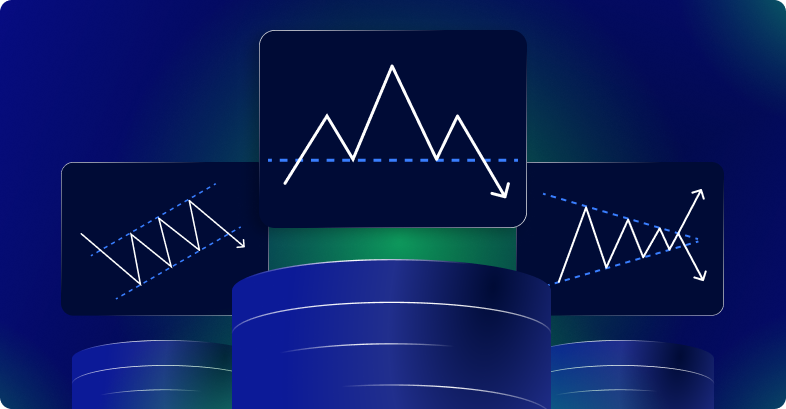

This strategy, often considered one of the best forex trading strategies, leverages the head and shoulders pattern, a key indicator in forex trading. This pattern is seen as a reliable predictor of a major trend reversal, making it a critical tool for successful forex trading. The formation consists of a lower peak (first shoulder), followed by a higher peak (head), and then another lower peak (second shoulder), signifying the shift from an upward to a downward trend. This method is versatile and can be applied across various currency pairs, making it a popular forex trading strategy.

This forex trading strategy is centered around the concept of market retracement. It’s a strategy that waits for a temporary reversal in the overall trend of a currency pair’s price, offering a strategic entry point. The key is to identify the moment when the market retracts from its primary trend and then capitalize on the opportunity to rejoin the trend at a more advantageous price. This approach is considered one of the best forex strategies for capturing potential profitable moves while maintaining alignment with the overall market direction. It suits various trading styles, including day trading and swing trading, and is effective for both beginner and experienced forex traders.

This strategy is an exemplary forex trading system that leverages the volatility caused by major economic news releases. It involves closely monitoring how currency prices are affected by news events and then making quick, informed trades based on the initial market reaction. This fast-paced strategy is most effective with major currency pairs like EURUSD, GBPUSD, USDJPY, USDCAD, and AUDUSD, as they tend to have the most pronounced response to news. The key is to observe the immediate price action post-news announcement and then execute trades that capitalize on this short-term market movement. It’s a popular forex strategy among traders who excel in making quick decisions and can handle the high pressure of trading on a one-minute timeframe.

Support and resistance trading is a fundamental and one of the best forex trading strategies, renowned for its effectiveness in both forex and currency trading. This method revolves around identifying specific levels in the market where prices have historically bounced back or broken through. These levels become crucial zones of interest for traders. The strategy involves trading based on the expectation that prices will either rebound off these levels (support or resistance) or break through them, signaling a potential trend shift. This approach is not only popular among forex traders but is also one of the best forex strategies for beginners, providing a clear framework for understanding market movements and making decisions. It can be applied across various currency pairs and suits different trading styles, from day trading to longer-term positional trading.

The ‘Inside Bar’ candlestick pattern strategy is a powerful method in forex trading, often included in the list of best forex trading strategies due to its simplicity and effectiveness. This pattern is formed when a candle is completely contained within the range of the previous day’s candle. This setup is typically considered a signal for a potential breakout. Traders using this strategy watch for the ‘Inside Bar’ as a pause or consolidation in the market, often preceding a significant move in the direction of the prevailing trend. It’s a versatile strategy that can be employed across various currency pairs and is particularly effective on a daily timeframe (D1), making it suitable for traders looking for forex strategies that align with a longer-term market view.

The ‘Pin Bar’ trading strategy is a key component of successful forex trading. It’s identified by its distinctive candlestick pattern, which features a long shadow (wick) and a small body. The ‘Pin Bar’ indicates a strong rejection of prices and a potential sharp reversal in the market. This strategy is widely recognized as one of the best forex trading strategies because it provides clear entry and exit points based on price action. Traders often use this pattern to pinpoint high-probability reversal points, making it a valuable tool for both beginner and experienced traders. The ‘Pin Bar’ can be effectively applied across various timeframes and currency pairs, offering versatility in forex trading.

The ‘Outside Bar’ pattern strategy is another vital component of forex trading strategies, especially in terms of identifying potential reversals. This pattern occurs when a candle’s highs and lows completely engulf the previous candle’s highs and lows. The strength of the ‘Outside Bar’ signal is often determined by the number of candles it engulfs – the more, the stronger the signal. This pattern is considered a powerful indicator of a possible change in market direction. Traders use this strategy to anticipate a reversal after a strong trend, making it one of the popular forex trading strategies for capturing shifts in market momentum. It’s effective on higher timeframes like H4 and D1 and can be applied to any currency pair, making it a versatile tool in a forex trader’s arsenal.

Swing Trading, particularly when combined with trend trading strategies, is an excellent approach for those new to forex trading. This strategy focuses on capturing gains from short-term trends in the forex market. Swing traders typically hold positions for several days or weeks, aiming to profit from price ‘swings’ or shifts. The key is to identify and follow the direction of the market trend, entering trades at points of momentum shift and exiting to capture quick, small profits while minimizing losses. This approach is less time-intensive than day trading, making it suitable for traders who cannot monitor the market continuously. Swing trading on H4 and D1 timeframes offers the advantage of catching more significant market moves, making it one of the preferred forex strategies for traders looking for a balance between time commitment and profit potential.

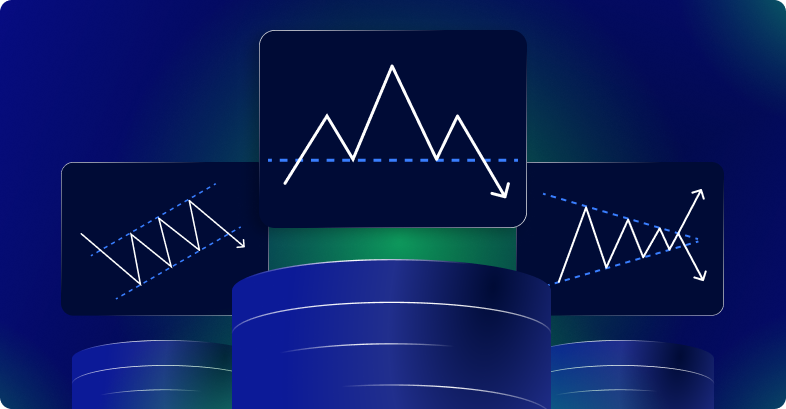

The Forex Breakout Strategy is a fundamental trading approach and is often regarded as one of the best forex trading strategies due to its straightforwardness and effectiveness. This strategy is centered around identifying and trading price breakouts. A breakout occurs when the price moves outside a defined support or resistance level with increased volume. Traders using this strategy aim to enter the market as soon as a breakout is confirmed, capturing the momentum that typically follows. This can lead to significant profits, especially in markets with strong trends. The H4 timeframe is particularly suitable for this strategy as it allows traders to spot and confirm breakouts more effectively than shorter timeframes, providing a balance between reaction time and avoiding false breakouts. This strategy can be applied to any currency pair, making it versatile and appealing to a wide range of forex traders.

The ‘Three Black Crows’ and ‘Three White Soldiers’ strategies are crucial patterns in forex trading, particularly effective in signaling trend reversals. The ‘Three Black Crows’ is a bearish pattern that typically emerges at the end of an uptrend, signaling a potential reversal. It consists of three consecutive long-bodied, bearish candles that close near their lows. On the flip side, the ‘Three White Soldiers’ is a bullish pattern that occurs at the end of a downtrend, consisting of three consecutive long-bodied, bullish candles closing near their highs. Both patterns are significant indicators of market sentiment shifting and are commonly used in forex trading strategies for identifying potential entry and exit points. Given their reliability, these patterns are particularly useful on the D1 (daily) timeframe and can be applied across various currency pairs.

The ‘Double Bottom’ strategy is a widely recognized and easy-to-implement forex trading strategy, particularly effective for spotting trend reversals. This pattern occurs when the price of a currency pair tests a support level twice without breaking through it, forming a W-like shape on the chart. The two lows represent the ‘double bottom’. This pattern is indicative of the end of a downtrend and the beginning of an upward trend. Traders using this strategy often wait for the price to break above the resistance level that forms between the two bottoms before entering a long position. The ‘Double Bottom’ is a powerful tool in a trader’s arsenal due to its simplicity and effectiveness in signaling potential upward market turns. It can be applied in various timeframes, such as H1 and H4, and works across different currency pairs, making it a versatile strategy for forex traders.

The ‘Double Top’ strategy is a prominent reversal trading technique used in forex trading, recognized for its reliability in predicting the end of bullish trends. This pattern is characterized by the price of a currency pair reaching a high point, undergoing a minor retracement, and then rising to the same level again, forming an M-like shape on the chart. The two peaks represent the ‘double top’.

This pattern indicates that the upward momentum is waning, and a reversal to a bearish trend is likely. Traders utilizing this strategy typically look for confirmation when the price falls below the support level formed between the two peaks. This breakdown signals an entry point for a short position.

The ‘Double Top’ is considered one of the more reliable indicators in technical analysis and is widely used by forex traders due to its clear signaling of potential market reversals. This strategy can be effectively applied in both H1 and H4 timeframes and is suitable for various currency pairs, making it a versatile and valuable tool for traders looking to capitalize on shifts in market momentum.

Choosing the optimal forex strategy hinges on your trading expertise, whether you’re navigating the forex market as a novice or wielding the charts with seasoned precision. Your trading style—be it the rapid-fire decisions of day trading or the measured pace of swing trading—plays a pivotal role in this selection. Beginners may find the high-octane world of scalping overwhelming, necessitating a focus on more grounded approaches like the Support and Resistance Trading Strategy or the methodical Swing Trading – Trend Trading Strategy. As your journey into technical analysis deepens, the arsenal of strategies discussed, including price action trading, moving averages, and the nuanced art of forex indicators, becomes increasingly relevant.

Remember, the elusive 100% success rate remains a myth in the fluctuating realms of currency trading. Strategies shine under specific market lights—whether it’s a particular season, the whirlwind of forex news trading, or the choice of forex pairs. Mastery involves the artful blending of forex strategies, a task that demands both experience and a keen sense of the market’s pulse. From the foundational strategies for beginners to advanced tactics like retracement trading or navigating forex trading systems, your path to forex proficiency is as diverse as the market itself. Embrace this journey with an open mind, leveraging popular forex trading strategies and the insights from successful forex trading stories to sculpt your unique trading narrative.