Both trading methodologies come with considerable risks. Awareness of these risks can help you understand which method offers the best risk-reward relationship for your trading style. Let’s take a look at the risk profile and reward potential of both.

- Risk Profile: One of the biggest risks of day trading is the psychological aspect of making several decisions under high pressure. Day traders are often wrong; accepting that and cutting losses quickly is highly important for long-term survival. However, a sequence of bad trades can cause an impact on the trader’s emotions, leading them to trade aggressively while on margin or revenge trading after a sequence of losses. This behavior can compound losses fast. The elevated levels of stress make day trading definitely a choice not for everyone. Day traders are also increasingly competing against high-frequency trading firms and algorithms, putting them against powerful market players. Risk management is essential to survive. Using strategies to avoid overtrading, tight stop-loss orders, and risking only a fraction of the trading capital per trade is a must.

- Reward Potential: One of the main advantages of day trading is the idea of achieving daily profits. A competent day trader can certainly make money every day by capturing small but accurate movements. Some trading sessions also offer the opportunity to catch large intraday rallies, where an asset can move up to 10% in a single day, offering high earnings for skilled day traders on leverage. If successful, a day trading account could yield annualized returns that outperform a buy-and-hold strategy. But it is important to highlight that it comes at the cost of high effort and risk. Statistics say that most day traders consistently lose money at first, and only a small minority is able to reap the rewards after a long learning curve.

Swing Trading

- Risk Profile: Swings trading risks come from the larger moves that can happen against the trader’s position. Since the time horizon is longer, most traders use looser stop-loss triggers, causing the drawdown to be significantly bigger than that of a bad intraday entry. The overnight gap can also be highly hurtful to a trading account when an unexpected event or major news hit. Luckily, swing trading isn’t typically done on as much leverage as day trading, so the damage can be diminished compared to highly leveraged day traders.

- Reward Potential: Overall, swing traders’ aim is toward fewer but larger wins. Instead of focusing on small, quick price swings, they focus on a 5-10% gain on a position. They also expose themselves much less than day traders, being able to focus on 2–3 trades a month that could yield 5-8% each. The upside per trade is much higher here than in day trading. Besides that, fewer trades mean fewer chances to make mistakes and less operational costs from opening positions and executing multiple orders throughout the month. Swing trading can be done with a calmer state of mind, reducing the risk of impulsive decision-making and erratic entries.

Deciding which one has the higher yield depends truly on the trader’s skills and the market. Fewer trades can be easier to manage and reduce operational costs while also allowing for more thoughtful decisions to be made. On the other hand, a highly skilled trader could have more window to outperform when taking more opportunities in intraday action.

At the end of the day, day trading is considered a higher frequency risk, while swing trading comes with a lower frequency, but each trade has the potential to yield larger drawdowns. Both can be profitable if well executed, just as much as terrible if poorly done. Beginners should move with caution with either approach. Start small and focus on the learning curve instead of focusing on huge profits right away.

Psychological Aspects of Swing Trading and Day Trading

Day trading can be quite exciting, but it is also intense and stressful. It tends to attract people who can make decisions in high-pressure situations. You need to make quick decisions without overthinking too much and recover quickly if things don’t go as expected. The trading day can be an emotional roller coaster, with lots of excitement when things go well and disappointment when things go wrong. When it comes to mental health, it’s easy to spiral into anxiety and stress, especially if your financial well-being heavily depends on the outcomes of your trades.

Swing trading is considered a more relaxed approach, but it also comes with its challenges. A competent swing trader must have patience and confidence in their market analysis. It can take a few days to be proven right or wrong, so mental strength is essential to stick to your plan and not overthink every daily fluctuation. Nevertheless, this approach offers a better work-life balance, which is more suitable for individuals more prone to FOMO and impulsivity—traits that are detrimental in intraday trading.

To determine which style suits you best, ask yourself the following questions:

- How much time can I dedicate to trading? Day trading can be really challenging if you already have a 9-to-5 job, especially since you need to commit during market hours. Swing trading is a better option for those with a busy schedule.

- Do I prefer fast or slow environments? If you handle pressure well, can multitask, and enjoy energetic, fast-paced decision-making settings, then you’re more likely to be suited as a day trader. Swing trading allows more time for reflection and offers a slower-paced approach.

- What is my stress tolerance? Day trading will constantly test your stress limits. I’m not saying you’ll be stress-free if you choose swing trading, but it may be much easier to feel overwhelmed by the fast pace of day trading.

- How much capital am I willing to risk? If you’re very risk-averse and have a small account, swing trading might be a better approach, especially considering the PDT rule.

- Am I tech-savvy? Day trading is becoming increasingly suitable for tech-savvy individuals. It often requires using advanced platforms, and being able to code is an advantage. The best day traders today are capable of incorporating algorithmic strategies into their toolkit to gain a competitive edge. If you enjoy technology and can learn it quickly, it’s a good sign that you could find a fitting approach in day trading.

- How do I handle being wrong? In day trading, you will frequently be wrong. The advantage lies in recognizing your mistakes, cutting losses quickly, and adapting your strategies. Some people struggle to admit they’re wrong—a terrible trait for a day trader. Reluctance to close losing positions, reorganize, and rethink your analysis can be catastrophic.

- How comfortable am I with overnight risk? Although not extremely common, unexpected events can lead to losses far exceeding expectations when planning a trade. When they occur outside of market hours, gaps can lead to significant drawdowns. This is the most notable risk in swing trading. If you find it difficult to leave a position open and focus on something else, adapting to swing trading may be hard for you.

Don’t neglect your mental health. Regardless of your choice, be sure to decompress by engaging in hobbies, exercising regularly, and focusing on other aspects of life beyond the market. Know your flaws—whether impulsivity or anxiety—and choose a trading style that’s less likely to negatively impact you.

As previously mentioned, day trading is becoming increasingly tied to technology and advanced platforms. Day traders need access to real-time data and must ensure rapid execution of their orders. A fast, stable internet connection and reliable hardware are crucial. Many traders use Python to integrate algorithmic trading strategies into their trading systems, along with other tools for real-time news, scanners, and trading signals. Popular platforms for day traders include MetaTrader, TradingView, NinjaTrader, etc. For this reason, startup costs for day trading can be higher.

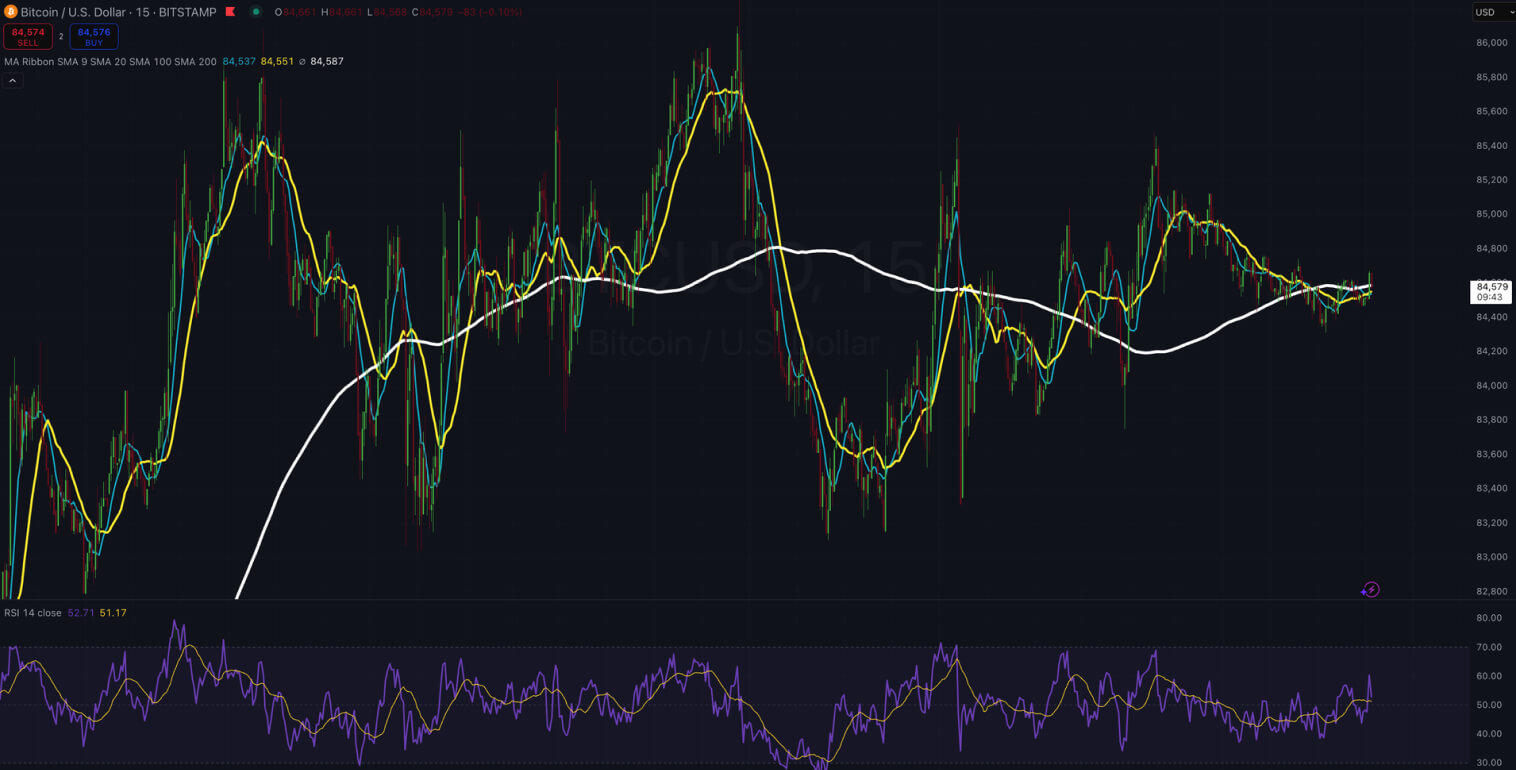

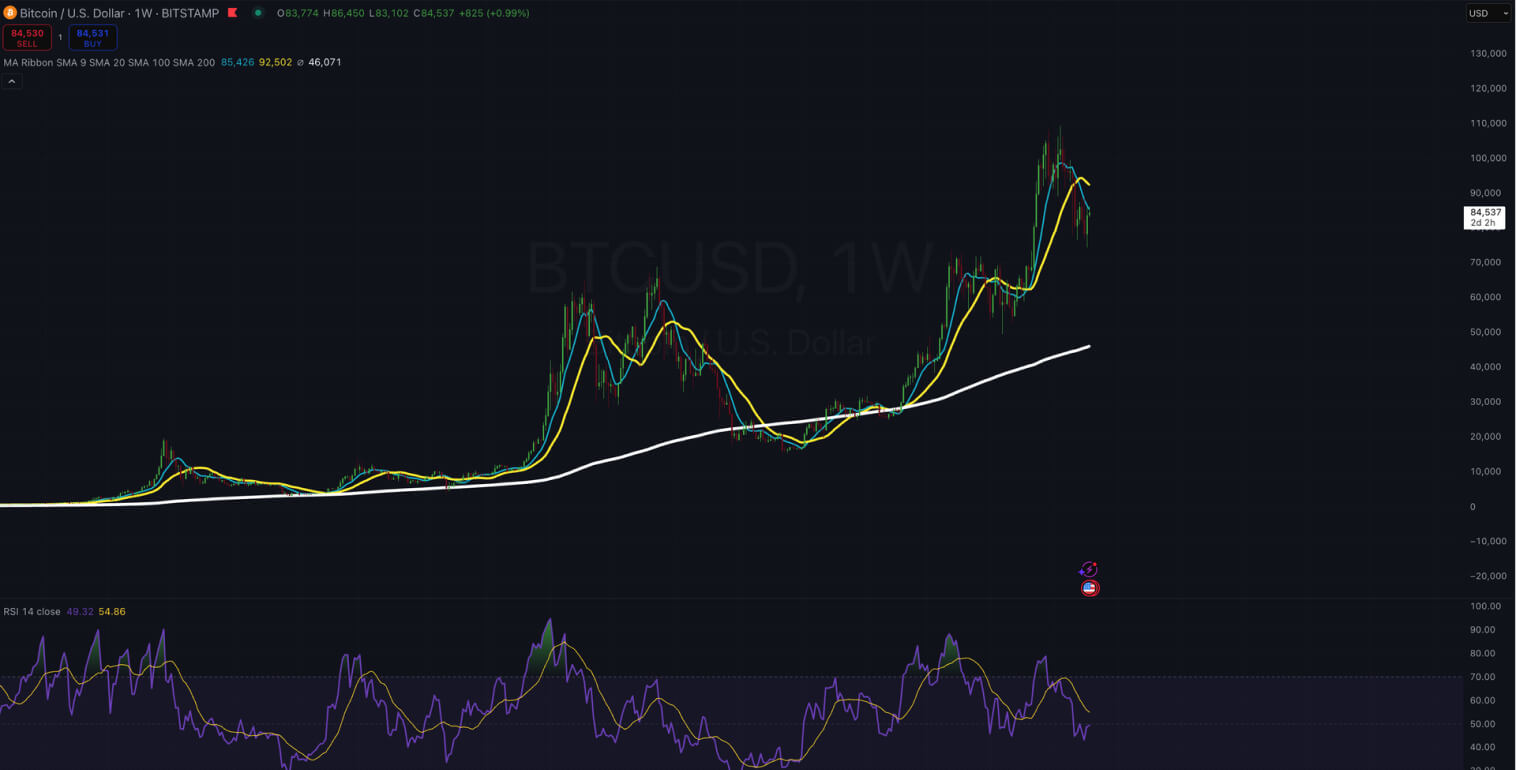

Swing trading setups tend to be simpler. A reliable broker with basic yet functional charting tools is sufficient. You also won’t need multiple monitors or cutting-edge technology to act immediately to enter or exit the market. Swing traders rely more on daily charts and classic technical indicators such as moving averages, RSI, and simpler screeners to spot opportunities. Overall, swing trading setups tend to be less expensive and simpler than those required for day trading. Feel free to check out our comprehensive guide to swing trading strategies and basics.

Closing Arguments

Choosing between day trading and swing trading is a delicate process that requires thoughtful reflection and deep analysis of your individual traits and needs. Day trading involves short timeframes, rapid decision-making, multiple entries and exits per day, high volatility, and a higher degree of stress. It not only demands significant time but also psychological resilience and more capital to start. It also increasingly requires knowledge of technology and programming. Swing trading, on the other hand, is about holding positions for several days or weeks and requires patience. It’s less expensive to start and better suited for those with a tight schedule and limited time to analyze the markets.

If you’re still unsure which method suits you better, you can try blending these approaches. It’s not uncommon for some swing traders to occasionally open intraday positions. In the beginning, it may be a good idea to specialize in one—I’d recommend focusing on swing trading as you gain experience—and only later try day trading when a good opportunity arises and you want to see how you adapt.

Choosing a style that matches your work-life balance, available time, risk tolerance, and personality is key to success. And before risking your hard-earned money, try paper trading to gain experience and understand market dynamics. Gradually increase your position size as you gain confidence in your skills—especially if you decide to day trade. Long-term success is achieved through discipline, risk management, and continuous learning.