Profitable CFD Trading Strategies

A CFD, or Contract for Difference, is a popular derivative that allows a trader to speculate on future price movements of various financial instruments, such as stocks, indices, commodities, and currency pairs, without owning the underlying asset. This kind of derivative trading gives the opportunity to profit from both bull and bear markets by allowing traders to open a long position (i.e., betting on a price increase) or open a short position (i.e., betting on a price decrease). The flexibility and leverage associated with CFDs make them extremely attractive for retail traders, but they also come with significant risks that traders should be aware of. Building a well-defined trading system for CFDs is not just advisable, but imperative to survive in one of the most competitive trading arenas in financial markets.

There are various strategies available for CFDs. Each strategy is designed to match with different personalities, risk appetites, and time commitments. These strategies can be focused on the short-term (day trading and scalping), medium-term (swing trading), or long-term (position trading) and are often built through a combination of technical analysis indicators or even fundamental analysis.

In this article, we will explore further and help you craft your own CFD trading system by helping you recognize your trading style and learn how to match that with a systematic approach to identify potential trading opportunities across markets.

Short-term strategies are highly popular in the CFD market, especially due to the overnight fees that are charged when a CFD position is held for more than a day. Traders using these strategies aim to profit from small price action. This high-paced trading allows for numerous opportunities, but also requires a robust risk management plan. To succeed, short-term traders tend to rely on technical analysis, using price charts and indicators to identify patterns and entry or exit signals.

One of the most common forms of short-term trading is day trading. A day trader will typically execute multiple trades throughout the day, closing all positions within a single trading session. The main idea of intraday trading is to profit from small price movements that occur during the day. Day traders usually use indicators like the RSI, MACD, and Bollinger Bands to identify overbought or oversold levels and bet on potential reversals. Managing positions during the day requires setting tight stop-loss orders to mitigate risks and defining profit targets to secure gains before the market turns, which isn’t unusual in intraday price action.

Scalping is an even more rapid form of day trading. The goal is to get tiny profits from a large number of trades. This popular short-term strategy focuses on the peculiarities of ultra-fast trading, where positions are held for no more than a few seconds or minutes. The main requirement for scalping trading strategies is an extremely fast execution. Speed is everything, as even a slight delay can turn a profitable trade into a loss. Profitability is based on accumulating several small gains from minimal price movements, often just a few pips at a time. Scalpers need a trading environment with very low spreads and commissions.

News trading is a strategy that involves capitalizing on the volatility created by major economic events and data releases. Traders who use this strategy focus on timing their position entry just before or immediately after a significant news announcement. These announcements can be related to interest rate decisions, GDP growth, or even employment data. The impact of relevant news can be quite high and affect different assets in different ways. A positive jobs report in the US, for example, has the potential to strengthen the US dollar, creating a trading opportunity to buy or sell a currency pair like EUR/USD. News trading requires a good economic calendar and the ability to quickly analyze and react to information.

Last, but not least, we get to range trading. This strategy focuses on trading within a sideways trend, where the price of an asset moves between two relatively stable price levels. The key to this strategy is accurately defining the support and resistance levels that form the boundaries of the range. Support and resistance are areas where the price has difficulty breaking through. Once these levels are identified, a trader can look to buy near the support level and sell near the resistance level. Indicators like the Stochastic Oscillator or the RSI are particularly useful in range trading because they can help identify overbought conditions near resistance and oversold conditions near support, providing clear signals to enter and exit trades.

Medium-term strategies typically involve holding positions for a few days to a few weeks. The idea is to reduce the amount of trading, while profiting from larger price swings. This approach requires much less constant monitoring than day trading, but still demands a solid understanding of technical indicators and market dynamics. Medium-term strategies are often an excellent choice for people who have other commitments and cannot dedicate their entire day to watching price charts and following market news.

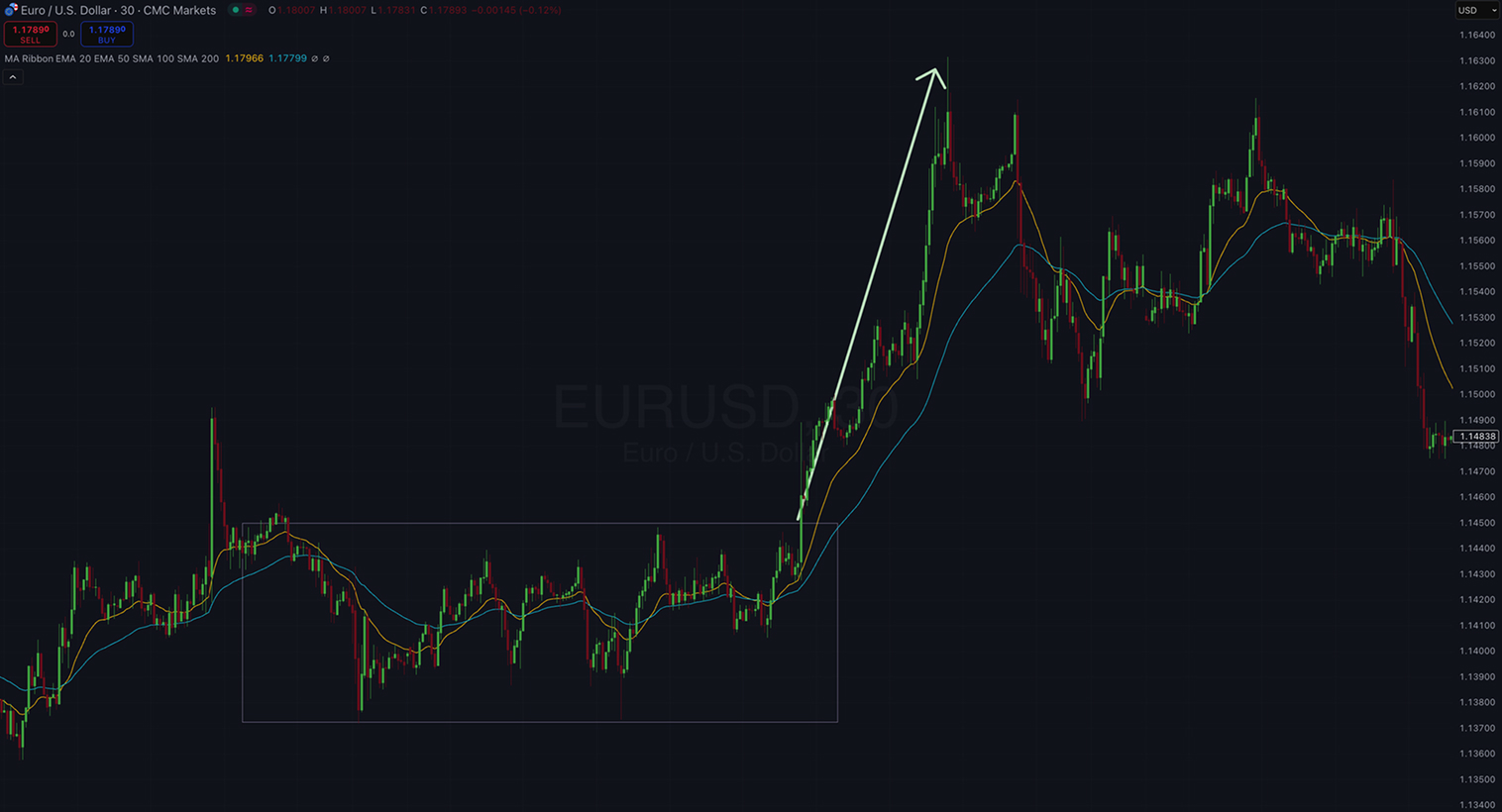

Swing trading is one of the most popular trading strategies in this category. Swing traders seek to take advantage of the natural swings in the market, which are the larger up and down movements that occur within a broader trend. They use a variety of technical indicators to identify potential entry and exit points. A moving average crossover, for example, can be a sign that a new trend is emerging, while oscillators can help identify weakening momentum and when a trend is more likely to reverse. The time frames used for analysis tend to range from 4-hour to daily charts. The image below provides an example that, even in an ascending move, prices still move in up-and-down swings, giving plenty of opportunities for swing traders to enter and exit positions.

Another popular strategy is breakout trading. Breakout trading involves identifying strong support and resistance levels and then placing a trade when the price breaks through either of these levels. The idea is that a breakout from a well-established range will often be followed by a strong and sustained move in the direction of the breakout. An important skill for breakout traders is learning how to distinguish between a true breakout and a false breakout, where the price briefly moves beyond a key level only to reverse direction. Confirmation signals, such as a significant increase in trading volume or a candlestick pattern confirming the move, are often used to validate a breakout and improve the probability of success.

Long-term position trading strategies are suitable for patient traders who prefer to focus on capturing large profits from major, long-term trends that can last for months or even years. This style of trading requires a deep understanding of market fundamentals and a strong conviction in the analysis.

Position trading is the main long-term strategy there is. The principles of position trading are based in a combination of technical and fundamental analysis (learn more about fundamental vs technical analysis). A position trader will often use weekly or monthly price charts to identify a primary trend, but they will also study the fundamental factors that could drive that trend over the long-term. This could include analyzing a company’s financial health, industry trends, or macroeconomic conditions. Position traders need to be well-capitalized to deal with short-term volatility against their position and must also account for overnight charges that can accumulate over time.

Hedging is another long-term strategy, but unlike all the previous strategies we have analyzed, the main goal of hedging is not to generate profits but to protect an existing investment portfolio from adverse price movements. Using a CFD trading account for hedging is a common practice. An investor who is holding a large portfolio of UK stocks, for example, might be concerned about a market downturn. To hedge this risk, they could open a short CFD position on a UK stock index like the FTSE 100. If the market falls, the losses on their stock portfolio would be offset by the gains on their short position. This is a practical hedging scenario that allows investors to mitigate risk without having to sell their long-term holdings. Pairs trading, where a trader takes a long position in one asset and a short position in a related one, is another form of hedging commonly practiced in the market.

Technical analysis is a large part of many successful CFD trading strategies. It is based on the study of historical price data and patterns on price charts to forecast future price movements. For a CFD trader, mastering technical analysis is crucial for identifying opportunities and making systematic decisions. It allows traders to read and understand market sentiment, as well as the dynamics of supply and demand.

The main tools of technical analysis are technical indicators, which are mathematical calculations based mainly on the asset’s price and trading volume. There is a large number of indicators, but some of the most common ones used in CFD trading include:

Although each indicator is able to provide valuable signals, they are most effective when used in combination with other forms of analysis. The study of price action patterns, for example, is an additional and vital component.

These patterns include triangles, flags, and figures like the Head and Shoulders, which are visual formations on a price chart that can forecast possible trend continuations or reversals. Many traders use these patterns as the primary basis for their trading decisions. The most effective strategies often involve a combination of different methods of analysis. For example, a trader might use a moving average to determine the overall trend, an oscillator to capture the best timing for their entry, and a price action pattern to confirm the trading signal. This approach helps to filter out bad trades and increase the probability of success.

The use of leverage in CFD trading means that, while profits can be amplified, so can losses. An effective risk management plan is a fundamental pillar of long-term profitability. Without it, even the most sophisticated trading system will fail. A robust risk management framework must include:

Considering the wide range of strategies available, selecting the one that best suits you can be challenging. The key is to find a strategy that aligns best with your personality, risk tolerance, available capital, and the amount of time you can dedicate to trading.

A checklist to help you define a strategy must involve a few key questions, such as:

Successful traders usually do not limit themselves to a single strategy. They often combine elements of different strategies to create a more robust trading system. A trader can be primarily a swing trader but may also engage in day trading when opportunities arise. The key is to have a well-defined plan that outlines which strategies to use under which market conditions.

For beginners, a step-by-step guide includes the following criteria:

| Strategy | Complexity | Capital Required | Time Commitment | Typical Holding Period | Risk Level | Psychological Profile | Primary Analysis Method | Profit Potential per Trade |

| Scalping | High | Medium to High | Very High (Constant focus) | Seconds to Minutes | Very High | Quick-thinking, Disciplined, Adrenaline-seeking | Purely Technical | Very Small, but frequent |

| Day Trading | High | Medium | High (Full trading session) | Minutes to Hours | High | Disciplined, Focused, Decisive | Primarily Technical | Small to Medium |

| Swing Trading | Medium | Medium | Medium (Daily checks) | Days to Weeks | Medium | Patient, Observant, Good at pattern recognition | Primarily Technical | Medium to Large |

| Position Trading | Medium | High | Low (Weekly/Monthly checks) | Months to Years | Medium-Low | Very Patient, Big-picture thinker, Resilient to volatility | Technical & Fundamental | Large |

| News Trading | High | Low to Medium | Medium (Regular monitoring) | Minutes to Hours (around the news release) | Very High | Quick to react, Analytical, Stays highly informed | Fundamental (Catalyst) & Technical (Entry/Exit) | Varies (Can be large in seconds) |

| Range Trading | Medium | Low to Medium | Medium (Regular monitoring) | Hours to Days | Medium | Patient, Disciplined, Good at identifying key levels | Technical (especially Oscillators) | Small to Medium |

CFD trading offers a wealth of opportunities for those willing to dedicate the time and effort to learn. There is a wide array of CFD trading strategies to choose from, each with its own unique set of characteristics, advantages, and disadvantages. We have the fast-paced environments of scalping and day trading, as well as the more measured approach of swing and position trading. The key to a successful selection lies in picking a strategy that aligns with your personal attributes and goals.

Successful trading is a journey of continuous learning and adaptation. Financial markets are dynamic, and what works today may not work tomorrow. It is crucial to remain flexible, constantly refine your approach, and practice disciplined risk management. Once you have a well-defined trading system, combined with a robust risk management plan and the right psychological mindset, you can highly improve your chances of achieving long-term success in CFD trading.