10 Best Funded Prop Firms in 2026: The Comparison Guide for Traders

Ask any trader what’s the one thing they need for a serious career boost, and you’ll hear the same answer: “Money.” Trading with big capital is a completely different game — but here’s the problem:

For many traders, prop firms are a shortcut to a professional trading career — offering large funding, generous profit splits, and a chance to trade without risking personal money.

👀 Confused?

Read more about how proprietary trading works and what’s the difference between prop trading and hedge funds.

Still, the prop firm world isn’t without its challenges:

This guide addresses all those concerns.

We’ve tested, compared, and rated the top 10 funded prop firms for 2026 — looking at their account sizes, costs, profit splits, payout speeds, and trading rules.

We evaluated 40+ firms and selected the top 10 using 10 key criteria:

| Criterion | Why It Matters |

| Profit Split | Determines how much of your profits you keep (80–95%). |

| Drawdown Rules | Protect your capital but can end challenges fast. |

| Evaluation Cost | Entry price affects accessibility. |

| Scaling Plan | Shows how much your account can grow. |

| Payout Speed | Some firms pay daily; others monthly. |

| Trading Restrictions | Check news/EA/weekend rules. |

| Support Quality | Good support = fewer surprises. |

| Reputation & Reviews | Verified payouts are key. |

| Platform Variety | MT4, MT5, cTrader, or WebTrader. |

| Regional Access | Especially for US-based traders. |

| Rank | Prop Firm | Rating | Funding (max) | Profit Split | Evaluation | Starting Price | Assets | Platforms | Best For |

| 🥇 1 | Sabio Trade | ★★★★★ | $1,000,000 | 90% | 1-Step | €119 | Forex, Stocks, Indices, Crypto, Commodities, ETFs | Proprietary | Best All-Rounder |

| 🥈 2 | FTMO | ★★★★★ | $200,000 | 90% | 2-Step | $155 | Forex, Indices, Commodities, Stocks, Crypto | MT4 / MT5 / cTrader / DXTrade | Best for Professionals |

| 🥉 3 | Funded Trading Plus | ★★★★★ | $200,000 | 80–90% | 1-Step / 2-Step | $119 | Forex, Commodities, Indices, Crypto | MT5 / cTrader / DXTrade / Match-Trade Technologies | Best for Beginners |

| 4 | FXIFY | ★★★★☆ | $400,000 | 90% | 1-Step / 2-Step | $39 | Forex, Indices | MT5, DXTrade | Best for Quick Funding |

| 5 | Topstep | ★★★★☆ | $150,000 | 90% | Futures Challenge | $49/month | Futures | NinjaTrader, Tradovate, TopstepX | Best for Futures Traders |

| 6 | E8 Funding (ETF) | ★★★★☆ | $500,000 | 80–100% | 1/2/3-Step | $40 | Forex, Indices, Metals | MT5 / Match Trader / cTrader / TradeLocker | Best for Advanced Traders |

| 7 | Goat Funded Trader | ★★★★☆ | $400,000 | 100% | 1/2/3-Step | $36 | Forex, Stocks, ETFs, Commodities, Crypto | MT5 / TradeLocker / Match-Trader / VolumetricaFX | Best for Speed & Simplicity |

| 8 | The 5%ers | ★★★★☆ | $250,000 | 50-100% | Instant Funding | $39 | Forex, Commodities, Indices, Crypto | MT4 / MT5 | Best for Low-Risk Traders |

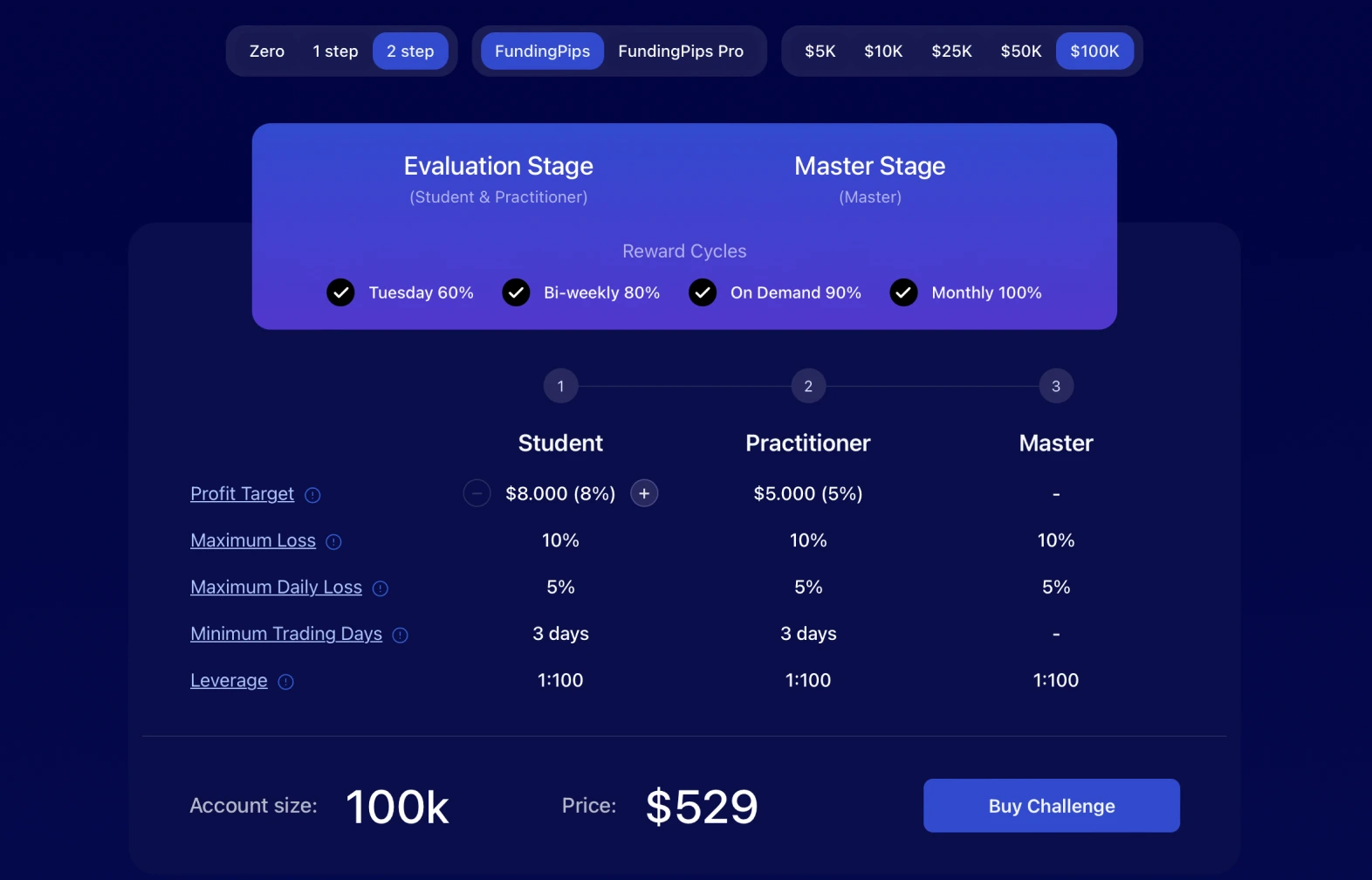

| 9 | Funding Pips | ★★★☆☆ | $100,000 | 60–100% | 1/2-Step, instant funding | $29 | Forex, indices, crypto, commodities | MT5 . Match-Trader / cTrader | Best for Swing Traders |

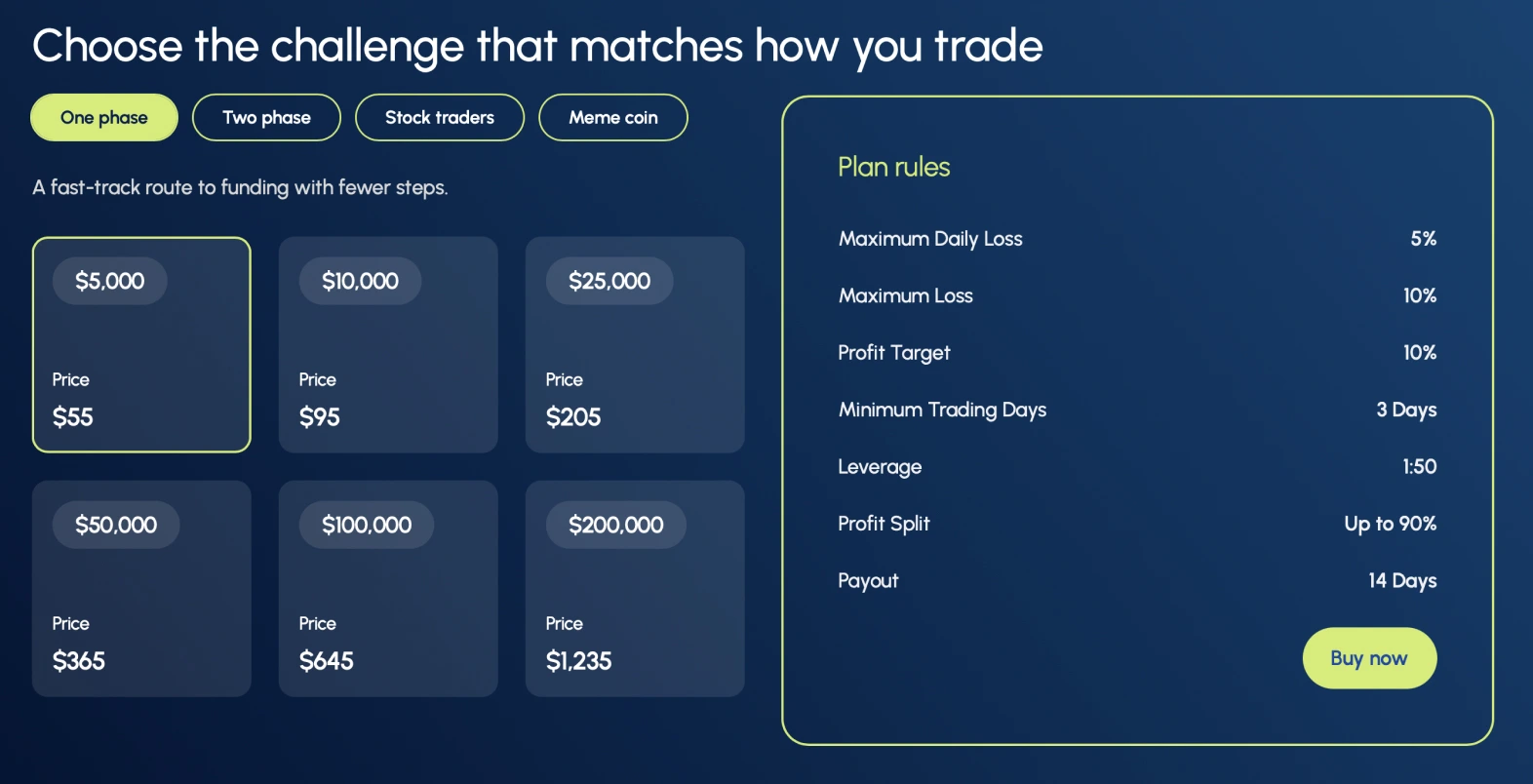

| 10 | FundedPrime | ★★★☆☆ | $200,000 | 80–90% | 1/2-Step | $35 | Forex, crypto, stocks | TradeLocker, DXTrade | Best for Experienced Traders |

👀 Being a funded trader is great… but becoming one isn’t easy. Check out this article to find out how to succeed as a funded trader.

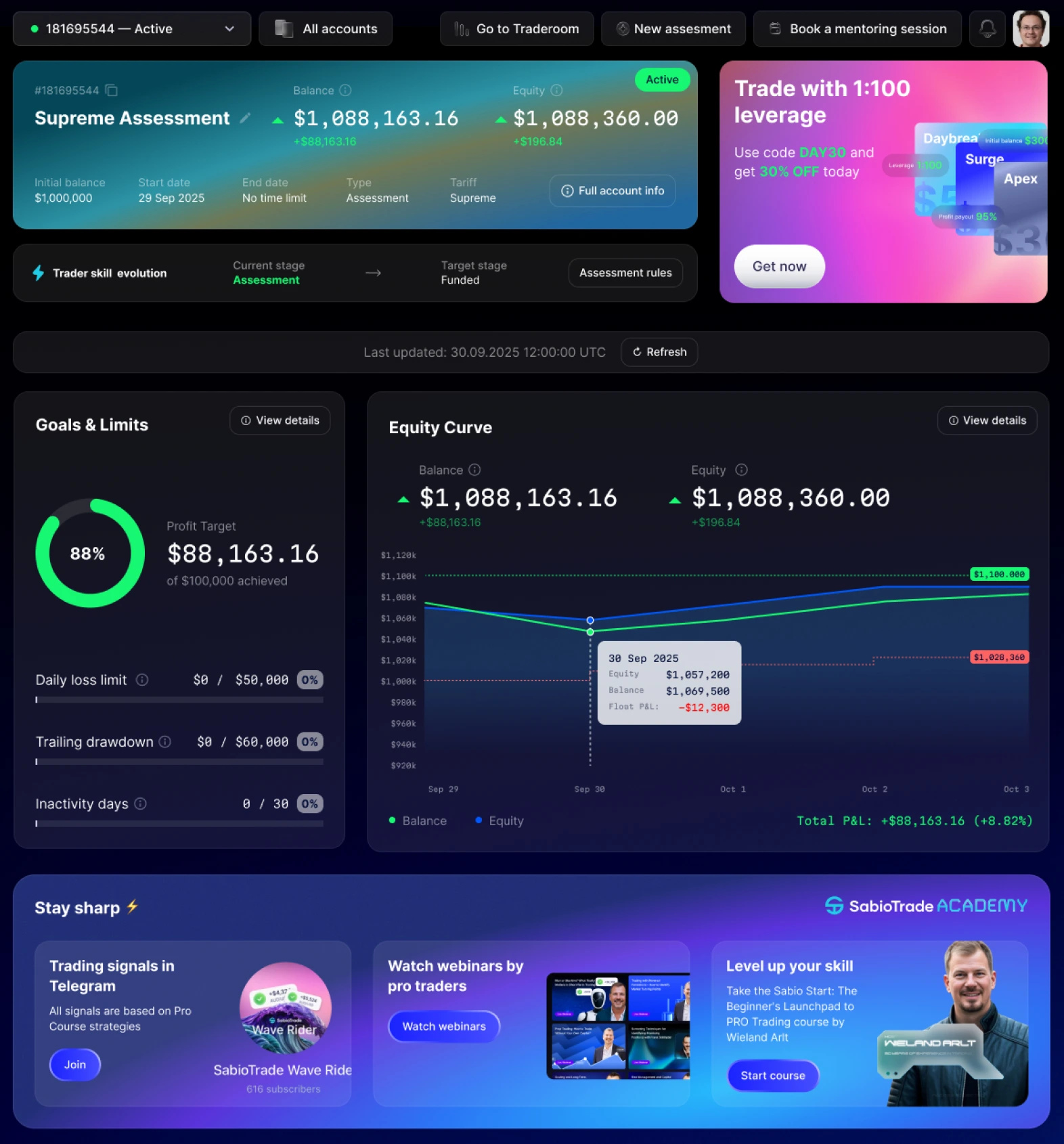

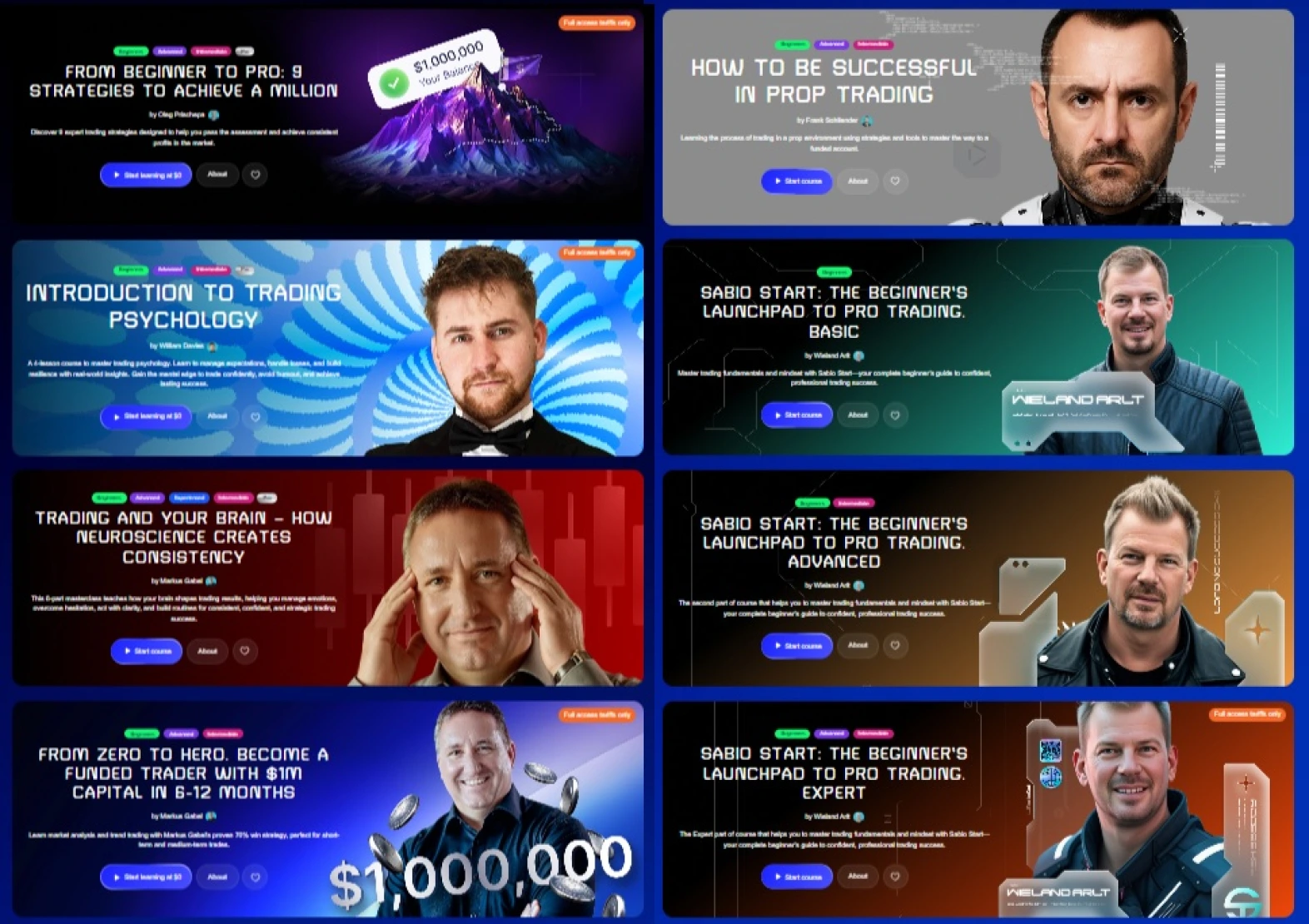

Sabio Trade combines features that make it a fit for all kinds of traders: simple 1-step assessment and free education for beginners, mentorship for developing traders, and extra-large funding for pros.

There are accounts for different goals and strategies, grouped in Single, PRO, and Intraday categories. Accounts are divided into Single, PRO, and Intraday plans, all with clear and consistent rules — no fine print, no complex scaling tables, no surprises.

Standout features include mobile trading (rare among prop firms), a strong educational ecosystem through Sabio Academy, and the well-designed trading ecosystem with a synchronized traderoom and dashboard.

On top of that, Sabio is known for regular promo codes, giveaways, and an active community.

Key Features:

| Pros: | Cons: |

|

|

Promo Code: 30% off the first purchase with promo code: SABIO26

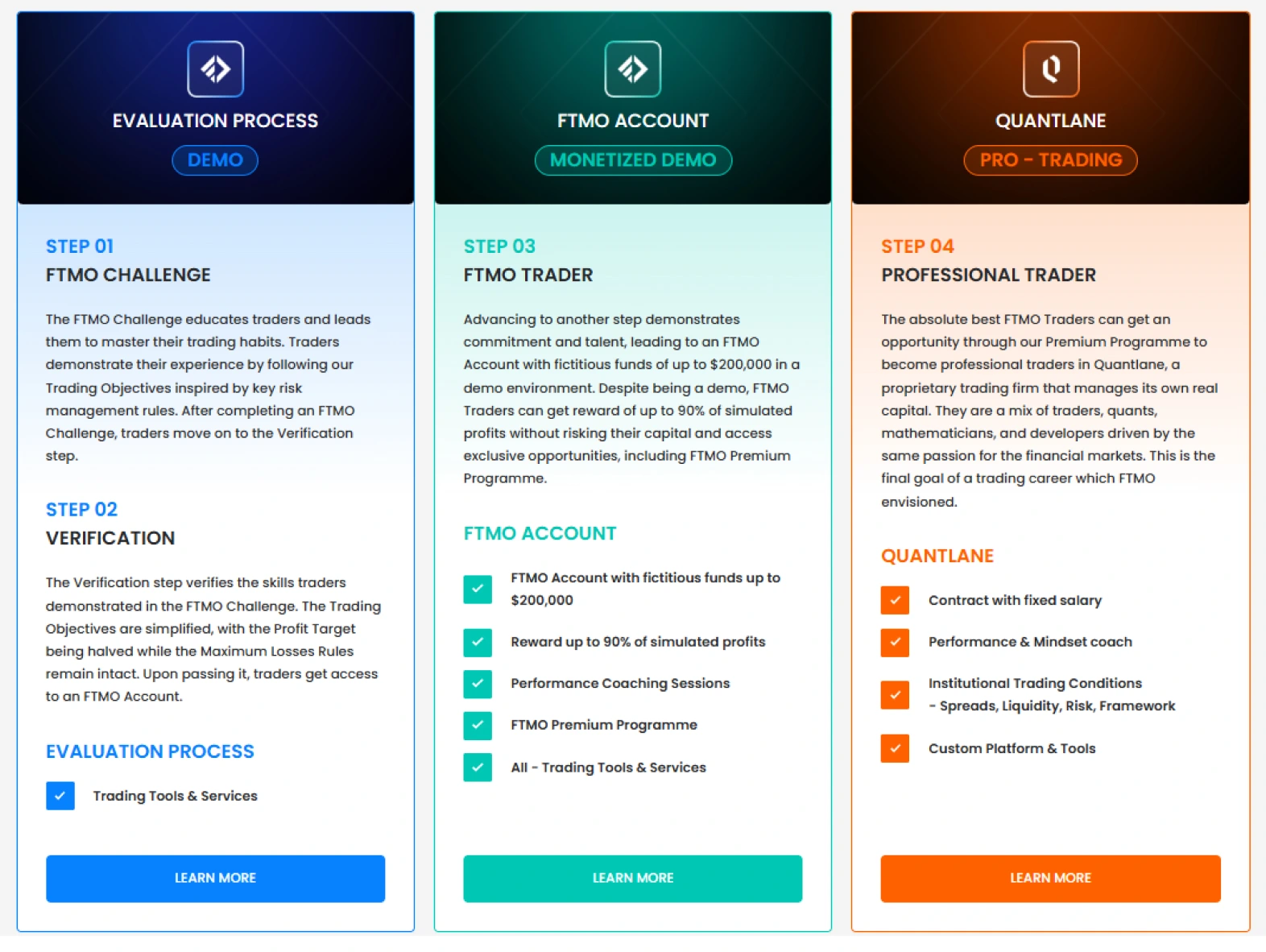

FTMO is one of the most reputable prop firms in the industry, known for its transparent rules, strong community, and proven payout record.

Founded in 2015, FTMO popularized the two-step evaluation model, setting the standard many other firms now follow.

While the rules are strict and you’ll need to pass both steps and adhere to drawdown/target requirements, the transparency, support structure, and scalable potential make FTMO a top choice for serious traders.

Key Features:

| Pros: | Cons: |

|

|

Promo Codes: 10-Year Anniversary Deal: 19% off the $100,000 FTMO Challenge — Now €439.

Special Deal: $10,000 FTMO Challenge for €89

Best for: Experienced traders who want structure and proven reliability.

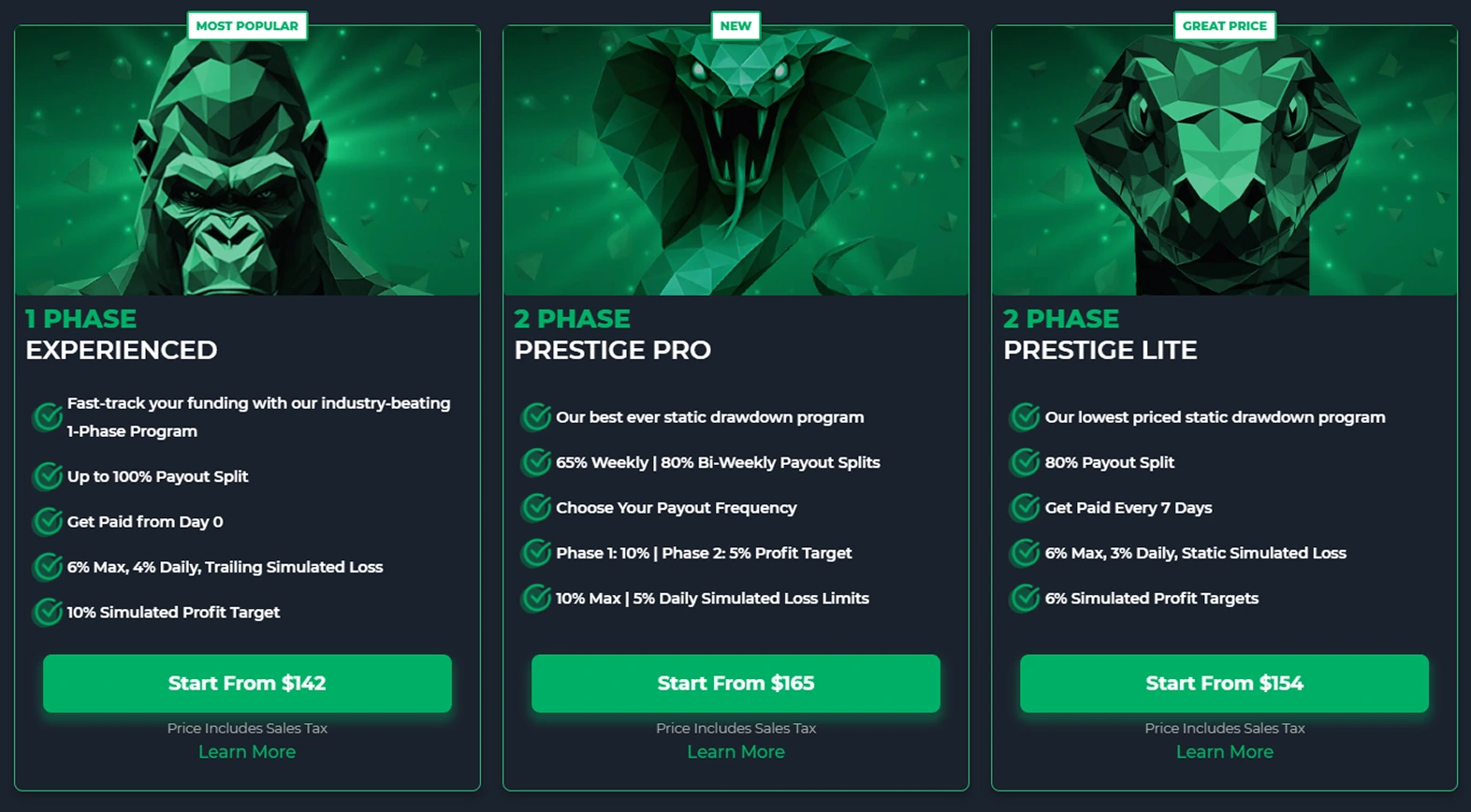

Funded Trading Plus (FT+) is designed for accessibility and speed. With affordable pricing and flexible 1-step or 2-step evaluations, it’s one of the best choices for traders entering prop trading for the first time.

The company is praised for transparent rules, quick support, and the ability to trade without time pressure. Trading conditions are notably flexible: EAs are allowed (especially via cTrader), weekend and news trading are permitted in most programs, and the firm accepts traders from over 165 countries including the U.S.

Key Features:

| Pros: | Cons: |

|

|

Promo Codes: Prestige Lite 10% Off – Use Code Lite10

Instant Master Trader 10% Off – Use Code 10Instant

Best for: Beginners who want an easy start and clear rules.

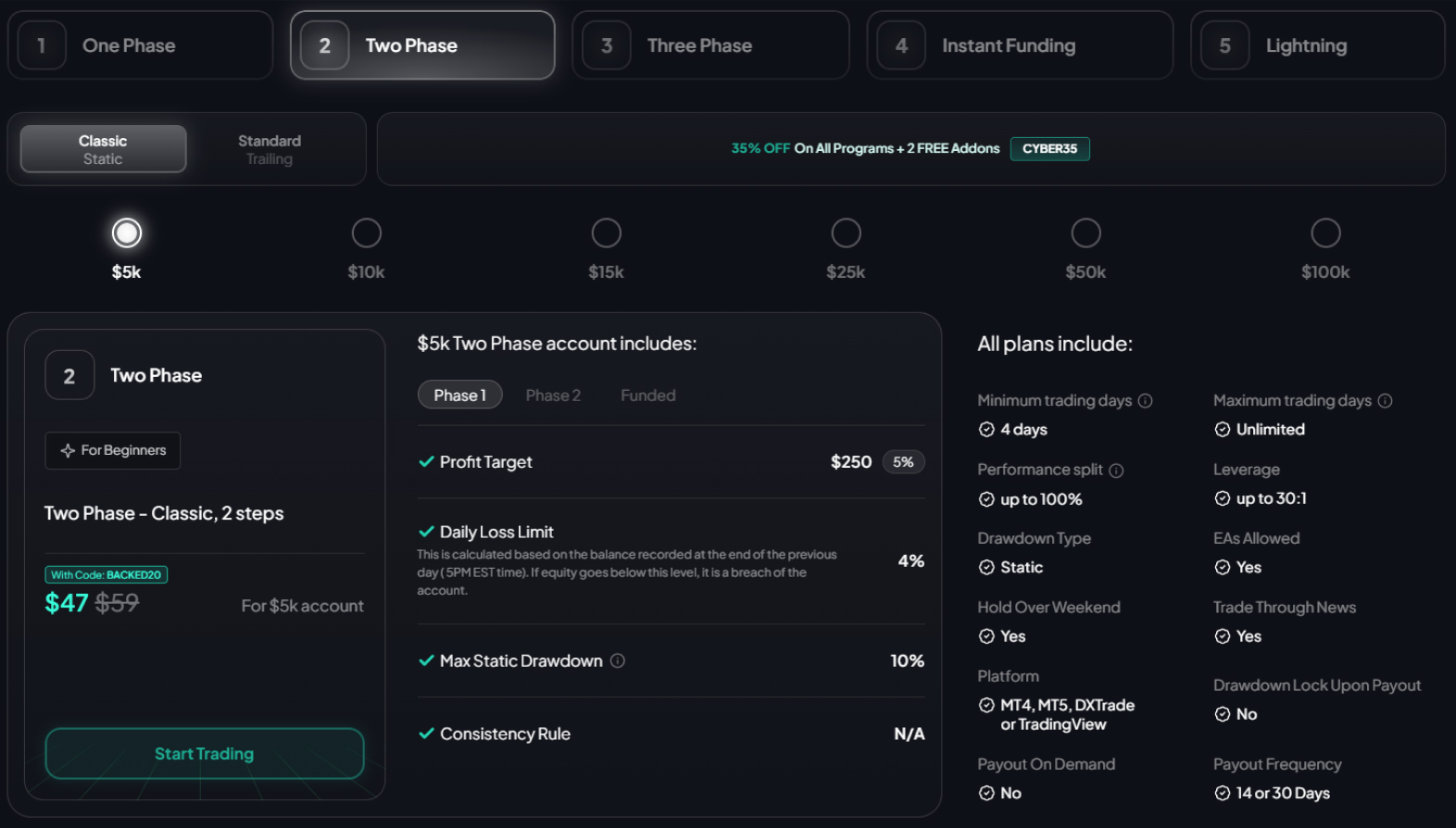

FXIFY offers traders quick access to capital through flexible evaluation programs. Traders can choose between 1-, 2-, and 3-phase challenges, with funding available up to $400,000. Experienced traders can try the Lightning Challenge, which allows them to complete a 1-step assessment in just 7 days, while crypto-focused traders can opt for the Crypto Challenge.

FXIFY also offers a special futures program with funding up to $450,000, operating on a monthly subscription model starting at $89/month.

FXIFY supports a wide range of assets and removes many traditional restrictions such as news trading, EAs, and hedging.

Want to jump in without extra red tape? FXIFY is your stop.

Key Features:

| Pros: | Cons: |

|

|

Promo Code: 20% OFF On All Evaluations with Promo Code BACKED20

Best for: Traders who want fast results and flexible funding.

Topstep is the pioneer in Futures prop trading, based in the U.S. and CFTC-compliant. It offers a structured “Trading Combine” evaluation where traders prove consistency before accessing real capital.

While the funding caps are lower compared to some forex-focused firms, Topstep’s model is especially solid for those whose expertise lies in trading futures contracts and want exposure to U.S. regulated markets.

Key Features:

| Pros: | Cons: |

|

|

Promo Code: 40% Off Trading Combine with promo code ONWARD40 (Nov 2026)

Best for: Professional or aspiring Futures traders.

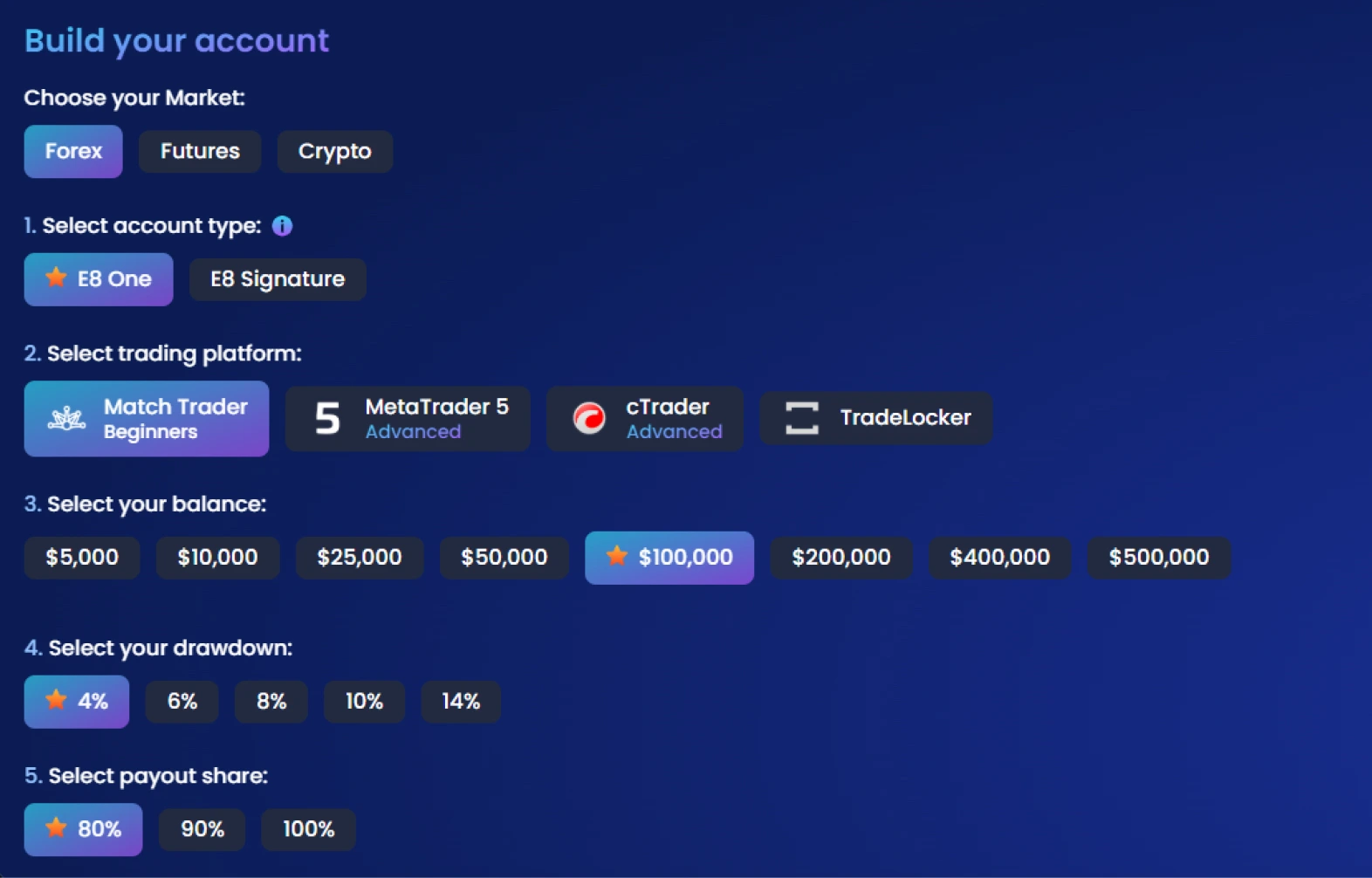

E8 Funding focuses on serious, high-volume traders who want generous scaling and advanced analytics.

E8 has several interesting features that make it stand out. For example, you can customize your assessment flow by choosing your market (Forex, Futures, or Crypto), assessment type (1-2-3 step), drawdown % and profit split % — something that we haven’t seen anywhere else.

It offers transparent rules, fast payouts, and an excellent user dashboard for tracking progress.

Key Features:

| Pros: | Cons: |

|

|

Promo Code: Occasional E8X promotions available.

Best for: Advanced traders seeking detailed performance insights.

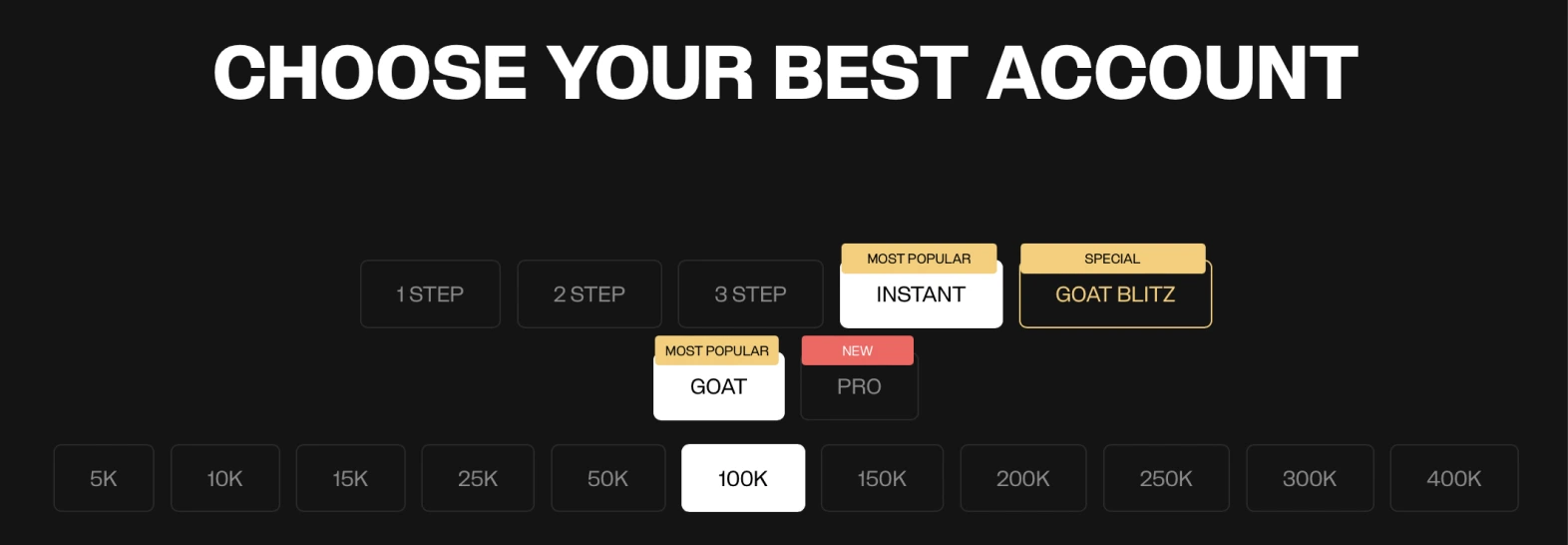

Goat Funded Trader (GFT) is a relatively new but rapidly growing prop firm (launched in 2022) with a wide range of account sizes and flexible rules.

Their fee structure is among the lowest in the industry (evaluation fees starting as low as ~$36) and they support a profit share up to 100% under certain add-ons.

Goat Funded Trader also offers a unique Pay Later model, where you only pay a $5 fee. You pay the full challenge fee after passing the evaluation.

Key Features:

| Pros: | Cons: |

|

|

Promo Code: 50% off for new users with the code: FIRSTGFT

Best for: Traders who want flexibility and fast scaling.

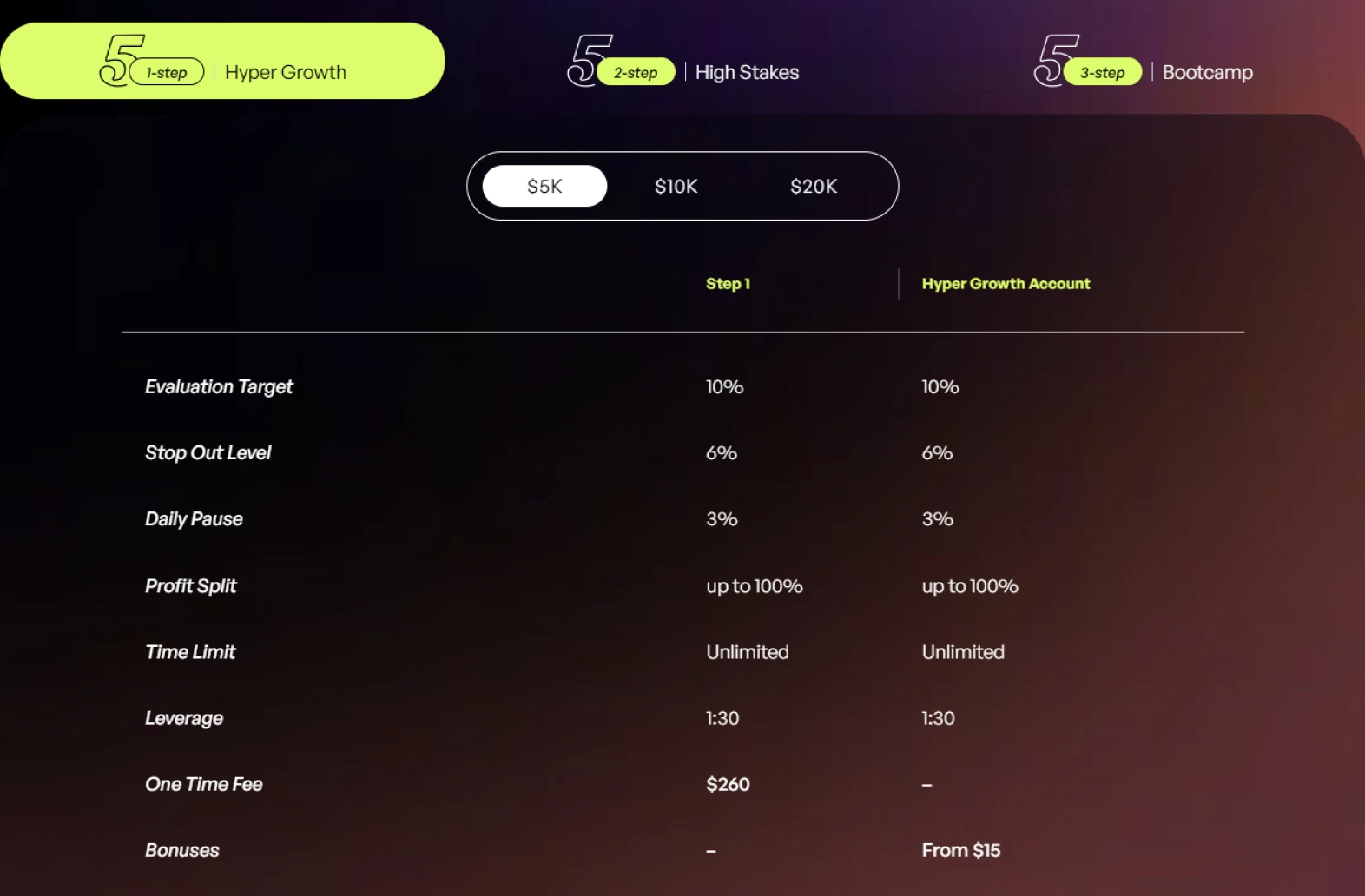

The 5%ers is known for its low-risk funding model and structured growth plans. Unlike many competitors, The 5%ers offers three different evaluation types — Hyper Growth, High Stakes, and Bootcamp — each with unique conditions and scaling paths.

While the structure is more complex than competitors, it offers flexibility for different experience levels.

The 5%ers also stands out with payouts starting from the evaluation stage, a rare advantage in the industry. However, traders must navigate a more intricate ruleset, including minimum profitable days and strict conditions.

Key Features:

| Pros: | Cons: |

|

|

Promo Codes: Seasonal bonuses and hub-credit promotions, varying by challenge type.

Current samples (may change seasonally):

Best for: Low-risk, consistent traders who want to start earning right away.

Funding Pips focuses on Forex and CFD trading and is known for its Zero Payout Denial commitment and straightforward rules. While its structure is similar to many major prop firms, Funding Pips includes several standout features.

First, there’s the FP Score system, which evaluates traders holistically on a 0–100 scale using multiple KPIs — not just profit.

They also offer the Hot Seat Program for top-performing traders. After 16 successful rewards and 40% total profit, traders unlock Elite Trader status, which includes: double initial balance, on-demand rewards, a 100% reward split, up to $2 million in capital, customized trading conditions, and monthly bonuses.

Key Features:

| Pros: | Cons: |

|

|

Promo Code: 20% off the first purchase with promo code: HELLO

Best for: Swing traders who want stable conditions and low costs.

FundedPrime focuses on risk-takers who want flexibility. Along with standard 1- and 2-step plans, it also offers innovative challenges tailored specifically for stock traders and meme coin traders.

Funding is capped at $200K, and scaling opportunities are limited. However, many traders may find the flexible conditions and the low entry cost — starting at just $35, one of the lowest on our list — especially appealing.

Key Features:

| Pros: | Cons: |

|

|

Promo Code: N/A

Best for: Crypto and stock traders

👀 Need help choosing the right prop firm?

Compare Top Prop Firms →

Before traders get access to a prop firm’s capital, they must first prove their skills through an assessment challenge.

Each firm structures its challenge differently, but most fall into three main types: 1-step, 2-step, and instant funding programs.

| Challenge Type | How It Works | Typical Terms | Profit Targets | Best For | Pros | Cons |

| 1-Step Evaluation | Trader completes a single phase with profit target + risk rules. Pass it → get funded. | One evaluation phase, daily/overall drawdown rules, minimum trading days. | Usually 8–10% in one phase. | Confident traders who want faster access to funded accounts. | • Faster funding • Lower stress • Often cheaper than instant funding |

• Profit targets can be higher • Some firms still have strict rules (daily DD, weekends, news) |

| 2-Step Evaluation | Two phases: Phase 1 (profit target) → Phase 2 (smaller target). Pass both → funded. | Two evaluation phases, reduced target in Phase 2, standard drawdown rules. | Phase 1: 8–10% Phase 2: 4–5% |

Traders who prefer more relaxed rules and lower second-phase goals. | • Lower targets in Phase 2 • Often cheaper entry fees • Many traders find the structure more manageable |

• Takes more time • Requires consistency over more trades |

| Instant Funding | No evaluation challenge. You pay a fee and trade a live-funded account immediately. | No evaluation, usually stricter scaling rules, higher fees, profit split may be lower at start. | — | Traders who value time over cost and prefer immediate access to capital. | • No challenge or verification • Instant access to live capital • Great for low-risk, long-term traders |

• Higher fees • Payouts or scaling may be slower • Stricter risk limits |

| Prop Firm | 1-Step | 2-Step | 3-Step | Instant |

| Sabio Trade | ✔️ | — | — | — |

| FTMO | — | ✔️ | — | — |

| Funded Trading Plus | ✔️ | ✔️ | — | — |

| FXIFY | ✔️ | ✔️ | ✔️ | ✔️ |

| Topstep | — | — | — | Futures challenge |

| E8 Funding (ETF) | ✔️ | ✔️ | ✔️ | — |

| Goat Funded Trader | ✔️ | ✔️ | ✔️ | — |

| The 5%ers | ✔️ | ✔️ | ✔️ | ✔️ |

| Funding Pips | ✔️ | ✔️ | — | — |

| FundedPrime | ✔️ | ✔️ | — | — |

In general, firms with 1-step evaluations or instant funding models release payouts the quickest.

While instant funding is generally better suited for experienced traders (read more in our article on instant funding prop firms), 1-step challenges are usually the best choice for beginner and intermediate traders. Based on our research, the best entry cost / profit target / account value ratio for 1-step challenge firms can be found at FXIFY, SabioTrade, Funded Trading Plus, and Goat Funded Trader.

Here are key strategies to boost your chances of success:

1. Treat the Evaluation Like a Real Account — Professional behavior during the challenge reflects how you’ll perform when funded.

2. Master Risk Management — Stick to a fixed risk per trade (1–2% max).

Most traders fail due to violating drawdown rules, not from lack of skill.

3. Don’t Rush the Target — Trying to hit profit targets too fast leads to overtrading. Spread your performance across several trading days.

4. Avoid Rule Violations

Always double-check firm policies on:

👀 How to pass the evaluation, you ask?

Read out tips to pass a funded trading challenge and find out about trading psychology for funded accounts before you start.

Most traders fail challenges not from bad strategy — but from drawdown breaches.

Drawdown is the maximum amount your account is allowed to lose before violating the rules.

Example:

On a $100,000 account:

Trailing Drawdown means your limit moves up as your balance grows. If you reach $105,000, your max loss line also moves up to protect profit.

👀 You can read more in our full guide here:

→ What is drawdown in trading

Prop firms earn mainly from:

Most challenges are demo-based, meaning trades aren’t executed on real markets — payouts are made from company revenue. That’s normal, but it means trust and transparency matter most.

Prop firms share profits after payouts, e.g. “90/10 split” means:

👀 You want the highest-paying prop firm, don’t you?

We’ve made a list — check it out here!

| Firm | Payout Frequency | Minimum Withdrawal | Methods |

| Sabio Trade | On demand | $1 Crypto and Amaiz

$30 Bank Transfer |

Bank transfer, crypto, instant payouts through Amaiz (for clients from EU and UK) |

| FTMO | Bi-weekly or on-demand after 14 days from the first trade | $20 for bank transfers, $50 for crypto withdrawals | Wire transfer/ Bank Transfer, Mastercard, Visa, Skrill, Credit/Debit Card, Crypto |

| Funded Trading Plus | Bi-weekly | $50 | Bank transfers, USDT, USDC |

| FXIFY | On demand | $50 | Bank Transfer, crypto, Riseworks |

| Topstep | Daily after 30 winning days on Live funded account | $125 | ACH, Wire/SWIFT |

| E8 Funding | Bi-weekly | Rise – $250, Plane – $50 | Bank transfer, USDC, USDT, Bitcoin, Ethereum |

| Goat Funded Trader | 10-14 days | $100 | Crypto, Skrill, Rise / Deel |

| The 5%ers | Bi-weekly | $150 | Rise, crypto, bank transfers |

| Funding Pips | Bi-weekly | 1% of the starting balance | Wire/Bank Transfer, crypto, Skrill, Neteller/ Rise, Visa, Mastercard |

| Funded Prime | Weekly/bi-weekly | $100 | USDT (TRC20/ERC20), BTC, International Bank Transfer, Credit/debit cards |

This way, you’ll find the fastest payouts at FTMO, Sabio Trade, Topstep, Funded Prime.

Be aware of hidden costs before you buy a challenge

| Firm | Evaluation fee | Reset fee | Platform fees | Monthly subscriptions | Spread | Commission per trade | Withdrawal fee |

| SabioTrade | $119–$5,989 | ❌ | ❌ | ❌ | – 0 on EUR/USD during the assessment

– Forex: floating from 1.2 – Stocks: from 0.003 – Commodities from 0.04 – Indices from 0.66 – ETFs from 0.01 |

❌ | ❌ |

| FTMO | $155–$1,080 | ❌ | ❌ | ❌ | – Raw from 0 pips – Forex: $6 per lot |

Forex: $2.50 per lot

Metals CFD 0.0007 per volume Crypto: 0.0325% per side Indices: $0 |

3% |

| Funded Trading Plus | $119–$949 | ❌ | ❌ | ❌ | EUR/USD: ~0.3

EUR/GBP: ~0.6 |

❌ | $50 |

| FXIFY | $69 – $1,999 | $79 | N/A | $89–$349/month | From 0 on majors and gold | $6 round-turn commission per lot on Raw Spread model | ❌ |

| Topstep | $49–$149 | $49 for 50K account reset

$99 for 100K account reset $149 for 150K account reset |

One-time $149 Activation Fee (Express Funded)

Level 2 Data: additional $34.25 per month. API Access: $29 per month |

$49 | Zero | Depends on the platform — view | ACH and Wise transfers: $20

Wire transfers: depend on your bank PayPal: depend on your bank |

| E8 Funding | $33–$1,097 | 5% discount on a reset with an active subscription | ❌ | $98–$268/month for Signature accounts

$88–$198 activation fee |

Raw or standard, vary | $6 per lot | ❌ |

| Goat Funded Trader | $36–$2,888 | $99–$349 | N/A | ❌ | Raw, vary | Flat fee of $0 per lot for cryptos, indices, commodities and stocks, $5 for FX and metals | ❌ |

| The 5%ers | $39–$850 | ❌ | ❌ | ❌ | From 0.2 on FX majors | Forex – $4 per round trip

Indices – 0 Crypto, metals, oil use a percentage-based formula |

2% for crypto, 3% for bank transfers |

| Funding Pips | $29–$555 | ❌ | ❌ | ❌ | 0 | ❌ | $10 |

| Funded Prime | $35–$1,248 | ❌ | – Crypto: 0.01% per position

– U.S. Stocks: $2 per lot – Non-U.S. Stocks: 0.1% – Other instruments: $5 per lot |

❌ | Floating | Vary | – 1% for crypto

– $50 for international bank transfers |

In short:

Best overall pricing: SabioTrade, Funding Pips

Highest costs: FXIFY, Topstep

Lowest entry threshold: Funding Pips, Funded Prime, E8 Funding

Most transparent: SabioTrade, FTMO

Regional Availability & US Traders

Due to regulation, many prop firms don’t accept US traders directly. This includes FTMO, which recently stopped new US registrations.

Best options for US traders (2026):

For EU and UK traders — all top firms are accessible.

| Rule | Meaning | Common Status | Firms That Allow It |

| News Trading | Keeping positions open during major economic announcements | Often banned or allowed only during the challenge phase | Funded Trading Plus, Topstep, The 5%ers (Hyper-Growth and Bootcamp), FundedPrime |

| Weekend Holding | Keeping trades open from Friday to Monday | Often allowed, but with limitations | Sabio Trade, FundedPrime, The 5%ers, Goat Funded Trader, FXIFY, Funded Trading Plus |

| EA/Bots | Using automated trading systems | Allowed by some, but with limitations (e.g. no high-frequency trading) | FTMO, Sabio Trade, Goat Funded Trader, Funded Trading Plus, E8 Funding, The 5%ers |

| Hedging | Opening opposite positions on the same pair | Allowed by some within a single account | FTMO, The 5%ers, Funded Trading Plus, FXIFY, FundedPrime |

| Copy Trading | Copying other traders’ signals or accounts | Usually banned | Allowed only at a few firms and only between your own accounts |

Here’s how the top prop firms stack up by market type:

| Asset Type | Best Prop Firms |

| Forex | All except Topstep |

| Indices | Sabio Trade, FTMO, Funded Trading Plus, FXIFY, E8 Funding, The 5%ers, Funding Pips |

| Futures | Topstep |

| Stocks | SabioTrade, FTMO, Goat Funded Trader, FundedPrime |

| Crypto | SabioTrade, FTMO, Funded Trading Plus, Goat Funded Trader, The 5%ers, Funding Pips, FundedPrime |

Tip: If you trade multiple asset classes, Sabio Trade and FTMO offer the most balanced mix of forex, indices, and crypto with reliable execution and consistent spreads.

👀 Crypto trader?

Read more about the best crypto prop trading firms

Before paying for any challenge:

Red Flags:

Read more about prop firm’s legitimacy in our article.

Top reasons traders fail evaluations:

Pro tip: Treat evaluations like live trading. Risk 1–2% per trade max, and plan trades carefully. If you fail, reset fees usually apply ($50–$200), but you can always retry.

Read more about risk management in funded trading.

Most prop firms allow traders to hold and trade several accounts at the same time. However, each firm sets its own limits on:

| Pros | Cons |

|

|

| Prop Firm | Multiple Accounts? | Capital Limit |

| Sabio Trade | Yes | Unlimited |

| FTMO | Yes | Up to $400k (merge allowed) |

| Funded Trading Plus | Yes | 2 accounts max, up to $200k total |

| FXIFY | Yes | 3 accounts max |

| Topstep | Yes | 1 Live Funded Account, up to 5 Express funded accounts |

| E8 Funding | Yes | Up to 5 accounts |

| Goat Funded Trader | Yes | Up to $400k total |

| The 5%ers | Yes | Up to 3 accounts |

| Funding Pips | Yes | Up to $300k total |

| FundedPrime | Yes | Up to $400k total |

Are prop firms legal?

Yes — they’re legitimate companies offering simulated trading accounts. Always check their registration and payout history.

Do prop firms really pay?

Top-tier firms have verified payout proofs and active communities.

Can beginners pass the assessment?

Yes, if you have solid risk management and discipline. Some firms (like Funded Trading Plus and SabioTrade) are built for beginners.

How long does it take to get funding?

Usually 1–3 days after passing the evaluation. Instant accounts are available too.

What happens if I fail the test?

You lose access to that evaluation — but you can always try again by purchasing a new account. Some firms offer discounted retakes.

Do I have to pay taxes on profits?

Yes, payouts are treated as income in most countries.

Which is better — 1-step or 2-step?

1-step is faster; 2-step builds more credibility and security.

Can I use EAs or bots?

Depends on the firm — many now allow them (FTMO, Sabio Trade, Goat Funded Trader). However, limitations may apply. For example, some firms allow EAs but forbid high-frequency trading (HFT).

How do I withdraw profits?

Withdrawals become available after passing the assessment and trading for a required amount of time (depending on the firm). You can withdraw money via crypto, bank transfer, or e-wallets.