The Definite Guide on Crypto Margin Trading: Trade Crypto Like a Pro

Margin trading crypto can be a double-edged sword. Many traders use leverage trading to boost their profits, but this method of trading cryptocurrencies can also amplify losses and increase risks.

In this guide, we will understand how crypto margin trading works. We will walk through a step-by-step tutorial to learn how to open and manage leveraged positions in crypto, compare the most popular trading platforms, explore the dynamics behind liquidation, and explore some core leverage strategies used by many traders all over the world. This article is definitely for you if you are a beginner who wants to explore Bitcoin margin trading.

When margin trading, you borrow funds – usually from an exchange – to manage a larger position than your capital would allow. The best crypto exchanges in the market usually lend you this extra capital while using your initial deposit (i.e., margin) as collateral. Leverage tends to be expressed as a multiplier that indicates how many times your position size is multiplied relative to your margin. For instance, a 10x leverage lets you control a position that is 10 times larger than your deposit.

If you have $1,000 and want to bet that Bitcoin prices will rise, you can open a long position with 10x leverage. You will borrow an additional $9,000 from the exchange, which will make it possible for you to buy $10,000 worth of BTC. If Bitcoin’s price rises by 5%, your $10,000 position goes to $10,500. This would give you a $500 profit, excluding fees, marking a 50% return on your initial deposit of $1,000. If Bitcoin faces a dip, you would also lose half of your initial capita – which is why margin trade requires an extremely diligent risk management plan and adherence to it.

In traditional spot trading, which does not use margin or leverage, a 5% surge in price on a $1,000 position would only yield $50. With 10x leverage, however, both gains and losses are amplified tenfold. This demonstrates how leverage can boost profitability and why it is so beloved by many traders. However, it also shows how much riskier it is than traditional trading methods.

Although it can significantly increase the return on investment, leverage also has the potential to amplify market movements against you. A minor price move in the wrong direction can quickly lead to margin calls and ruin your trade. Beginners tend to underestimate the risk and over-leverage themselves – a typical mistake we will approach later on.

Before opening a leveraged position, there are a few steps to take into account. We will walk through the entire process, including the importance of setting stop-loss and take-profit orders and understanding the nuances between isolated margin trading and cross margin trading.

Throughout the entire process of margin trading in crypto, you must be aware of the risks of crypto margin trading and have risk management in mind. Carefully use leverage, stick to your trading system, and don’t hesitate to close a position if it isn’t working. Plan your trade and trade your plan.

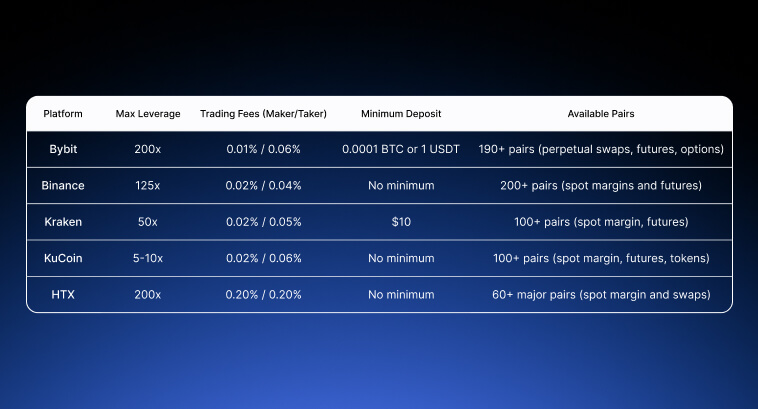

Not all exchanges employ the same rules and structures when it comes to advanced trading strategies, such as futures trading on a margin. I have put together some important aspects of the five most common exchanges for crypto derivatives trading. We will explore the differences in maximum leverage, trading fees, minimum deposit, and the selection of trading pairs.

As you can see, Binance and Bybit are highly appealing to high-leverage traders since they offer up to 100x or more leverage. Kraken and Kucoin, on the other hand, are more conservative approaches, focusing on risk-limited leverage.

There is also a difference in fee structures. HTX’s fees are higher than other exchanges. It is important to notice that many platforms have a fee structure where fees get lower the more you trade or the higher the financial volume you trade within a certain period. Be certain to check the rules and guidelines concerning fees whenever selecting a crypto platform.

It’s important to highlight that you should always be aware of the regulatory landscape before deciding which platforms to choose and how you approach margin trade services in general. Countries such as the USA, for example, might apply some restrictions on offshore exchanges. Binance is one of the exchanges that had to open its separate US entity, Binance.US, to comply with American regulations. Always check whether the exchange you are interested in joining has all the legal and regulatory permission to operate in your country.

You cannot open a leveraged position without first knowing the risks of margin trading and the tools available to minimize risk for both you and the exchange.

Liquidation is the forced closure of your position that is executed by the exchange when your losses hit a certain threshold. The idea behind it is that it protects both the trader and the platform from even larger losses. It is important to highlight, however, that many platforms charge a fee or penalty for liquidation, called a liquidation fee. Whenever your position is automatically closed due to losses, a value is taken from your remaining assets. This is meant to incentivize traders to manage their margins effectively and proactively. With that being said, keep in mind that it is always better you close a losing position than let it get liquidated.

The maintenance margin is the minimum amount of money you have to keep in your margin account during a leveraged trade. If your losses erode your maintenance margin, the exchange will be forced to liquidate your position to ensure you will be able to repay the borrowed funds they gave you. They close your position before the margin is entirely gone.

Let’s say you:

Even a 10% price swing in the opposite direction to your position can wipe out 100% of your margin when using 10x leverage. This is why understanding the benefits and risks of crypto trading on a margin is understanding that the higher the leverage, the smaller the gap between your entry price and the liquidation price. At 2x leverage, a 50% move against you leads to you losing your margin; at 3x leverage, a 33% move; at 20x leverage, a 5% move. It gets tighter and tighter the more leverage you use.

To find out the liquidation price of your leveraged position, you can use the simplified formula below, considering that it ignores any fees and additional costs for simplicity. Check the specific formula for your exchange for a more accurate result.

Liquidation Price ≈ Entry Price * (1 – 1/Leverage)

Consider an entry point at $20,000 with 10x leverage.

Liquidation Price ≈ 20,000 * (1 – 1/10) = 18,000

If Bitcoins fall to $18,000, your position will be liquidated,

A margin call is a notification that your margin level is getting too low. It serves to make you decide whether to deposit more funds or reduce your position. Considering that market conditions are fast and extremely dynamic in the crypto market – even more than in the stock market – margin calls can turn into liquidations very fast if you don’t act on them. Do not ignore margin calls when they appear. Cut your losses or put in more money to sustain your position.

Margin trading in crypto is a method of trading, not a strategy per se. The three most common trading strategies – plus risk management tips – are outlined below:

Many crypto traders fall into the same trips when they begin margin trading in a cryptocurrency exchange. Luckily, we have a list of some of the most common pitfalls, along with the consequences of these mistakes and how to avoid them:

Many regulators are especially focused on leverage trading with cryptocurrency due to its high risks. Different countries may impose different rules on trading with leverage, especially crypto. Below, you have an overview of regulations related to margin trading in the USA, EU, and Asia:

Regulatory requirements vary widely from country to country. Always check the laws and rules applied in your country and verify if the exchange you’re interested in has all the permissions and is compliant with your local legislation and regulations.

Although regulation feels a bit limiting, it serves the purpose of protecting traders against reckless leverage. If your country prohibits trading with over 2x leverage, it is probably a good idea to stay on the lower end of leverage. You can still trade effectively with these ratios.

Margin trade offers wonderful opportunities to boost profits. It is, however, a double-edged sword, since it also increases risks exponentially. For this reason, this trading methodology attracts the attention of regulators all over the world, ensuring exchanges develop safety mechanisms and good practices to avoid overleveraging.

In this article, we went through the most important intricacies of margin trading. We saw how it works, what are margin calls, the liquidations process, the most common strategies (with risk management tips), besides the most common beginner mistakes that you should avoid.

When used wisely, leverage can be an excellent tool to multiply your results, especially if you’re a trader with higher wins than losses. If used recklessly, however, margin trading can be the end of your career as a trader. Respect the power of leverage, manage risks effectively, and keep in mind that learning is a continuous process. Each trade has something new to teach you. Approach the market with humility and a robust trading system at hand, and you will be able to increase your odds of success in margin trading.