SabioTrade vs The Funded Trader: Comparing Prop Firms

SabioTrade and TFT are two emerging prop trading firms offering funding programs and utilizing profit-sharing models. Let’s determine which funding program is superior by comparing them based on important factors.

| SabioTrade | The Funded Trader | |

| Entry-level accounts ($10-50K) | ✔️ | ✔️ |

| Mid-tier accounts ($50-100K) | ✔️ | ✔️ |

| Large accounts ($200+K) | ✔️ | ✔️ |

| Scaling with leverage | Up to $2 mln. | Up to $1,5 mln. |

| One-step assessment | ✔️ | ✔️ |

| Two-step assessment | ❌ | ✔️ |

| Three-step assessment | ❌ | ✔️ |

| Refunds | ✔️ | ✔️ |

| Profit split | 80-90% | 80-95% |

| Price | $119 – $939 | $49 – $1,879 |

| Free education | ✔️ | ❌ |

| Unlimited time for assessment | ✔️ | ✔️ |

| Minimum trading days | 0 | 3 – 5 |

| Profit target | 10% | 5-10% |

| Daily loss limit | 3-5% | 3-5% |

| Max. trailing drawdown | 6% | 10% |

| Simple rules | ✔️ | ❌ |

| Trading platform | Quadcode trading platform | MT4, MT5, cTrader |

| Payout scheme | Anytime | Monthly/bi-weekly |

| Algorithmic trading | ✔️ | ✔️ |

| Trial account | ✔️ | ✔️ |

SabioTrade SabioTrade is a prop firm with minimal complexities. With funded accounts reaching up to $200,000, traders can earn up to 90% of generated profits, with fixed rules and transparent conditions.

Sabio’s proprietary Quadcode-powered platform and dashboard form a unified ecosystem where everything is seamlessly integrated for traders’ convenience. It means you can trade and track your stats within the same interface.

Furthermore, SabioTrade has developed Discord and Telegram communities and provides training at their boot camp.

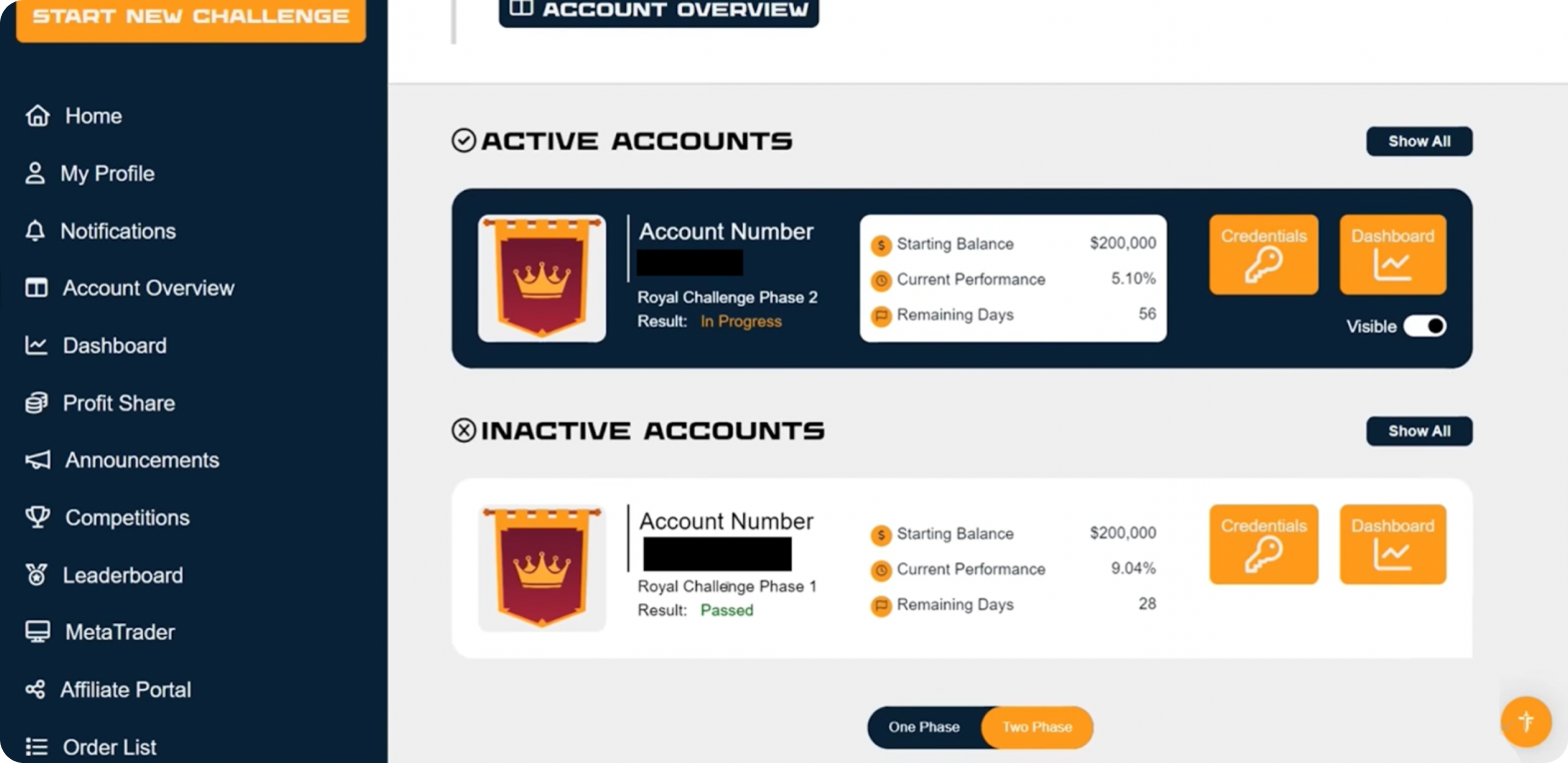

The Funded Trader provides higher maximum trailing drawdowns of up to 10% and offers flexible plans. This prop firm offers five types of assessments and an intricate tariff structure. It resembles a constructor, as conditions vary depending on the assessment type, chosen trading style, and selection of add-ons.

The maximum funded account size is $400K, with a maximum profit share of 90%. The most successful traders may qualify for upgrades, allowing them to operate an account of up to $600K and receive increased payouts of up to 95%.

In both firms, traders need to undergo an assessment procedure before gaining access to a funded account. Let’s compare which one is easier to pass.

| SabioTrade | The Funded Trader | |

| Assessment types | 1 (Standard) | 5 |

| Stages of assessment | 1 | 1-2 depending on the plan |

| Time limit | No | Depends on the plan, including no time limits |

| Min. evaluation fee | $119 for a $20K account | $49 for a $5K account (Dragon plan) |

At SabioTrade, you take a one-step assessment and pass it at your own pace, with the same daily drawdown, max. daily loss and profit target figures for all accounts.

At The Funded Trader, you need to assemble your preferred plan configuration by choosing the following:

In short: TFT will suit those seeking more flexibility, while Sabio is good for those who prefer simple conditions.

Now, to the most important part — the costs.

| Funding | $20K | $50K | $100K | $200K |

| Profit % | 80% | 80% | 80% | 90% |

| Price | $119 | $289 | $479 | $939 |

| Standard challenge | ||||||||

| Funding | $5K | $10K | $25K | $50K | $100K | $200K | $300K | $400K |

| Profit % | 80% | 80% | 80% | 80% | 80% | 80% | 80% | 80% |

| Price | $65 | $129 | $199 | $299 | $499 | $939 | $1,469 | $1,879 |

| Rapid challenge | ||||||||

| Funding | $5K | $10K | $25K | $50K | $100K | $200K | — | — |

| Profit % | 80% | 80% | 80% | 80% | 80% | 80% | — | — |

| Price | $79 | $129 | $229 | $299 | $499 | $899 | — | — |

| Royal challenge | ||||||||

| Funding | $50K | $100K | $200K | $300K | $400K | — | — | — |

| Profit % | 80% | 80% | 80% | 80% | 80% | — | — | — |

| Price | $289 | $489 | $939 | $1,399 | $1,869 | — | — | — |

| Knight’s challenge | ||||||||

| Funding | $5K | $10K | $25K | $50K | $100K | $200K | — | — |

| Profit % | 80% | 80% | 80% | 80% | 80% | 80% | — | — |

| Price | $59 | $99 | $189 | $289 | $489 | $939 | — | — |

| Dragon challenge | ||||||||

| Funding | $5K | $10K | $25K | $50K | $100K | $200K | — | — |

| Profit % | 75% (95% with VIP) | 75% (95% with VIP) | 75% (95% with VIP) | 75% (95% with VIP) | 75% (95% with VIP) | 75% (95% with VIP) | — | — |

| Price | $49 | $99 | $135 | $205 | $355 | $495 | — | — |

In short: In hard numbers, comparable tariffs in Sabio and TFT are nearly identical, although certain Sabio tariffs win based on a combination of other criteria, such as profit split percentage.

For example, if we compare $200K accounts from Sabio and TFT, their costs are approximately the same, despite the fact that Sabio’s payout percentage will be 10% higher.

TFT offers a more affordable $5K plan ($49-79), but Sabio’s cheapest plan ($119 for $20K) is more balanced and offers better overall value.

Let’s figure out how realistic our opponents’ profit targets are and explore other crucial trading conditions.

| SabioTrade | The Funded Trader | |

| Leverage | 3:1 – 100:1 | 2:1 – 100:1 |

| Profit target | 10% | 5-10% |

| Daily loss limit | 3-5% | 3-5% |

| Max . trailing drawdown | 6% | 3 – 5% |

| Trading commissions | No | No |

In short: The Funded Trader boasts a tighter maximum trailing drawdown figures, which is the feature that they market as TFT’s competitive advantage. Some TFT account options also offer lower profit targets, yet Sabio has slightly higher scaling possibilities on crypto, with the leverage of 3:1 vs TFT’s 2:1.

Let’s skip to both prop companies’ over.

Sabio integrates a proprietary platform with its dashboard, setting it apart from other prop firms that typically only offer a dashboard and direct users to third-party platforms. With SabioTrade, traders can transition between their platform and dash without disrupting their trading flow. Here are the key features:

Through the SabioDashboard, users can access the platform, track their progress, monitor account status, and be notified of any rule breaches. Additionally, users can manage their accounts, access educational videos and FAQs, and receive notifications and updates.

With The Funded Trader, things are a bit more complicated. This prop firm collaborates with two brokers: Purple Trading SC and Think Markets. The former operates on MT4, while the latter works on MT4/MT5 and has its own proprietary platform. You need to choose your brokerage upon purchasing a tariff.

Funded trading statistics reside in a separate interface, allowing for monitoring progress toward profit targets, among other things.

Now, let’s compare the two in terms on tradable assets:

| SabioTrade | The Funded Trader | |

| Forex | ✔️ | ✔️ |

| Stocks | ✔️ | ❌ |

| Commodities | ✔️ | ✔️ |

| Indices | ✔️ | ✔️ |

| ETFs | ✔️ | ❌ |

| Crypto | ✔️ | ✔️ |

Bottom line: both competitors offer a convenient and modern dashboard for monitoring performance and profits. However, with TFT, users must switch to a third-party platform, whereas with SabioTrade, trading can be done directly from the dashboard using a proprietary platform.

Sabio’s list of tradable assets additionally includes stocks and ETFs. Other than that, the trading flow in both prop firms is pretty smooth.

Here’s a breakdown of payment methods you can use to buy plans and withdraw profits.

| SabioTrade | The Funded Trader | |

| Wire transfers | ✔️ | ❌ |

| Credit/debit cards | ✔️ | ✔️ |

| E-wallets | ❌ | ❌ |

| Crypto | ✔️ | ✔️ |

Bottom line: SabioTrade has wire transfers on top of TFT’s payment options.

Let’s see if traders can seek training at SabioTrade and The Funded Trader.

| SabioTrade | The Funded Trader | |

| Trading education at boot camp | ✔️ | ❌ |

| Telegram analytics | ✔️ | ❌ |

| FAQ | ✔️ | ✔️ |

SabioTrade places a strong emphasis on trader education. The company organizes a boot camp featuring live training sessions with professional traders, which include Q&A, live trading, weekly webinars and daily Telegram analytics. Furthermore, Sabio traders have access to educational videos within the dash and can also access the FAQ section.

The Funded Trader does not offer training, but has a really good and well-structured FAQ section. This section provides in-depth explanations of the complex TFT rules, helping traders understand the various account options and varying terms.

In short: If you have limited experience and aim to learn, Sabio is better suited for you. However, if you’re already a highly confident trader, both prop firms are suitable options. TFT has excelled with its comprehensive FAQ section, providing valuable explainers for traders.

| Simplicity | Flexibility | Profit share | Pricing | Assets | Trading experience | Education | |

| SabioTrade | 10/10 | 5/10 | 9/10 | 9/10 | 9/10 | 9/10 | 10/10 |

| The Funded Trader | 6/10 | 10/10 | 9/10 | 8/10 | 8/10 | 8/10 | 6/10 |

A full comparison of the key parameters reveals that both SabioTrade and The Funded Trader are reputable prop trading firms. They both offer affordable tariffs, typically below market average, high profit percentages, and favorable trading conditions.

TFT is ideal for experienced traders seeking customizable configurations tailored to their skills and objectives (if you want to do it quickly, or have more drawdown, or seeking a wider price range, etc.). On the other hand, Sabio is more suited for traders who prefer simplicity and predictability, without delving into complexities and pitfalls, while still aiming for profitability.