SabioTrade

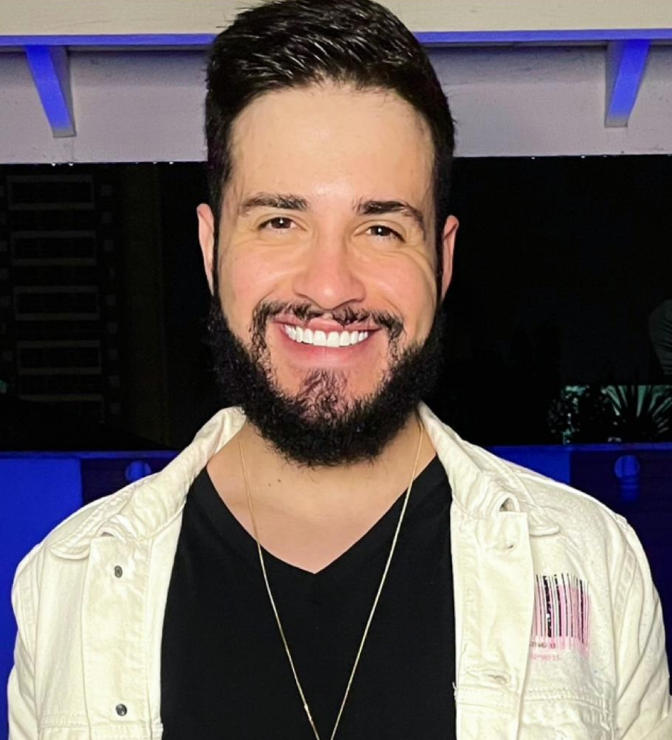

A $80M Trader Talks Scaling, Scalping, And Cringe

Meet Ulises Cárcamo, a man who has traded $80 million in volume in 2024. If you’ve ever wondered what it takes to operate at this level, what separates pros from amateurs, and what mistakes to avoid — this is for you.