SabioTrade vs Rocket21: An Honest Comparison Of Prop Trading Firms

SabioTrade and Rocket21 are two proprietary trading firms, both boasting high Trustpilot scores and dedicated user bases. At first glance, Sabio and Rocket have similar funding program offers with a profit-sharing model of up to 90%. However, you’ll notice several substantial differences if you scratch the surface. Let’s explore them by comparing the firms’ approaches to prop trading.

| SabioTrade | Rocket21 | |

| Entry-level accounts ($10-50K) | ✔️ | ✔️ |

| Mid-tier accounts ($60-100K) | ✔️ | ✔️ |

| Large accounts ($200+K) | ✔️ | ✔️ |

| Scaling opportunities | Up to $2 mln. | Up to $2 mln. |

| One-step assessment | ✔️ | ✔️ |

| Refunds | ✔️ | ✔️ |

| Profit split | 80-90% | 85-90% |

| Price | $119 – $939 | $79 – $1,399 |

| Free education | ✔️ | ❌ |

| Unlimited time for assessment | ✔️ | ✔️ |

| Minimum trading days | 0 | 3-5 days |

| Profit target | 10% | 8-9% |

| Daily loss limit | 3-5% | 3-5% |

| Max. trailing drawdown | 6% | 5% |

| Simple rules | ✔️ | ❌ |

| Trading platform | Quadcode trading platform | MT4, MT5 |

| Payout scheme | Anytime | Monthly/bi-weekly |

| Algorithmic trading | ✔️ | ✔️ |

| Trial account | ✔️ | ✔️ |

SabioTrade has garnered fame within the prop trading community due to its straightforward mechanics: fixed conditions, a one-step assessment without time limits, and a transparent tariff structure.

Sabio traders have the opportunity to earn a share of the profits from their trading activities in funded accounts extending up to $200,000. Trading occurs on a proprietary platform equipped with useful tools such as indicators, widgets, calendars, price alerts, and more. A convenient dashboard is also provided for tracking statistics and merged with the platform into a unified ecosystem.

SabioTrade is recognized for its significant dedication to the community. The company offers trading education through a boot camp and actively maintains Discord and Telegram channels.

Rocket21 Rocket21 has been operating since 2019 and boasts a good performance track record in the prop trading market. The firm offers a wide range of accounts, starting from $5K and going up to $300K. It provides two distinct funding programs: the Standard 2-step challenge and the Apollo 11 one-step challenge.

Similar to Sabio, Rocket21 maintains a vast community on Discord and offers dedicated support. One distinctive feature of Rocket21 is the Revive option, allowing traders to pay extra to retain their Phase 2 account if breached and stay in the game.

| SabioTrade | Rocket21 | |

| Assessment types | 1 | 2 |

| Stages of assessment | 1 | 1 or 2 |

| Time limit | ∞ | From 5 days to ∞ |

| Min. evaluation fee | $119 for a $20K account | $79 for a $5K account |

SabioTrade features a straightforward assessment process. It’s a one-step evaluation with fixed requirements and no time limits, allowing traders to complete the assessment at their own pace.

Contrastingly, Rocket21 has a more complex evaluation structure, encompassing 2 account types:

| Summary: The assessment procedure at Sabio is simpler and more straightforward, characterized by fixed rules, a single-step assessment, and predictable outcomes.

In contrast, Rocket21 employs a more intricate assessment structure. Traders must choose between a 1-step and a 2-step challenge. When comparing the one-step challenges, the conditions for Sabio and Rocket are relatively similar. |

| Funding | $20K | $50K | $100K | $200K |

| Profit % | 80% | 80% | 80% | 90% |

| Price | $119 | $289 | $479 | $939 |

STANDARD

| Funding | $5K | $10K | $20K | $50K | $100K | $200K | $300K |

| Profit % | 85-90% | 85-90% | 85-90% | 85-90% | 85-90% | 85-90% | 85-90% |

| Price | $79 | $139 | $239 | $349 | $549 | $939 | $1,399 |

APOLLO 11

| Funding | $10K | $20K | $50K | $100K | $200K |

| Profit % | 85-90% | 85-90% | 85-90% | 85-90% | 85-90% |

| Price | $119 | $199 | $299 | $499 | $939 |

| Summary: Rocket21 tariffs are more diverse yet more expensive compared to Sabio’s. Rocket offers a beginner-level $5K account for $79, but the follow-up accounts are $20-100+ more expensive than Sabio’s. For example, a $100K tariff at Sabio will cost you $479, whereas at Rocket21, it ranges from $499 to $549, depending on the assessment type. |

| SabioTrade | Rocket21 | |

| Leverage | 1:30 | 1:100 on Standard

1:30 on Apollo 11 |

| Revival option | ❌ | ✔️ |

| Profit target | 10% | 8-9% |

| Daily loss limit | 3% | 3-5% |

| Max . trailing drawdown | 6% | 5% |

| Trading commissions | No | No |

| Summary: both firms feature realistic profit targets. SabioTrade imposes a slightly higher profit target and maximum daily drawdown. Rocket21 offers a rare Revival feature, allowing traders to save a breached account for a fee from $113 to $2,332. |

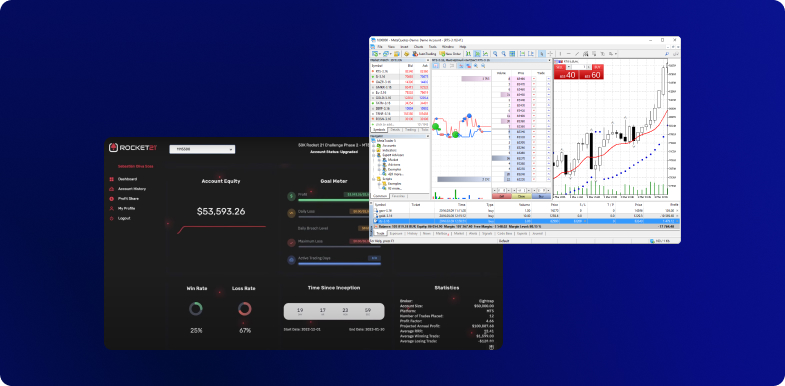

Employing the time-tested MT4 and MT5 engine, Rocket21 grants users entry to an intuitive dashboard, facilitating various functions:

With this foundation, let’s delve into a comparative analysis of the two platforms concerning tradable assets:

| SabioTrade | Rocket21 | |

| Forex | ✔️ | ✔️ |

| Stocks | ✔️ | ❌ |

| Commodities | ✔️ | ✔️ |

| Indices | ✔️ | ✔️ |

| ETFs | ✔️ | ❌ |

| Crypto | ✔️ | ✔️ |

| Summary: Both contenders provide a modernized dashboard for tracking performance and profits. Nevertheless, there’s a notable distinction – Rocket21 necessitates users to switch to MetaTrader, while SabioTrade allows seamless trading directly from its proprietary platform embedded within the dashboard.

In terms of tradable instruments, both proprietary firms support trading currency pairs, indices, cryptocurrencies, and commodities. SabioTrade goes a step further, additionally offering stocks and ETFs. |

| SabioTrade | Rocket21 | |

| Wire transfers | ✔️ | ❌ |

| Credit/debit cards | ✔️ | ✔️ |

| E-wallets | ❌ | ❌ |

| Crypto | ✔️ | ✔️ |

| Summary: Both accept Visa/Mastercard and crypto payments. SabioTrade additionally offers wire transfers. |

| SabioTrade | Rocket21 | |

| Trading education at boot camp | ✔️ | ❌ |

| Telegram analytics | ✔️ | ❌ |

| FAQ | ✔️ | ✔️ |

| Summary: SabioTrade stands out as the superior choice for trading education. Offering a comprehensive package, SabioTrade includes a boot camp, online training sessions conducted by industry experts, interactive Q&A sessions, live trading sessions, and more. Moreover, Sabio traders benefit from valuable insights and strategies shared by analysts through Telegram.

In contrast, Rocket21 caters primarily to seasoned professionals, lacking any educational materials in its offerings. |

When weighing the choice between SabioTrade and Rocket21, traders should factor in various aspects:

Upon thorough examination of both proprietary firms, it becomes evident that SabioTrade is a more straightforward, cost-effective, and user-centric platform for proprietary trading. Particularly suited for beginners avoiding complex payment structures, it also proves advantageous for individuals seeking educational resources.

Conversely, Rocket21 introduces heightened flexibility through several tariff configurations. The inclusion of the Revive feature might attract those keen on preserving their progress even in the event of an account breach, albeit at a relatively steep cost.