Top 7 Best Indicators for Swing Trading

Swing trading is a methodology where traders focus on capturing short-to-medium-term price movements across markets. While day trading is focused on intraday price action, leading day traders to close their positions by the end of the day, swing traders hold positions overnight for a few days to a few weeks. Swing trading also differs from long-term trading because swing traders seek to capitalize on short-term trends and price fluctuations instead of holding positions for years or decades.

We can say that swing trading sits in the middle ground between fast-paced day trading and patient long-term investing. This approach allows traders to operate the markets without the constant need to monitor them all day since positions take days to be closed and analysis can be done once a day by the time of the closing, unlike day trading.

Swing traders tend to rely on technical analysis to time entry and exit points, often relying on price charts and using indicators instead of long-term fundamentals. The focus tends to be on momentum and reversal patterns that play out over days or weeks. The goal is to enter near the set of a price swing and exit before it ends. Profits, on average, tend to be larger than in day trading due to larger movements but smaller than the long-term trend following due to the timeframe.

In this article, we will explore the best swing trading indicators and how to use them. From stocks to forex, we will see how these tools can help you improve your timing, risk management, and profitability in the long run. We will also touch on how to combine multiple indicators effectively and how to adapt indicators to different market conditions.

Swing trading is all about taking advantage of market swings that occur in the span of a few days to a couple of weeks. Swing traders might use trend indicators or oscillators to measure when a stock is overbought or oversold and enter the trade when there are signs that a relevant swing is about to happen. To better understand swing trading strategies and style, let’s take a look at its core characteristics:

You can check our blog for reading more about the differences between day trading and swing trading, as well as checking this comprehensive approach to swing trading.

Technical indicators are essential tools for swing traders. They help inspect price trends, momentum, volatility, and volume to decide on whether to enter or exit a trade.

There is no single magic bullet when talking about indicators. Swing traders often combine multiple of them to confirm their analyses and improve the odds of success. Let’s take a look at 7 of the best swing trading indicators you can start using today.

Moving averages are behind any of the trend-following trading decisions. They are responsible for smoothing price data to reduce market noise and highlight the trend. The two most common indicators are the simple moving average (SMA) and the exponential moving average (EMA). The first is a basic average of prices over a period, while the latter prioritizes the most recent prices for faster responsiveness.

Formula:

SMA: SMA = (P1 + P2 + . . . + Pn) ÷ n (where P is price and n is periods)

EMA: EMA_today = EMA_yesterday + (K * (Price_today – EMA_yesterday)) (where K = 2 ÷ (n+1))

Moving averages are used as trend indicators, and their slope points out toward the direction. Price crossing above or below an MA can indicate trend changes. Crossovers between shorter MAs and longer MAs also generate well-known buy/sell signals (e.g., a “golden cross” happens when a 20-day SMA crosses above a 50-day SMA). MAs can also act as dynamic support and resistance levels, with many traders using them as a pullback entry sign when prices touch a rising MA in an uptrend before moving back up.

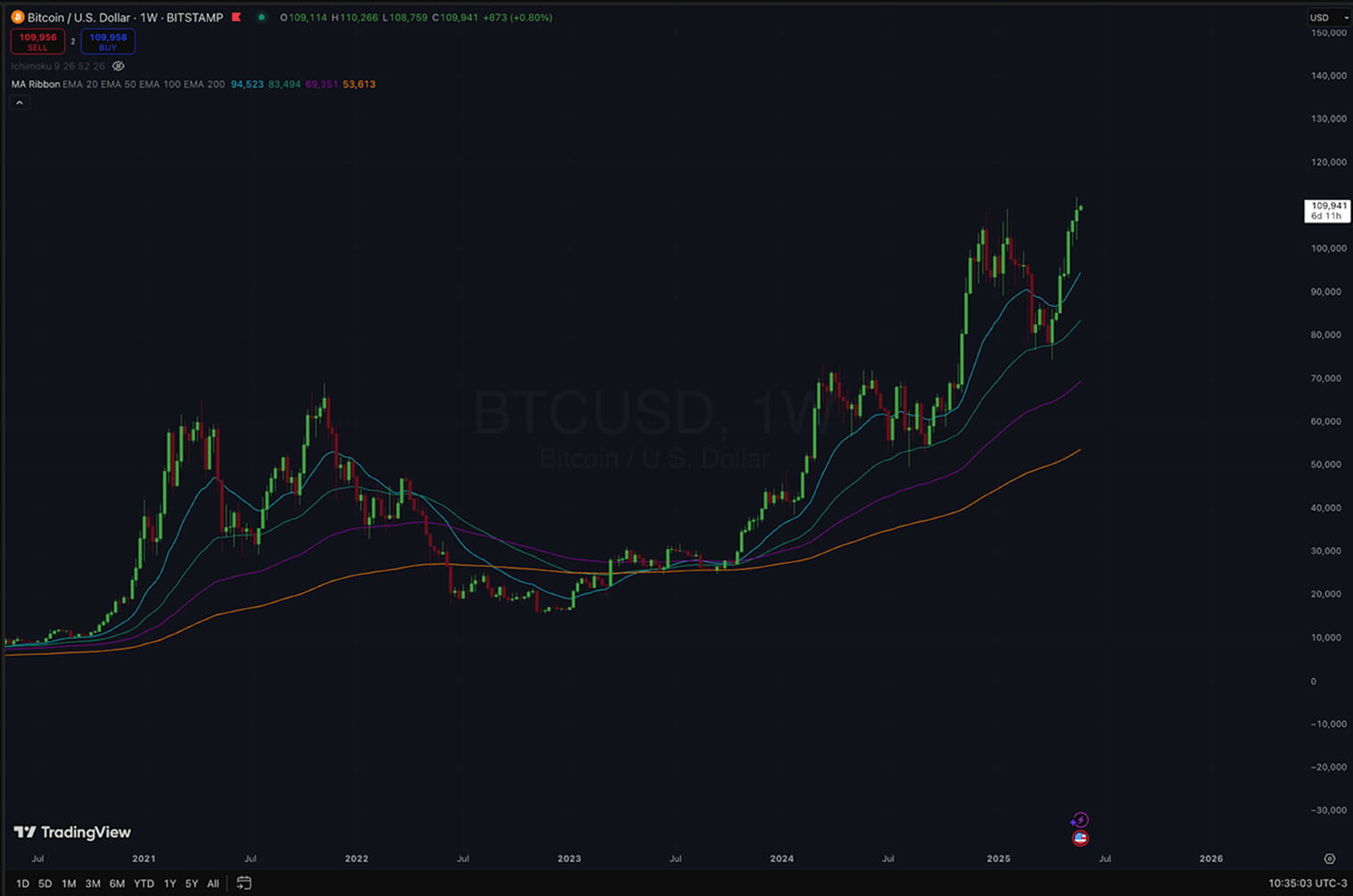

Swing traders tend to use a combination of MAs, usually using them in pairs (20-day; 50-day), mixing EMAs (for shorter averages like 10 or 20) and SMAs (for longer averages like 100 or 200) to measure the main trend and time their entries, or even using a ribbon of several EMAs to measure the strength of the trend (if all are aligned, the trend is strong).

Pros: MAs are simple and effective for trend identification. One of the best swing trading indicators to find dynamic support and resistance levels, helping traders identify relevant entry points.

Cons: MAs are lagging indicators, meaning signals can come after a move has begun, leading to late entries. They also tend to generate many false signals in sideways markets, providing more trustworthy trading signals where there is a clear trend.

The Relative Strength Index, aka RSI, is a momentum oscillator developed by J. Welles Wilder Jr. It oscillates between 0 and 100, measuring the speed and change of price movements to identify overbought or oversold conditions. Values above 70 are seen as a signal that prices reached an overbought state and a downward correction might be near. Values below 30 indicate an oversold condition, implying a possible upward turnaround.

Formula:

The RSI calculation starts with computing the Relative Strength (RS) by dividing the average gain by the average loss over a specified period (14 by default). The final RSI value is then scaled using the equation below:

RSI=100−[100 ÷ (1+RS)]

This results in an oscillator that highlights strong upward momentum with high values and strong downward momentum with low values, with 50 as the midpoint, representing equal gains and losses.

Swing traders use the RSI in several key ways. They tend to seek a buying opportunity when it recovers from below 30 and seek a selling opportunity when it drops below 70. Traders also look for divergences between price and indicator. When prices are making lower lows but the RSI is making higher lows, a bullish swing can be expected, especially if prices are around a support level. You can read more about strategies based on RSI divergence here.

Pros: the RSI often indicates reversals before price confirms. It also provides quantifiable momentum levels and is versatile enough to be able to confirm trends while also warning of reversals. For swing traders, it’s considered one of the best indicators for identifying overbought/oversold conditions and timing entries/exits.

Cons: like other oscillators, the RSI can generate many false signals, especially in strong trends. Prices can remain under overbought or oversold conditions for extended periods. Although divergence signals are powerful, they are not accurate all the time. The RSI is also solely price-based and doesn’t factor in other important elements like volume, so it’s usually best used in conjunction with other indicators for signal validation.

The Moving Average Convergence Divergence (MACD) is an indicator that blends trend-following and momentum analysis. It has three main elements:

Formula:

Considering a common default settings (12, 26, 9):

Swing traders use the MACD to identify momentum and trend direction through key signals like crossovers between lines and divergences. A bullish signal occurs when the MACD line crosses above the signal line, while a bearish one happens when it crosses below. Crosses above or below the zero line confirm trend direction. Histogram bars can also give interesting insights, with expanding bars indicating strong momentum and shrinking ones suggesting a slowdown.

Similarly to the RSI, divergences between price and MACD warn of reversals. Many traders combine MACD with support and resistance levels or candlestick patterns, such as the flag pattern, for additional confirmation. Although the default settings work quite well, traders tend to tweak them to get quicker signals based on market volatility, asset behavior, timeframe, and personal trading style

Pros: highly versatile indicator, combining trend and momentum analysis while generating clear signals. Accessible for beginners, helping them confirm trend direction and momentum shifts for entries and exits.

Cons: also considered a lagging indicator due to the fact it is based on moving averages, so their signals can sometimes come only after a significant price move. It doesn’t work that well in sideways markets, and it doesn’t offer clear overbought or oversold levels like other oscillators.

Bollinger Bands, created by John Bollinger, are among the top swing trading indicators used to measure market volatility and identify relative price highs and lows. They consist of three lines plotted on a price chart: a middle band, which is typically a 20-period simple moving average; an upper band (middle band plus two standard deviations); and a lower band (middle band minus two standard deviations). These bands expand or contract according to market volatility, visually indicating when price is unusually high or low relative to its recent average and helping traders spot eventual reversals or breakout opportunities.

Formula:

The default setting for Bollinger Bands is (20, 2):

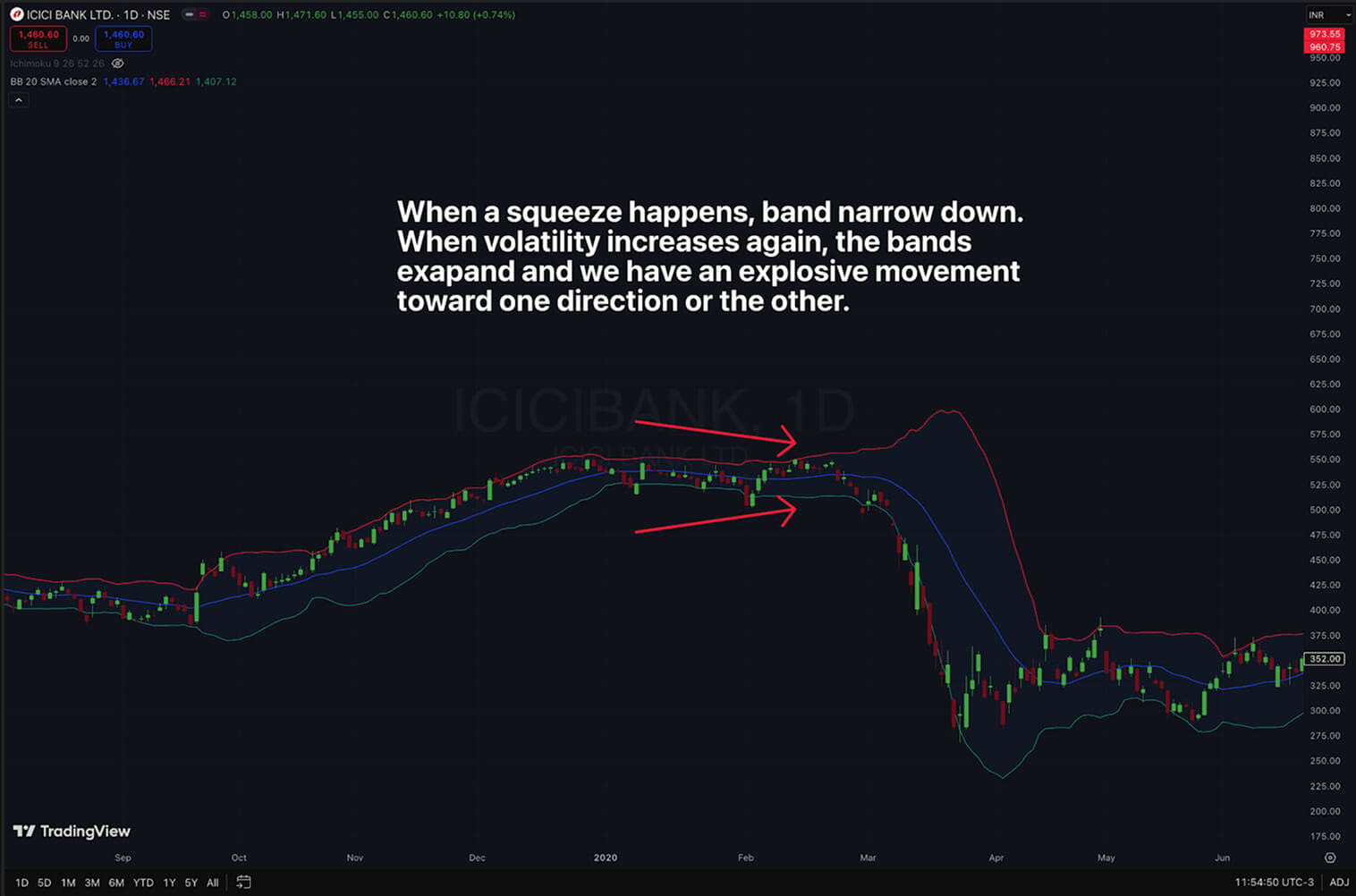

Swing traders can use Bollinger Bands to evaluate price extremes, trends, and volatility. When price touches the upper band, it may indicate overbought conditions, while touching the lower band suggests oversold. In strong trends, price can ride along a band, indicating strong momentum rather than a reversal. A “squeeze,” where bands narrow tight, indicates low volatility and often triggers explosive breakouts, being one of the most common strategies employed by swing traders.

Bollinger Bands also help with mean reversion strategies, as prices tend to return to the middle band, especially in sideways markets. While the standard 20,2 setting is widely used, these parameters can be adjusted based on the volatility levels of the security, with some exhibiting a more volatile nature than others.

Pros: the Bollinger Bands dynamically adapt to volatility, giving us a clear sense of trend direction, volatility levels, and overbought/oversold conditions. They can be adapted for range trading, while also being useful in trend-following scenarios.

Cons: during a squeeze, it can be challenging to know the direction of the breakout. When a trend is too strong, the price can stick to one band, leading to losses when trying to make mean-reversion trades.

Volume is a crucial indicator for technical analysis since it measures the conviction behind price movements. High volume suggests increased market participation, making the move more robust and trustworthy. Volume indicators like the OBV (on balance volume) can help us identify and understand buying or selling pressure.

Formula:

Here’s how to calculate the OBV:

Swing traders use trading volume to back up trends, breakouts, and reversal swings. High volume validates the significance of price movements, whereas low volume suggests an increased risk of a false move. Volume at support or resistance levels can also indicate the strength of those levels. The OBV is usually used to identify divergences, indicating accumulation and distribution phases where “quiet buying” or “quiet selling” could be happening.

Pros: we can say that volume acts as a “lie detector” for price movements, confirming their intensity and validity. It helps avoid false signals, and for this reason it is incorporated into successful swing trading strategies to reveal market activity not visible in price alone.

Cons: interpreting can be quite complex and requires a deeper understanding of context. Not all volume spikes are extremely revealing; an example would be volume spikes derived from news events. In some markets, especially forex, reliable volume data can be scarce. An excess in reliance on volume can lead to missed opportunities if you’re always waiting for the perfect volume confirmation.

The Stochastic Oscillator is a momentum indicator that measures the closing price’s position relative to its recent trading range (14 periods by default). It oscillates between 0 and 100, and it’s used to identify overbought and oversold conditions, with values above 80 considered overbought and below 20 oversold. Unlike the RSI, its formula focuses on the relationship between the closing price and the period’s high-low range. It is made up of two lines: the %K line and the %D line, a 3-period simple moving average of %K, acting as a signal line.

Formula:

%K = [(Close – Lowest Low_n ÷ Highest High_n – Lowest Low_n)] * 100% (where n is the periods)

The %D is the 3-period simple moving average of %K.

The Stochastic Oscillator is primarily used for timing entries and exits, especially in sideways markets. When the %K line crosses above the %D line from below the 20 level, it generates a bullish signal. On the other hand, a cross below the %D line from above the 80 level generates a bearish signal. It is also used to identify and measure divergences, indicating the possibility of trend reversals. In trending markets, it can be used to identify pullbacks for buying or selling opportunities.

Pros: it can accurately identify short-term price reversals, providing signals much faster than other indicators, which can be a huge advantage. Its dual-line crossover system and clearly-established overbought and oversold zones make it extremely intuitive and easy to use, especially for beginners.

Cons: it tends to be overly sensitive, much more than the RSI, which can lead to false or premature signals, especially during strong trends, where it might remain under overbought or oversold conditions for a large period. Sudden, sharp price spikes can easily distort the oscillator. Its effectiveness can decrease during strong, directional trends.

Support and resistance levels are among the most fundamental and basic concepts in technical analysis. These are price zones where historical buying or selling pressure has been strong enough to reverse price movements. Support is a price level where demand concentrates, expected to stop a bearish trend, whereas resistance is where supply concentrates, expected to pause a bullish advance. Markets tend to respect these levels quite frequently.

These levels are not mathematical indicators. Instead, they can be identified through previous highs and lows, trendlines, or moving averages, which act as dynamic support and resistance levels. Fibonacci retracement levels or psychological round numbers can also be seen as relevant points.

Pros: support and resistance are foundational concepts to technical analysis, representing the dynamics between supply and demand. They are extremely important for any trader, regardless of timeframe, and facilitate when thinking about take-profit targets, stop-loss orders, etc. They work best when combined with additional indicators, especially with the RSI or Stochastic Oscillator.

Cons: they can be quite subjective. These levels are also not infallible, and they eventually break. False breakouts are also common, however, trapping traders into bad positions.

For a better understanding, here is a comparison table where we summarize each one of the indicators above so you can measure which works best for your trading style and goals.

| Indicator | Purpose | Best Use | Watch Out For |

| Moving Averages | Highlight trend direction and smooths price action | Trending markets. You can combine long + short MAs for entries | Laggy signals and false moves in sideways markets |

| RSI | Measures momentum and spots overbought/oversold conditions | Range or mild trends. Good for identifying buy and sell points | Can stay under extreme conditions during strong trends |

| MACD | Mixes trend + momentum. Uses line crossovers. | Trend confirmation and spotting reversals with divergences | Lags on entries. There are no clear overbought/oversold levels |

| Bollinger Bands | Shows volatility. Identifies high/low extremes | Mean reversion trades and spotting breakouts via squeezes | Prices can stick to the bands during strong trends |

| OBV | Confirms strength behind price movements. Shows accumulation. | Spotting hidden reversals or strength behind reversals | Noisy on low-volume securities. |

| Stochastic Oscillator | Fast momentum tool. Highlights short-term price reversals | Quick swing trades in ranges. Good timing at price extremes | Too sensitive in trending markets |

| Support and Resistance | Key price zones for bounce or breakout | Entry and exit levels. Stop-loss and take-profit planning | Can be subjective and tricky to identify |

Executing a successful swing trade strategy with indicators requires a structured approach. Determining the conditions of the market (is it trending or is it within a range?) is key to establishing your directional bias. You can easily do that using moving averages (50-day and 200-day SMA do the job). Next, you must identify the nearest, most relevant support and resistance levels, since they act as important entry and exit reference points. Then, you can set up your indicators for entry signals, which would typically include a 14-period RSI or a stochastic oscillator for timing, MACD for confirmation, plus the ATR for risk management.

Once you have prepared your trading system, you must find a setup that is aligned with your market analysis, such as a pullback to a support level within an uptrend. Before entering the trade, you should check whether there is a convergence of signals. Are all your indicators, or most of them, saying the same thing? If yes, you can execute the entry. After opening a position, you can place a stop-loss and a profit target using the ATR indicator.

Success as a trader depends on psychological discipline. You must keep strict adherence to your trading plan, never forgetting to define stop-loss orders and limit the amount of orders you will open over a time period. Beware of overreliance on a single indicator, define a set of criteria for reading trading signals, and build a checklist to check if there is a convergence of signals in your trading system. Be patient and don’t give in to the urge to trade when the system is only partially signaling you to open a position. Manage your emotional responses to wins and losses and keep a trading journal to track your emotional state and reinforce discipline.

The ATR (Average True Range) is an important indicator used for volatility-adjusted risk management in swing trading. It allows traders to quantify the typical price movement of a security, helping set realistic stop-loss orders and take-profit targets. For stop-losses, a common method is to set them K*ATR away from your entry price (2*ATR, for example), providing a safeguard against normal market noise. For profit targets, aim for a multiple of your ATR-based risk to ensure a favorable risk-reward relationship (2:1, for example). The ATR ensures your risk management is adaptable to current market volatility, preventing premature exits or unrealistic targets.

Before risking your money, it is a good idea to backtest your strategies on historical data to evaluate their performance. Platforms like TradingView or MetaTrader can help you simulate your trading system. You can define all your rules, including stop-loss orders and take-profits, plus taxes and costs to ensure realistic results. Some of the key metrics to evaluate include win rate, max drawdown, and profit factor. Backtesting is great to iterate and refine your trading system, helping you add new filters or adjust relevant parameters.

Markets are very dynamic and fluid. They go from clear directional bias to range-bound phases with different degrees of volatility. Swing trading allows for profiting under diverse conditions, but different indicators work best in specific environments. In trending markets, traders aim to align with the dominant direction. Trend-following momentum indicators like the MACD are extremely important for confirming the strength of a trend and guiding through entry and exit points.

Oscillators like the RSI and stochastic have a different nature from that of trend-following indicators. In a strong uptrend, the RSI can oscillate between 40 and 70, rarely hitting 30 or 70. In these cases, traders aim to profit by using these oscillators to find the optimal entry point aligned with the trend, rather than try to employ counter-trend trades.

Effective adaptation is key. Using the moving average is crucial for trend identification, while oscillators are vital for sideways price action. During periods of high volatility, the ATR helps in setting stops and targets aligned with the current conditions. Low volatility, on the other hand, tends to come before a breakout, so traders might use Bollinger Bands to help deal with it. The goal is to find the top combinations and how to interpret them within the overall context, ensuring your trading plan is adaptable and robust to market dynamics.

Improve your trading strategy by combining multiple, complementary indicators to confirm signals and filter false ones. Avoid redundancy by mixing categories: a trend-following momentum indicator that shows direction (moving averages), a momentum oscillator for refining entries (RSI), and volume indicators to help confirm market participation. A trade with higher probability occurs when all chosen indicators align. Effective combinations include:

A major mistake is, of course, too much reliance on a single indicator. An asset under oversold condition on the RSI, for example, can be highly misleading during a strong bullish trend. On the other hand, too many indicators can lead to analysis paralysis, causing traders to wait indefinitely for every indicator to align. Adapting to market conditions and using the right tools for trending or sideways environments is crucial. It’s also important to know how to read markets and identify when volatility is changing, volume is exhibiting different patterns, and overall conditions are changing.

Ignoring risk management and neglecting stop-loss order or setting improper position sizings are yet another critical error. Moving stops or targets indiscriminately due to fear and greed, or chasing trades can also be extremely costly. A trading journal helps identify and correct these mistakes, building the discipline needed for consistent gains in the long run.

Successful swing trading using technical indicators requires a mix of analytical skills, discipline, and the wish to continuously learn. Key indicators like moving averages, the RSI, the MACD, Bollinger Bands, Volume, Stochastic Oscillator, and Support and Resistance levels can help you visualize key info about market dynamics and gain insights that you wouldn’t have without them. Adapting to different market conditions and managing risk with indicators like the ATR are vital for long-term success and survival in a high-stakes environment like financial markets. The path to excellence is full of constant refinement through backtesting, journaling, and managing your emotions.