Mastering Drawdown in Trading: Manage Drawdown in Forex Trading and More

In the intricate world of trading, whether it be stocks, forex, or crypto, understanding the concept of drawdown is fundamental. Drawdown represents the decline from a peak to a trough in the value of your trading account or portfolio, before a new peak is achieved. This metric is critical as it directly reflects the potential losses you might face during your trading journey.

For both novice and seasoned traders, comprehending drawdown is vital as it helps gauge the effectiveness of trading strategies and adherence to proper risk management techniques. By mastering the dynamics of drawdown, traders can enhance their resilience against financial market volatility and improve their overall trading performance.

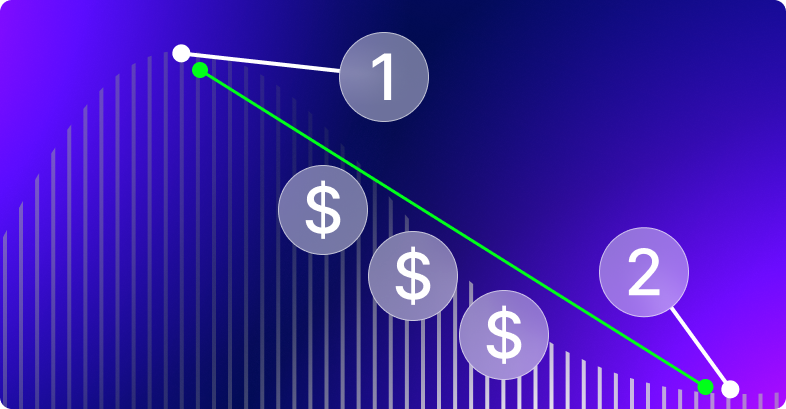

Drawdown in trading quantifies the decline in investment or trading account balance from its peak to its lowest point before reaching a new high. This measure is crucial for assessing the risk inherent in a trading strategy, as it gives a clear picture of your potential exposure during losing streaks.

Absolute drawdown refers to the reduction from the initial account balance to the lowest point, regardless of previous peaks. Conversely, relative drawdown represents the percentage decrease from the highest account balance to the subsequent lowest balance.

Let’s say your trading account reaches a high of $10,000 but then falls to $7,000 before climbing back above $10,000. The drawdown here would be $3,000 or 30%. This simple calculation helps traders understand the magnitude of potential losses during adverse market conditions.

Strategy drawdown occurs when trading decisions result in a series of losses. This type of drawdown is directly tied to the trader’s chosen methodologies and their effectiveness under specific market conditions.

Technical drawdown arises from technical failures or misjudgments, such as inadequate stop loss settings or poor timing in entering trades. It often reflects the mechanical risks associated with the trading system rather than market volatility.

Psychological drawdown is perhaps the most complex, stemming from emotional responses to the market. Traders experiencing a significant drawdown may become risk-averse or overly aggressive, potentially exacerbating losses rather than controlling them.

The impact of these drawdown types extends beyond financial losses, influencing trading decisions and overall strategy adherence. Recognizing the source of drawdowns can lead to more effective adjustments in trading plans and risk management approaches.

Forex trading, with its high liquidity and 24-hour market operation, often experiences rapid price movements which can lead to significant drawdowns. Understanding drawdown in the context of Forex is crucial because the leverage used in Forex trading can amplify both gains and losses.

Forex drawdowns often occur due to sudden economic announcements, geopolitical events, or changes in market sentiment. These factors can cause rapid shifts in currency values, impacting traders who might be on the wrong side of a move.

To navigate drawdown in Forex effectively, traders should:

To calculate drawdown, identify the peak value of the account before the decline and the lowest point during the subsequent drop. The formula is:

Drawdown = Peak value − Trough value / Peak value × 100

Imagine a forex trader whose account balance reaches a new high of $15,000 but then drops to $12,000 before increasing again. The drawdown calculation would be:

Drawdown = 15,000 − 12,000 / 15,000 ×100 = 20%

This 20% drawdown indicates how much the account balance decreased from its peak during a specific period.

Calculating drawdown is a fundamental skill for traders to manage their risk per trade and understand the historical risk associated with their trading activities. By routinely measuring drawdown, traders can get a realistic sense of their risk tolerance and adjust their strategies accordingly.

In the subsequent sections, we will delve deeper into the implications of maximum drawdown, explore real-world scenarios to understand its practical impacts, and discuss advanced management techniques to effectively handle drawdowns in trading.

Maximum drawdown (MDD) is a crucial metric for traders and investors as it provides the deepest percentage drop in an account or portfolio from peak to trough before a new peak is achieved. Understanding MDD is essential for evaluating the risk associated with a particular trading strategy.

Maximum drawdown helps traders to understand the worst-case scenario they might face and whether it’s within their risk tolerance limits. For instance, a trading strategy with a maximum drawdown of 50% suggests that at one point, the trader could have lost half of their peak account balance, which might be unacceptable for those with a low risk tolerance.

In backtesting, maximum drawdown is used to simulate your potential losses during historical downturns. This aids in refining trading strategies to minimize future drawdowns and implement proper risk management techniques. It also helps in determining the right size and timing of stop loss orders to protect capital.

Analyzing real-world examples of significant drawdowns provides valuable insights into how they occur and how they can be managed.

Consider a forex trader whose account experienced a large drawdown due to unexpected market news that caused significant volatility. The trader’s account went from a peak of $20,000 to a trough of $10,000 over several days, marking a 50% drawdown.

By analyzing this scenario, we can learn about the importance of having protective measures like stop-loss orders and the necessity of staying informed about market events that could affect trading positions.

In this case, the drawdown not only affected the trader’s capital but also their ability to make rational decisions. The psychological impact of seeing half of the account’s value disappear could lead traders to make hasty decisions – either to recoup losses quickly or to stop trading out of fear.

Understanding drawdown helps in preparing mentally for such downturns and in developing strategies to recover sustainably without taking excessive risks.

Effective management of drawdown is fundamental in maintaining a healthy trading account and ensuring long-term profitability.

One of the most effective strategies to manage drawdown is diversification. By spreading investments across different asset classes, sectors, or geographical regions, traders can reduce the risk of a large drawdown affecting their entire portfolio. This helps in smoothing out returns as not all assets will experience low points simultaneously.

Using stop loss orders is a critical risk management tool. It allows traders to set a specific price at which their position will automatically close to prevent further losses. This is particularly useful in limiting drawdown during volatile market conditions.

Managing the psychological aspect of trading during drawdown periods involves maintaining discipline, sticking to a trading plan, and avoiding emotional trading. Traders should also continuously educate themselves about market conditions and trading strategies to adapt their approaches according to market behavior.

Advancements in trading technology have made it easier for traders to monitor and navigate drawdowns effectively.

There are various software and trading platforms that provide real-time analytics and metrics on drawdown. These tools help traders track their peak-to-trough performance and make informed decisions to adjust their strategies or exit positions.

Technology also aids in conducting thorough market analysis and backtesting strategies against historical data to foresee how they might perform in future scenarios. This predictive capability is invaluable in minimizing potential drawdowns and optimizing trading outcomes.

By utilizing these technological tools, traders can maintain better control over their trading accounts, manage risks more effectively, and enhance their decision-making process, thus potentially reducing the impact and frequency of drawdowns.

Mastering the concept of drawdown is pivotal for any trader aiming to succeed in the volatile realms of forex, crypto, or stock trading. Throughout this article, we have explored the nuances of drawdown from basic definitions to more sophisticated management techniques. We’ve examined how drawdowns are measured, the different types that traders might encounter, and how they can profoundly affect trading decisions and overall performance.

Key strategies such as diversification, the use of stop-loss orders, and psychological resilience have been highlighted as essential for monitoring drawdown effectively.

Additionally, the role of technology in monitoring and mitigating drawdown has been emphasized to ensure traders can make informed decisions and maintain robust risk management practices.

Drawdown is calculated by measuring the difference between a relative peak in capital minus a trough. It’s expressed as a percentage and indicates the risk level of the investment strategy.

Maximum drawdown measures the largest single drop from peak to trough before a new peak is achieved, reflecting the greatest loss experienced. Absolute drawdown shows the loss from the initial account balance to its lowest point, regardless of any peaks.

Large drawdowns can lead to emotional trading, causing a trader to deviate from planned strategies. This might include taking higher risks to recover losses or hesitating to take valid setups due to fear of further losses.

Best practices include:

While technology cannot predict drawdowns with absolute certainty, tools like backtesting software can help traders understand potential drawdowns under various conditions, thus preparing them to handle those scenarios better.