The Anatomy of a $120,000 Month: An Interview with Sabio’s Top Trader of January

In January, a 55-year-old Sabio trader from Lauf an der Pegnitz, Germany generated ~$120,000 in profit trading USD currency pairs and silver.

We knew this wasn’t just a lucky month — so we sat down with him for a private conversation to break down exactly how he did it.

For privacy and security reasons, we’ll refer to him as Trader X.

Read until the end to discover his actionable trading approach and the tips from our best performing trader of January.

Trader X is not new to markets. With over 30 years of trading experience, he began long before prop firms and online platforms became mainstream.

Professionally, he is an experienced IT executive with a background in market research and manufacturing industries. He holds a Bachelor’s degree in Computer and Information Sciences from FH Wiesbaden and has spent decades working in business process optimization, IT strategy, and data infrastructure.

That structured, systems-oriented mindset clearly carries over into his trading.

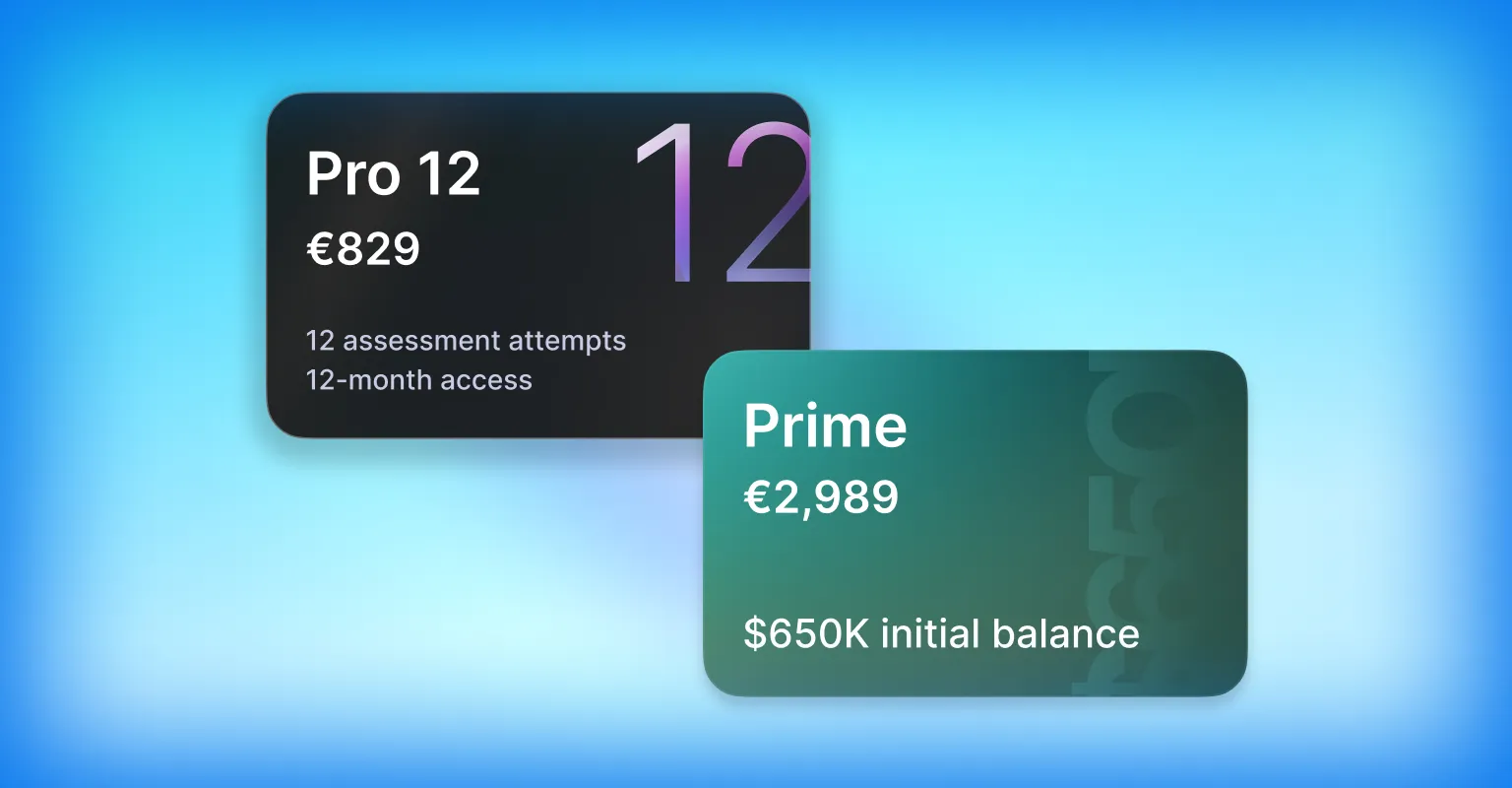

Today, he operates across multiple accounts, including:

In January, his combined activity across these accounts resulted in approximately $120,000 in profit, primarily from USD currency pairs and silver.

But the number alone doesn’t tell the story. What matters more is how he approaches markets.

Here’s what he shared.

— How did your trading journey begin?

I started traditionally — buying stocks through my bank and holding them for years. More recently, when I had more time, I moved into active trading. I took courses, studied futures and options, and gradually shifted toward shorter-term trading.

Today I focus mainly on futures, currencies, and metals.

— When did you discover prop trading?

Last year. One of the courses I took recommended prop accounts as an alternative to using your own capital. They highlighted one of your competitors, but I didn’t like their rules — they were too restrictive: no news trading, minimum holding times, and so on.

— What do you think about prop trading overall?

I enjoy it, and I’m considering doing more via prop trading because it has a big advantage: strict drawdown rules.

When you trade your own money, emotions kick in — you ignore your own rules and walk around them.

With prop accounts, there is no walking around the rules.

The drawdown is clear, and if you break it, that’s it.

I notice that I trade much more carefully and consciously compared to my own accounts.

On my personal accounts, I lost quite a bit in recent months, while I was stable on the prop account. That gave me a clear sign that prop trading may be the better way — especially if you have itchy fingers.

— You mentioned you tried other prop firms. What was your experience?

Yes, some were quite restrictive in what you’re allowed to do.

One thing I really liked about SabioTrade compared to others was this: if you had a funded account and were profitable, but later reached the drawdown, you still paid out the profit. That felt unique compared to what I’ve seen elsewhere.

— You had both large and small accounts — what was the reasoning?

My initial idea was to test different strategies and different assets across different accounts.

But later I concluded that it makes sense to limit the number of assets — maybe two or three, maximum four.

It doesn’t make sense to trade 20 strategies and 70 assets.

I don’t have the time.

Typically, I trade silver, gold, oil, and a couple of currencies — mainly USD, sometimes AUD or JPY. Occasionally I try something else, but I’m narrowing it down.

Managing 20 accounts is cumbersome because you have to toggle between them.

At the beginning, it was also about testing your platform. I didn’t know you at all, so I started with smaller accounts first.

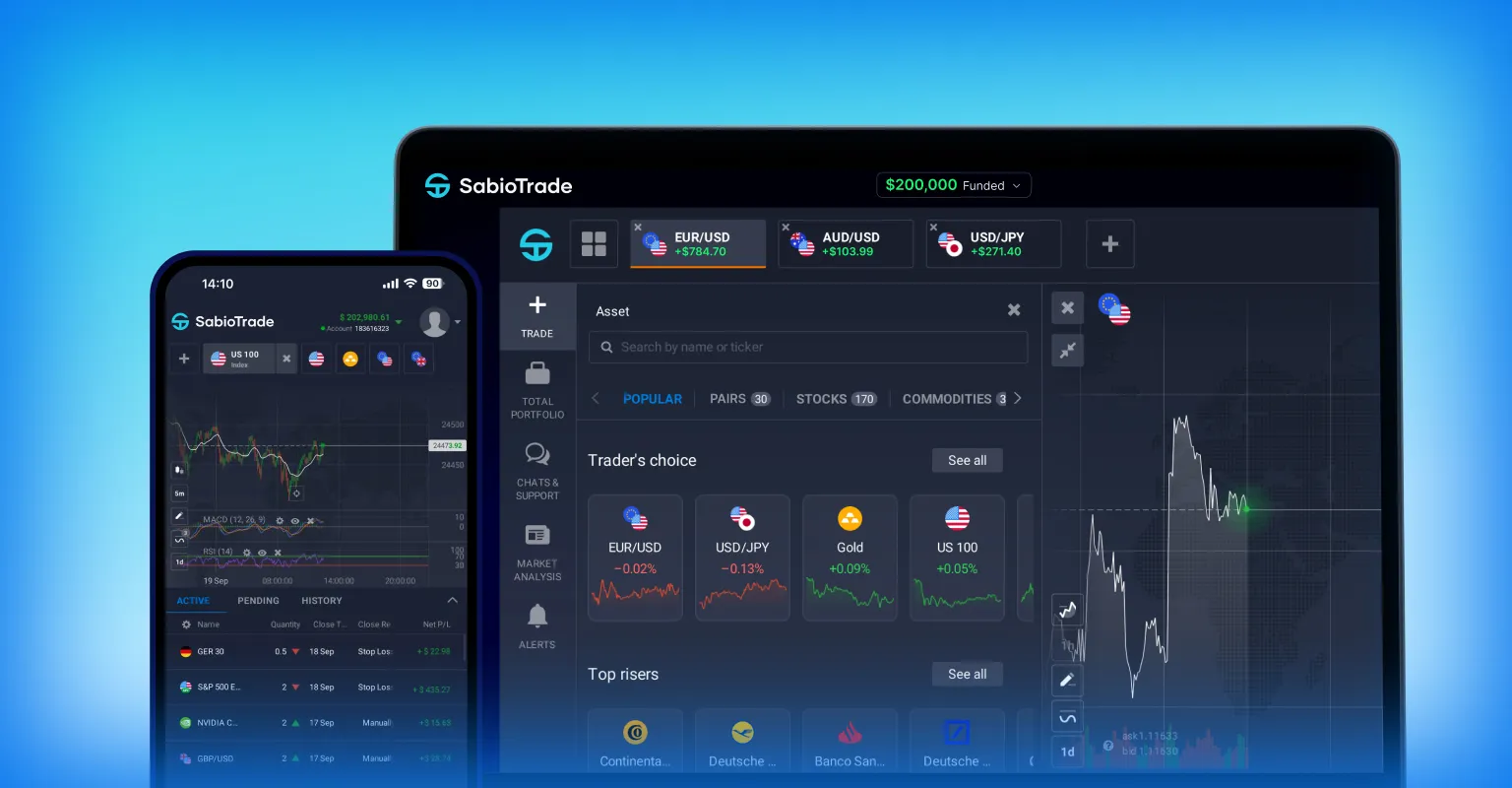

— What do you think about the platform overall?

The interface is easy to use and very comfortable. It works smoothly on both PC and mobile. I enjoy it.

I don’t use it for charting or analysis, though. I do my analysis on other platforms — primarily TradingView — and then execute trades here.

I also use MetaTrader 5 because I’m experimenting with automated bot-type trading, although it’s still in the early stages.

— We’re working on algo trading features too, but it will take time. One thing we do have: the ability to insert your own script in the platform. It’s not compatible with MT4/MT5 code, but if you have your own coding or AI-based logic, it can work.

I’ll check out the scripting feature you mentioned. I didn’t notice that before.

— Do you trade the news?

Not directly. I consider what’s happening in the world and how it might influence markets.

I don’t trade events like CPI releases directly — they’re too volatile.

I use news to support the broader view: are we in a bull or bear market, and does the news fit the trend? I try to trade in the direction of the trend, and the news should align with it.

— How would you describe your strategy?

Simply: trend following.

I wait for dips and buy on dips. Then I look at chart structure — support and resistance levels — as additional confirmation.

Overall: trade in the direction of the trend, use news as context, and use chart patterns to support decisions.

— How do you determine your risk per trade?

It depends on volatility and the situation. If it’s a very volatile asset, I take a smaller position. If it’s slower-moving, I can take slightly more risk.

I don’t have a fixed number like “X% per trade.” It’s situational.

The key is to define your risk level and have a plan for why you’re taking it.

With many small accounts, I’m more willing to take bigger risks — more experimental. On the larger account, I’m more cautious.

— Are you afraid of taking risk?

No.

I accept that I will lose money; it’s part of the game. I don’t invest money I can’t lose.

In my private accounts, even a 20–40% drawdown doesn’t create emotional stress for me — I believe it can recover.

But with your drawdown limits, I don’t even reach that level of risk on the prop side.

I’m not a full-time trader. Even if I lost everything, life goes on because I have a normal job and stable income. That makes trading more relaxed. You can’t force making money.

— Do you communicate with mentors or trading communities?

I’m skeptical about communities and recommendations. At the beginning, I subscribed to newsletters and magazines with recommendations. My impression was: the more I followed them, the more money I lost.

So I decided to trade with my own brain.

Then I can only blame myself.

There are two types of communities. One says “buy this stock, sell that stock” — I avoid that.

The other discusses general topics — market perception, analysis, risks, and pitfalls. That can be valuable. Not precise advice like “buy gold now,” but knowledge and understanding.

— Would you recommend SabioTrade?

Yes, definitely. I already recommended it — my nephew is trading with you as well. He just started. He has good times and bad times, but he’s enjoying it.

Overall, I’m a happy customer. The platform is good, the rules are flexible enough, and I enjoy working with it.

After 30 years in the markets and a ~$120,000 January, Trader X’s philosophy is:

We hope these insights were valuable 🙏 Adopt the winner’s mindset, apply the principles, and make your next trading month a victorious one!