Demystifying Swing Trading: A Comprehensive Approach to Strategies and Basics

This article delves into swing trading, a strategy aiming for short- to medium-term gains by leveraging market volatility. It emphasizes technical analysis for predicting market movements and sometimes incorporates fundamental analysis for a more thorough decision-making process. Swing trading is portrayed as a versatile approach, suitable for various financial instruments, focusing on technical indicators like chart patterns and price movements to pinpoint entry and exit points.

The material discusses core concepts such as trend recognition, risk management, and technical analysis, and compares swing trading with day trading, noting its extended timeframe and lower daily risk. Advantages include suitability for those with limited time and lower stress levels, while challenges involve the need for patience and exposure to market risks. It outlines beginner strategies and stresses the importance of risk management, making it a comprehensive guide for traders seeking to exploit short-term market trends.

Swing trading positions itself as a cornerstone strategy in the realm of financial markets, with the primary objective of securing short- to medium-term profits from stocks or a diverse array of financial instruments. This approach spans a timeframe that can range from a few days to several weeks, making it a versatile option for traders looking to capitalize on market volatility.

Central to the swing trading methodology is the use of technical analysis, a tool that traders leverage to predict market movements with a degree of precision. This analysis focuses on chart patterns, price movements, and trading volumes to identify potential entry and exit points for trades.

Moreover, swing trading isn’t solely reliant on technical analysis; it often incorporates elements of fundamental analysis to provide a more comprehensive view of the market. This dual approach allows traders to assess the intrinsic value of securities, considering economic indicators and company-specific news, which can influence stock prices beyond mere chart patterns. By blending these analytical methods, swing traders aim to enhance their decision-making process, seeking to improve the accuracy of their market predictions and, consequently, the profitability of their trades.

This trading style is particularly appreciated for its adaptability, offering traders the flexibility to adjust their strategies in response to changing market conditions. Whether through the meticulous examination of moving averages, the application of RSI (Relative Strength Index), or the interpretation of MACD (Moving Average Convergence Divergence) signals, swing traders utilize a comprehensive toolkit to navigate the complexities of the financial markets. This strategic approach not only aims to exploit short-term market trends but also to mitigate risks through disciplined risk management techniques, including the setting of stop-loss orders and the careful selection of stocks to swing trade.

Trend Recognition: This principle is centered on identifying the market’s or a specific stock’s general trajectory. Swing traders often rely on technical indicators like moving averages and MACD (Moving Average Convergence Divergence) to gauge the bullish or bearish trends, ensuring their trades align with the market’s momentum.

Risk Management: An indispensable component of swing trading, risk management involves the strategic placement of stop-loss orders and predetermined profit-taking points to safeguard investments. Effective risk management is crucial for navigating the volatility and uncertainties inherent in the stock market, allowing traders to preserve capital and secure gains.

Technical Analysis: The cornerstone of swing trading, technical analysis involves a detailed examination of charts and various analytical tools to analyze market dynamics. Swing traders use technical analysis to identify trading opportunities, employing chart patterns, such as head and shoulders or flags, and technical indicators, like RSI (Relative Strength Index), to predict future price movements.

Market Analysis: The foundational step in swing trading, market analysis involves a thorough search for potential trading opportunities. Swing traders utilize a blend of technical and fundamental analysis to identify stocks that exhibit the potential for significant price movements within the desired trading timeframe.

Entry Point Determination: Determining the optimal entry point is crucial for swing trading success. Traders leverage technical indicators, such as support and resistance levels or moving averages, to pinpoint the most advantageous moments to initiate a trade. This step often involves analyzing the stock’s price action and the trading volume to confirm the strength of the trend.

Exit Strategy: Crafting a well-defined exit strategy is essential for realizing profits and minimizing losses. Swing traders establish exit points based on technical analysis, including take-profit levels and stop-loss orders, to exit a trade either at a predetermined profit target or to cut losses. This approach ensures that traders can manage their risk effectively and capitalize on the market’s swings.

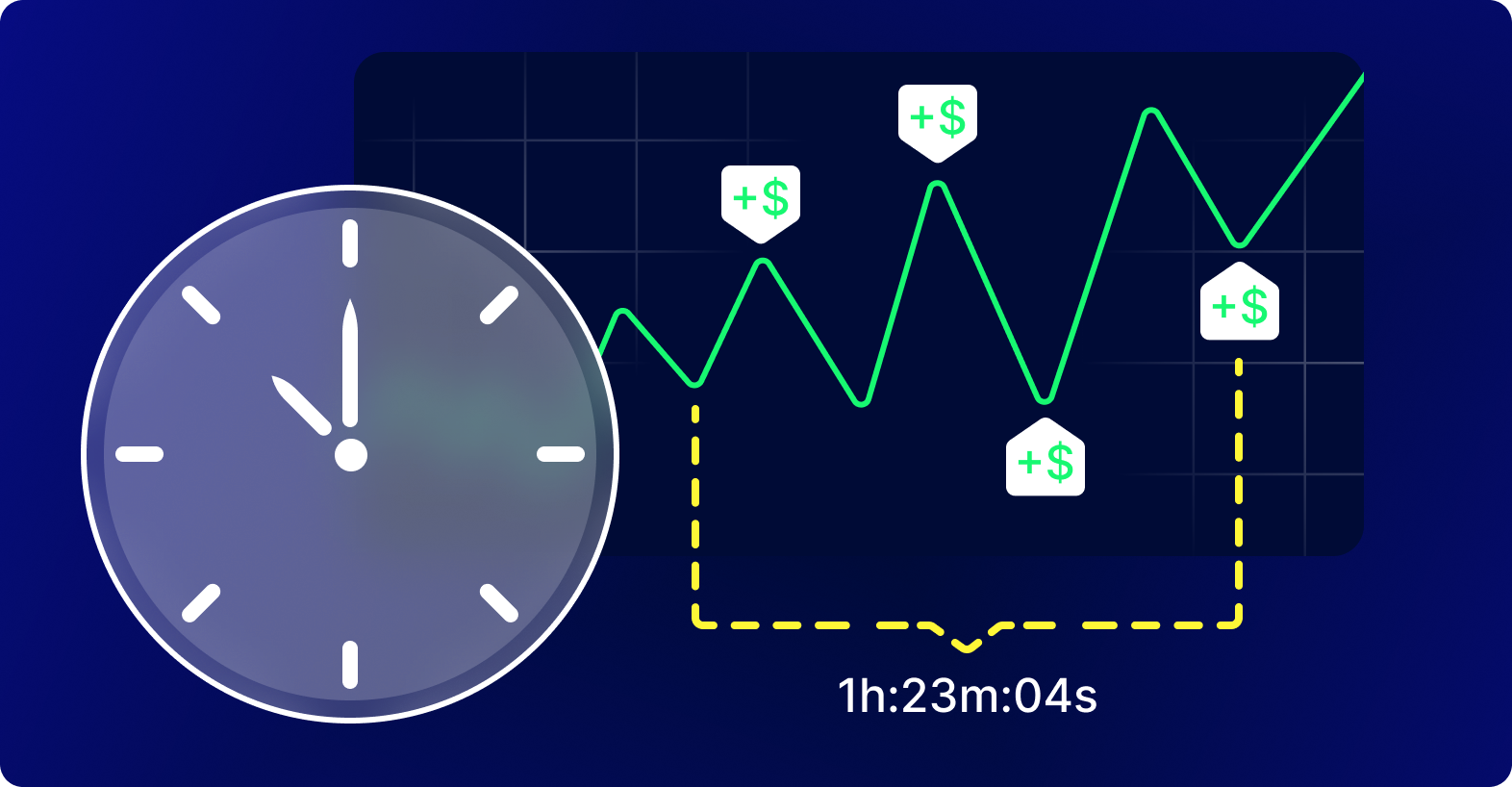

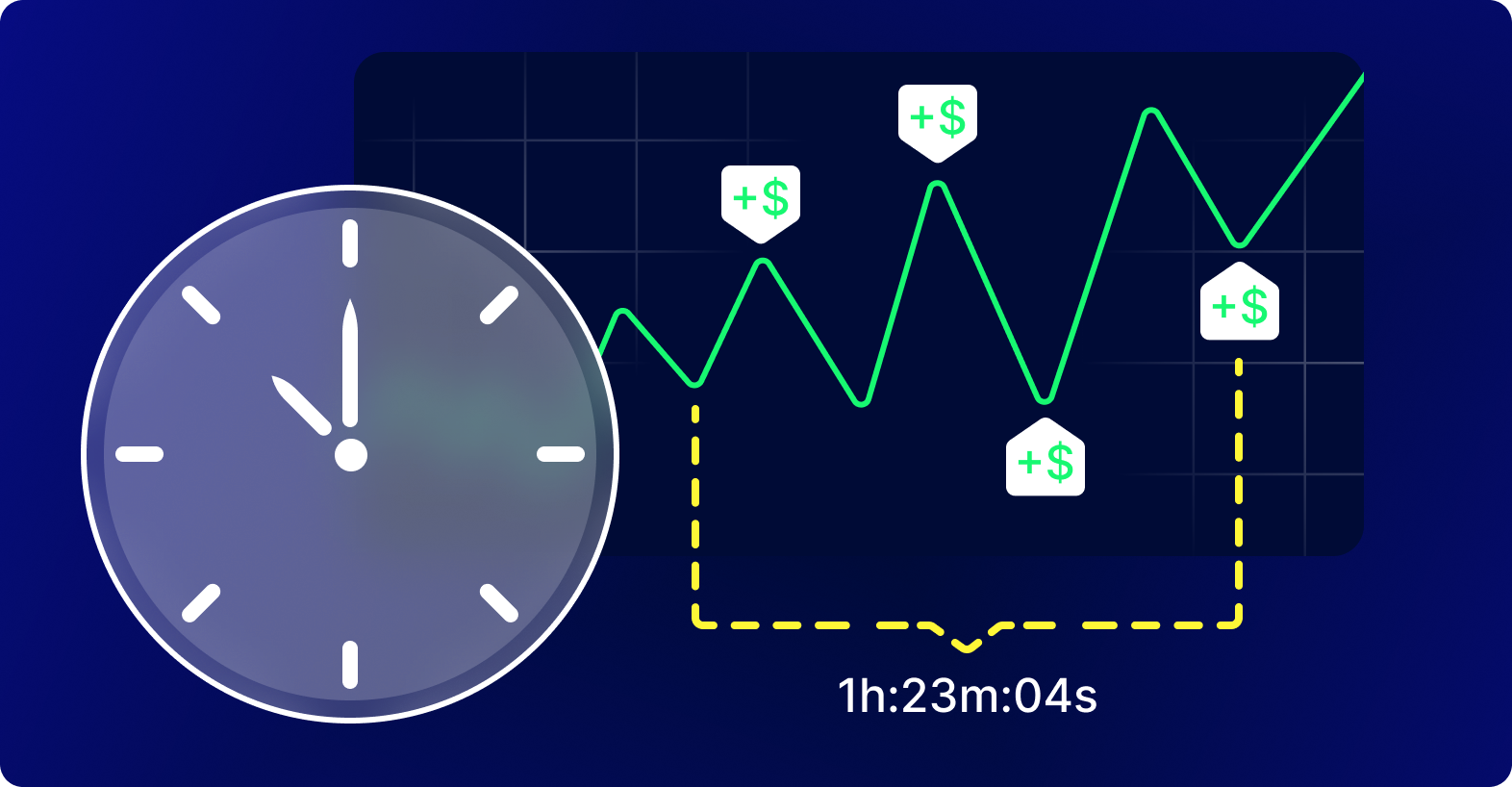

Time Frame: Swing trading spans a more extensive period, from several days to weeks, offering a contrast to day trading’s confined operations within the bounds of a single day. This extended timeframe allows swing traders to capitalize on larger market movements and trends.

Risk and Effort: Generally, swing trading is viewed as carrying a lower daily risk and requiring less effort than day trading. This is because swing traders do not need to monitor the markets continuously throughout the day, reducing the intensity and frequency of trading decisions.

Flexibility for Busy Schedules: Swing trading is well-suited for those with daytime jobs or other commitments, as it does not require constant market surveillance.

Reduced Stress Levels: Compared to the fast-paced nature of day trading, swing trading is often considered less stressful, given its longer-term perspective and reduced need for immediate decision-making.

Need for Patience and Discipline: Successful swing trading demands a high level of patience and discipline to wait for the right trading opportunities and to stick to a trading plan.

Market Risk Exposure: Swing traders face the risk of market gaps and volatility during overnight and weekend periods when they cannot manage their positions actively.

Trend Following: This strategy involves identifying and following the market’s direction, buying stocks in uptrends, and selling stocks in downtrends. Swing traders use technical analysis tools, such as moving averages and trend lines, to identify these trends and make informed trading decisions.

Counter-Trend Trading: This approach takes a position opposite to the prevailing market trend, based on the expectation of a trend reversal. Swing traders applying this strategy look for potential reversal signals, such as bearish or bullish divergences in momentum indicators like the RSI (Relative Strength Index) or patterns indicating a trend exhaustion, to enter trades at the potential onset of a new trend.

In the realm of swing trading, where market volatility can be both a friend and foe, implementing robust risk management strategies is paramount. This trading style, nestled between the rapid-fire approach of day trading and the patience of long-term investment, thrives on the swings of market prices. To navigate this environment successfully, traders employ a variety of risk management techniques, ensuring that potential losses do not derail their trading goals.

Setting Stop Loss Orders: A fundamental tool in a swing trader’s arsenal, stop loss orders act as a safety net, automatically selling a security when it reaches a predetermined price. This limits losses and prevents emotional decision-making.

Diversification: By spreading investments across different stocks or sectors, swing traders can mitigate the risk of a significant loss from a single trade. Diversification is a cornerstone of trading strategies, helping to stabilize returns in the face of market fluctuations.

Position Sizing: Careful consideration of how much capital to allocate to a single trade is crucial. By limiting the size of each trade, traders can ensure that a loss on one position doesn’t significantly impact their overall portfolio.

Technical Analysis: Utilizing technical indicators and chart patterns, traders can identify potential entry and exit points, support and resistance levels, and signs of a trend reversal. This analysis aids in making informed decisions and timing trades effectively.

Adherence to a Trading Plan: A well-defined trading plan outlines the trader’s strategy, including criteria for trade entry and exit, risk tolerance, and profit targets. Sticking to this plan helps traders maintain discipline and focus, reducing the temptation to make impulsive decisions based on market noise.

Regular Review and Adjustment: The market’s dynamic nature requires traders to regularly review their strategies and adjust them based on current market conditions and performance. This continuous learning process is essential for long-term success in swing trading.

By integrating these risk management strategies, swing traders can protect their capital from significant losses, ensuring that they remain in the game to capitalize on future opportunities. Effective risk management is not just about preventing losses; it’s about creating a sustainable trading approach that can adapt to the ever-changing market landscape.

Staying updated on market trends is crucial for investors and traders looking to make informed decisions. Here are several strategies to keep abreast of the latest market movements:

Financial News Websites and Apps: Regularly visit reputable financial news platforms such as Bloomberg, CNBC, and Reuters for real-time market news and analysis. Many of these sites have mobile apps that send push notifications for breaking news.

Subscription to Financial Journals: Consider subscribing to financial journals like The Wall Street Journal or the Financial Times. These publications offer in-depth analysis and expert opinions on market trends and economic indicators.

Use of Social Media and Forums: Platforms like Twitter, LinkedIn, and Reddit can be valuable sources of instant market news and investor sentiment. Follow industry leaders, financial analysts, and investment firms to get insights and updates.

Financial Podcasts and Webinars: Listening to financial podcasts and attending webinars can provide expert analysis and commentary on market trends, helping you understand the factors driving the markets.

Market Analysis Software: Utilize market analysis tools and software that offer real-time data, technical analysis, and market forecasts. Many trading platforms provide these tools as part of their service.

Networking with Other Traders: Joining trading communities or investment clubs can offer insights and tips from fellow traders. Sharing experiences and strategies can help in understanding market trends better.

Educational Resources: Continuously educate yourself on market analysis and investment strategies through online courses, books, and workshops. Understanding the fundamentals can help you interpret market trends more accurately.

By combining these resources, you can develop a comprehensive approach to staying informed about market trends, enabling you to make more educated investment decisions.

Choosing the right swing trading strategy involves a blend of technical analysis, market insight, and personal trading style. Here’s how to select a strategy that aligns with your trading goals using key terms from the provided list:

Assess Volatility and Market Trends: Swing trading thrives on volatility. Use technical analysis to identify stocks with significant price movements and potential for swing trading. Look for trends in the stock chart that indicate a swing within days or weeks.

Select Stocks with High Trading Volume: Focus on actively traded stocks. High volume indicates strong interest from traders and investors, making it easier to enter and exit trades. Stocks to swing trade should have a clear pattern of volatility and liquidity.

Use Technical Indicators: Incorporate technical indicators like moving averages, support and resistance levels, and MACD to gauge market sentiment and identify potential entry and exit points. Swing traders often rely on these indicators to make informed decisions.

Develop a Trade Setup: A solid trade setup is crucial for swing trading. Identify stocks with a potential uptrend or downtrend and plan your trade around these movements. Use a combination of chart patterns, technical analysis, and market trends to formulate your strategy.

Manage Risk with Stop Loss Orders: To safeguard against market reversals, implement stop loss orders. This will help you manage risk and protect your investment from significant losses.

Stay Informed with Business Daily and Financial News: Keep up with the latest market news and trends by following reputable sources like Business Daily. Being informed about market conditions and economic indicators can influence your swing trading decisions.

Practice on a SwingTrader Product or Simulation: Before committing real money, practice your swing trading strategy using simulation tools or products like IBD’s SwingTrader. This allows you to test your strategy in real-time market conditions without financial risk.

Evaluate and Adjust Your Strategy: Swing trading requires flexibility. Regularly review your trades, learn from successes and failures, and adjust your strategy as needed. The goal is to capitalize on short-term price movements while managing your risk effectively.

By integrating these elements into your swing trading approach, you can develop a strategy that not only aligns with your trading style but also maximizes your potential for profit in the swing trading environment.

Recovering from a bad trade is a crucial skill for swing traders. Here are some strategies to bounce back, using terms from the provided list:

Analyze What Went Wrong: Reflect on the trade setup and execution. Did you follow your swing trading strategies? Were your technical analysis and reading of chart patterns accurate? Understanding the missteps can prevent future errors.

Revisit Your Trading Plan: Every swing trader should have a trading plan that includes risk management strategies, such as stop loss orders and take profit points. If a bad trade occurred, reassess your plan to ensure it aligns with your risk tolerance and trading goals.

Maintain a Trading Journal: Documenting your trades, including both the successes and the failures, can provide valuable insights. Use this journal to identify patterns in your trading behavior that may need adjustment.

Focus on the Long-Term: Swing trading is about capitalizing on short-term market movements, but it’s essential to keep an eye on the longer-term trends and your overall investment strategies. One bad trade doesn’t define your trading career.

Practice Emotional Discipline: Swing trading can be a rollercoaster of emotions. Practice staying calm and avoid making impulsive decisions based on short-term losses. Remember, volatility is a swing trader’s playground, but it requires a cool head to navigate.

Take a Break If Needed: Sometimes, stepping away from the trading environment after a loss can help clear your mind and reduce the temptation to “revenge trade.” Use this time to analyze the market’s movements without the pressure of active trading.

Educate Yourself Continuously: The market is always evolving, and so should your trading skills. Utilize resources like IBD Digital and the SwingTrader product to stay informed about new strategies, technical analysis tools, and market trends.

Seek Feedback from Other Traders: Engage with a community of traders to gain different perspectives on your trading approach. Sometimes, an outsider’s view can highlight blind spots in your strategy.

Start Small on Your Next Trade: After a loss, consider reducing the size of your next trade to manage risk more effectively. This approach can help rebuild your confidence while minimizing potential losses.

Remember, Losses Are Part of Trading: Every trader experiences losses; they’re an integral part of the learning process. The key is to learn from them and not let them deter you from your trading objectives.

By applying these tips, swing traders can overcome the setbacks of a bad trade and continue to pursue their trading goals with renewed perspective and strategies.

1H EUR/USD chart

Take a look at the hourly EUR/USD chart. You can see how the price failed to break through the resistance level and bounced downwards (red candle) towards the ascending trend line (white line), breaking below it on February 11, 2023. Upon retesting the trend line, the price failed to break through and entered a sideways movement. At the same time, the MACD dropped into the negative zone, indicating pressure on the pair. Currently, there are no clear indications for opening a position.

However, on February 13, 2023, economic news on US inflation (US CPI) came out worse than expected, and against this backdrop, the price sharply dropped (red candle), breaking through two key support levels in its path. The MA(50) and MA(200), which we also use in our example, were above the price. At the same time, the MACD confirmed the continuation of the decline.

Typically, it is not recommended to open positions before the release of important economic news, and the US CPI is precisely such. Therefore, to determine the best entry point into the market, it is necessary to switch to a smaller time frame.

It is also not recommended to open a trade immediately after the news release, as it is important to see how the market reacts. In our example, the price broke the key support level of 1.07569 at the 15-minute mark, and it would have been advisable to open a sell trade in this area, setting the Take Profit at another key support level of 1.07245 and Stop Loss at 1.07694.

Here, we have used the primary indicators for the Swing Trading Strategy – Moving Averages, MACD, trend lines, and trading levels. At the same time, we demonstrated how technical analysis works with fundamental analysis.

Swing trading is a dynamic trading style that captures the essence of market volatility to capitalize on short to medium-term price movements. It’s an ideal strategy for individuals who cannot dedicate the entire day to market monitoring, making it perfect for those seeking to engage in the market part-time. Swing traders utilize a mix of technical analysis, chart patterns, and market trends to identify potential trading opportunities, aiming to maximize returns through strategic entry and exit points.

Who Should Opt for Swing Trading?

Swing trading is best suited for investors who have a basic understanding of the stock market but limited time to monitor it constantly. It’s an excellent approach for those looking to trade swings in the market without the commitment required for day trading. Swing traders often rely on technical indicators and chart patterns to make informed decisions, making it a good fit for those comfortable with these tools.

Can Swing Trading Be Pursued Part-Time?

Absolutely. Swing trading strategies are designed to be flexible, allowing traders to analyze the market and make trades based on significant trends that develop over days or weeks. This flexibility makes swing trading an attractive option for individuals looking to supplement their income without the need to constantly watch the market.

Expected Returns from Swing Trading

The potential returns from swing trading can vary widely and depend on several factors, including market conditions, the trader’s expertise, and the effectiveness of their trading strategy. While some swing traders achieve substantial profits by capitalizing on market volatility and leveraging technical analysis, others may experience losses. It’s crucial to have realistic expectations and understand that success in swing trading requires patience, discipline, and continuous learning.

Managing Losses in Swing Trading

Loss management is a critical aspect of swing trading. Successful traders accept that losses are a part of the trading process and focus on minimizing them through effective risk management strategies. This includes setting stop loss orders to limit potential losses, carefully selecting stocks to swing trade based on thorough research, and adhering to a well-thought-out trading plan.

Is Swing Trading Legal and Safe?

Swing trading is a legal and widely practiced trading style across global markets. However, like all trading strategies, it carries risks, especially due to market volatility and the potential for rapid price changes. Ensuring safety in swing trading involves diligent research, sound risk management practices, and the use of technical analysis to make informed decisions. Traders should also stay updated on market trends and economic indicators to navigate the trading environment effectively.

In summary, swing trading offers a flexible and strategic approach to trading that can yield significant returns for those who master its nuances. By understanding the market’s swings and leveraging technical analysis, traders can identify opportunities to buy low and sell high, capitalizing on short-term market movements.