YOY (Year-Over-Year) Explained: Meaning, Calculation & Uses

YOY, which stands for Year-Over-Year, is a fundamental method commonly used in financial analysis to compare the performance of the current year with the previous year. For example, examining financial reports of a company’s revenue in Q1 2024 YOY involves comparing it to its revenue in Q1 2023. This kind of analysis allows investors to assess growth trends and measure the sequential growth progress of a company’s financial performance over time. Year-over-year analysis mitigates the impact of seasonality, which can distort short-term comparisons. By focusing on the same periods across different years, YOY provides a clearer picture of underlying trends and patterns of the company’s trajectory.

While YOY is used to compare data in an annual timeframe, other metrics like Quarter-over-Quarter (QOQ) and Year-to-Date (YTD) provide different perspectives. QOQ is a financial metric used to compare data between the current quarter and the previous quarter, highlighting short-term fluctuations and capturing seasonal trends. YTD, on the other hand, is used to evaluate performance relative to the beginning of the year up to the current date, offering a running total for analysis. Financial analysts use year-to-year analysis to assess financial performance due to its strength in revealing long-term trends and linear growth while mitigating the effects of seasonality. YOY financial analysis is relevant for setting realistic targets, benchmarking against competitors, and understanding the effectiveness of business strategies over time.

Consider the following example of how one can use YOY calculations to understand how growth compares between the current quarter and the quarter of the previous year:

Analyzing the year-over-year performance, this specific company demonstrates impressive growth across key financial metrics. Revenue experienced a significant YOY increase of 35%, indicating successful strategies driving sales and expanding market share. Similarly, profits surged by 39% compared to last year, highlighting the company’s ability to manage costs and convert increased revenue into higher profitability. While expenses also saw a rise of 13% from the past year, this is overshadowed by the substantial revenue growth, demonstrating the company’s ability to maintain a healthy balance between income and expenditure. This positive year-over-year performance paints a picture of a thriving company with strong financial health and promising prospects.

Investors use year-over-year analysis due to the several benefits it offers for evaluating business performance. YOY analysis is effective in obtaining valuable insights into trends and growth rates by comparing data from one period to the same period in the year prior, such as the results in the fourth quarter or in the month of August, for example. This metric allows businesses to track progress over time, identify areas for improvement, and make informed business decisions based on historical data and past growth patterns. For instance, YOY analysis of the company’s revenue reveals whether sales are increasing or decreasing, helping assess the effectiveness of marketing and current business strategies. Similarly, analyzing profits year over year provides a clear picture of the company’s financial health and its ability to manage costs effectively and stay profitable in the long run.

The benefits of YOY extend beyond internal evaluation. YOY measurements are essential for benchmarking a company’s performance against industry averages and competitors. This external perspective helps identify areas where the company excels or lags behind, helping in the decision-making process and competitive positioning. Additionally, YOY data is crucial for setting realistic and achievable goals for future growth, providing an understanding of historical performance trends that allows businesses to make informed projections and develop strategies to capitalize on opportunities and mitigate risks.

One of the most common uses of year-over-year analysis is measuring revenue growth. By comparing a company’s revenue from one period to the same period in the year prior, investors can assess the company’s growth trajectory and identify patterns and trends. A consistent YOY increase in revenue indicates successful business strategies and a growing market share, while a decline may signal underlying challenges or shifts in the competitive landscape. YOY analysis of cash flow is equally important, as it provides insights into the company’s ability to generate and manage cash, which is crucial for its financial stability and ability to invest in growth opportunities.

Year-over-year analysis goes beyond top-line metrics like revenue and cash flow and is invaluable for conducting an in-depth examination of financial health. By applying YOY comparisons to various financial ratios, such as profitability margins, debt-to-equity ratios, and efficiency ratios, investors can gain a comprehensive understanding of the business’s stability and efficiency. For instance, analyzing the YOY trend of the gross profit margin reveals changes in production costs and pricing strategies, while examining the YOY movement of the debt-to-equity ratio sheds light on the business’s financial leverage and risk profile.

By considering industry-specific trends and benchmarks, YOY comparisons allow a more meaningful evaluation of a company’s performance relative to its competitors. For example, a high YOY growth rate in a rapidly expanding industry may be average, while the same growth rate in a mature industry could indicate exceptional performance.

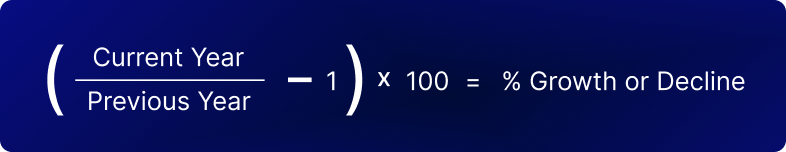

The formula below describes how to accurately calculate year-over-year changes in business metrics:

Considering the business’s revenue, and suppose you want to compare the current year’s value with the previous year for the fourth quarter. You should first obtain the data:

Step 1: Obtain Revenue Data

Step 2: Divide The Current Year’s Value by The Previous Year’s Value

Step 3: Subtract 1

Step 4: Multiply by 100

The value above indicates a 33% growth in revenue from Q4 2022 to Q4 2023.

Comparing data from the same season or month across different years provides an accurate picture of the overall trends in the business across consecutive years. When analyzing shorter periods, such as Month-over-Month changes, it’s essential to account for any one-time events or anomalies that may distort the results, such as a marketing campaign, a one-time product launch, or an unexpected supply chain disruption.

Quarter-over-Quarter analyses, on the other hand, capture changes across quarters and can be ideal for understanding the impacts of seasonality in the company.

While year-over-year analysis is a valuable tool for assessing trends and growth patterns, it’s important to consider its limitations. One key limitation is that it provides fewer data points compared to metrics like Month-over-Month (MOM) or Quarter-over-Quarter (QOQ), potentially obscuring short-term fluctuations and emerging trends. This can make it challenging to identify turning points or sudden shifts in performance. Additionally, YOY analysis may fail to account for seasonality, which makes it harder to understand the impact of specific seasons on the business model. For companies with high seasonality, such as tourism or retail businesses, YOY analysis may not accurately represent underlying trends due to significant variations in revenue and expenses throughout the year, making metrics like QOQ or MOM more adequate.

Another challenge of YOY analysis lies in navigating inconsistent growth patterns. External factors, such as economic conditions, industry shifts, and competitive pressures, can significantly impact a company’s year-over-year performance, leading to fluctuations that may not reflect the effectiveness of its internal strategies. It’s crucial to consider these external influences when interpreting results and avoid attributing all changes solely to internal factors. Furthermore, one-time events or anomalies, such as mergers, acquisitions, or major product launches, can also distort YOY comparisons. By understanding these limitations and considering the broader context, businesses can utilize YOY analysis more effectively and gain a more nuanced understanding of their performance trajectory.