The Fear And Greed Index As An Investor Sentiment Tool

The Fear and Greed Index is an important tool for measuring current investor sentiment in the stock market. Developed by CNN, it measures the balance between two powerful emotions that drive the financial market: fear and greed. The index helps investors understand the level of optimism or pessimism in the market, providing information on whether stocks are overbought or oversold due to emotional reactions.

The Fear and Greed Index is designed to help investors determine whether the market is behaving irrationally due to emotions such as extreme fear or extreme greed. Extreme fear can cause stocks to trade far below their intrinsic value, while extreme greed can drive prices far above their fair value. The idea behind this indicator is that investors tend to overreact to prevailing sentiment, whether it is optimistic or pessimistic.

The index is calculated using seven key market indicators, each of which reflects a different aspect of investor sentiment:

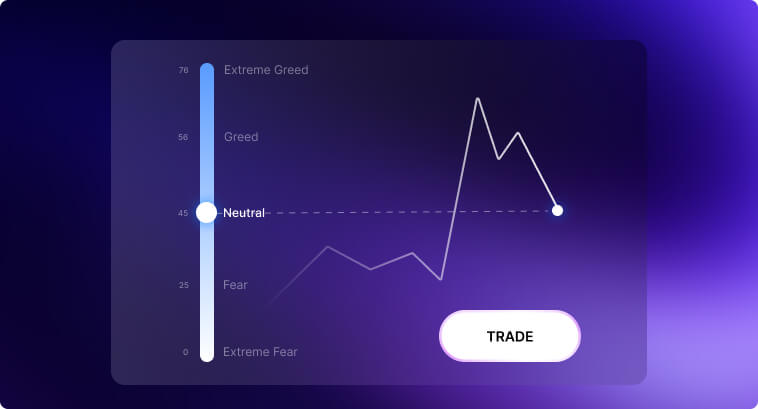

Each of these indicators contributes equally to the overall index score, which ranges from 0 to 100. The score provides a snapshot of the prevailing sentiment in the market. A score of 0 represents extreme fear, while a score of 100 represents extreme greed. The middle range, around 50, indicates neutral sentiment, where no emotion is dominant.

The Fear and Greed Index ranges from 0 to 100, with different ranges of scores representing different levels of sentiment:

When the index shows a high level of extreme fear — a score close to 0 — it indicates that many investors are extremely pessimistic, and stocks may be undervalued, suggesting potential buying opportunities. Conversely, when the index approaches extreme greed — a score close to 100 — it may indicate that the market is overbought and prone to a correction, signaling that it might be time to sell or exercise caution.

By tracking the index, traders and investors can assess the level of risk in the financial market and make more informed decisions based on volatility and market sentiment. However, it is important to note that the index should not be used in isolation, but rather alongside other tools of technical and fundamental analysis to form a complete picture of the market.

In stock markets, sentiment often plays a key role in determining market movements. The Fear and Greed Index provides valuable information about these emotional upheavals. There is a well-known quote by Nathan Mayer Rothschild that says: “Buy when the cannons fire, and sell when the trumpets sound”. This quote perfectly describes the opposite approach recommended when using the Fear and Greed Index. This principle advises investors to act contrary to prevailing emotions — to buy in times of fear and sell in periods of greed.

The Fear and Greed Index tracks market sentiment across various indicators, and each indicator signals a specific state of the market:

One of the most valuable index uses is determining when the market becomes overbought or oversold. High levels of extreme greed can indicate that the market is overbought, where asset prices have risen too quickly, and a bull market may be nearing its end. Extreme fear will often indicate that the market is oversold, which could precede a rebound.

The same principles apply to crypto. A crypto fear index functions similarly, measuring market sentiment for cryptocurrencies like Bitcoin. The crypto market tends to be heavily driven by emotions, so tracking crypto fear is a must for crypto investors to identify key points to enter or exit positions.

The most powerful application of the Fear and Greed Index is its ability to signal trend reversals. When markets exhibit extreme fear, it may be a good sign that selling pressure is exhausting and a bull market could be on the horizon. Likewise, during extreme greed, the index warns of a possible reversal as markets become overheated and a correction may be due.

Incorporating the Fear and Greed Index into your investment strategy can definitely offer great insights into when to buy or sell, but you should also combine it with other analysis tools and indicators. It works best as a part of an overall strategy that also includes fundamental analysis, technical analysis, and efficient risk management.

The Crypto Fear and Greed Index was developed by the website Alternative.me to specifically track the volatile nature of the crypto market. It was launched to give crypto investors a similar tool to the traditional stock market Fear and Greed Index, originally developed by CNN. Given the emotional and often irrational swings in the crypto space, this index provides insights into whether crypto traders are behaving with extreme fear or extreme greed, offering a way to capture market sentiment. The creators were motivated by the need for a reliable greed index in a market known for its extremely volatile nature, rapid changes, and a lack of stable fundamentals

Crypto investors can use the Crypto Fear and Greed Index to identify opportunities to invest in such a highly volatile market. The index is based on multiple factors such as volatility, market momentum, and even social media sentiment. This index helps investors manage crypto fear, as it signals whether the market is oversold due to panic or overbought because of FOMO—fear of missing out—. Similarly to the original index, when the Crypto Fear and Greed Index shows high levels of fear, it indicates that assets are undervalued, while an index leaning toward greed suggests the market might be overextended.

Given the emotional nature of crypto trading, you can use this index as an efficient tool to mitigate irrational decision-making. It helps investors decide when to buy into extreme fear or consider selling when the market shows signs of extreme greed. When you track crypto fear, you can align your trades with actual market conditions instead of succumbing to panic or hype.

Though the Crypto Fear and Greed Index shares the same concept as the traditional index developed by CNN, there are notable differences. The traditional Fear and Greed Index focuses on the stock market and uses indicators like the VIX, put and call options, and stock price strength. In contrast, the crypto version incorporates metrics unique to the digital asset environment, such as Bitcoin dominance—considering Bitcoin as the “safe haven” of the crypto world—, Google Trends data related to crypto, and social media activity.

Both indices track a range from extreme fear to extreme greed, but the crypto index reflects the greater emotional swings typical of cryptocurrency markets. The fear and greed index is a measure of investor sentiment in both cases, but the crypto index attempts to account for the speculative nature of cryptocurrencies through additional variables like social media trends. While the traditional index is used mainly by long-term investors, the crypto index is more relevant to short-term traders who need to stay on top of market sentiment fluctuations.

Although both indices offer valuable insights into market emotions, the crypto fear and greed index is designed specifically for the wild swings seen in cryptocurrencies, helping traders navigate periods of extreme fear and extreme greed more effectively.

The Fear and Greed Index, whether it’s CNN’s for traditional markets or Alternative.me’s for the crypto world, is a crucial tool for investors. It simplifies complex market data into a digestible format that effectively captures market sentiment. The index provides a window into whether stocks on the NYSE or crypto assets are fairly priced by measuring key indicators such as the number of stocks hitting 52-week highs and market volatility. This insight can be invaluable for navigating turbulent times and avoiding emotional reactions.

The index is particularly useful for helping traders determine when high levels of greed or fear drive market actions and prices. As the index shifts toward greed, it may signal that stocks trading at their 52-week highs could be overbought, while extreme fear might indicate a buying opportunity. Whether you’re tracking S&P 500 options or fear of Bitcoin, this tool allows you to leverage the logic that excessive fear lowers prices while excessive greed inflates them.

For investors looking to understand better how the Fear and Greed Index fits into a broader, sustainable trading strategy, it’s important to recognize that this tool alone is not enough. An approach that combines market sentiment data with technical analysis or fundamental indicators can significantly enhance investment outcomes. To learn how the Fear and Greed Index can help make better investment decisions alongside other indicators for sustainable profits, I highly recommend reading the article “ Exploring the Best Stock Trading Strategy for Sustainable Profits” – SabioTrade, so you can see how traders can use the index for smart trading of financial assets.

Remember, the Fear and Greed Index updates daily and tracks seven different indicators measuring market conditions. Use it as part of your toolkit to avoid emotional investing and stay aware of whether stocks are fairly priced or are about to change in response to current market sentiments.