The Head And Shoulders Pattern: A Powerful Chart Pattern for Trading

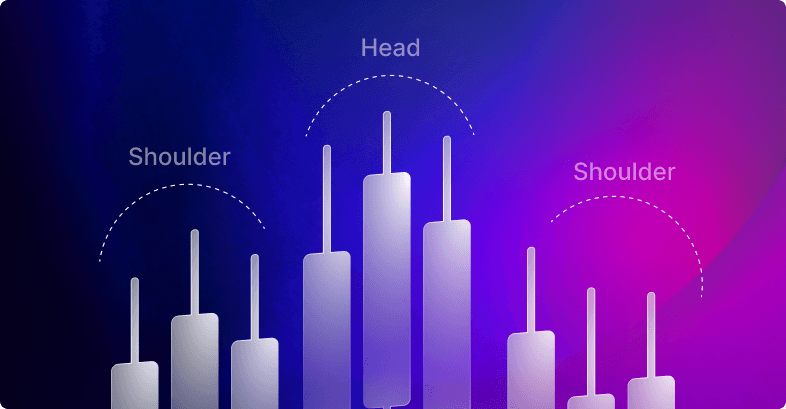

The Head and Shoulders pattern is a popular chart pattern that predicts reversals in both bullish and bearish trends. The pattern is characterized by three peaks: a higher peak (the head) with two lower peaks (the shoulders). It marks a potential change in market direction at the top of a trend (a typical Head and Shoulders pattern) or at the bottom of a trend (also known as an Inverse Head and Shoulders pattern). Recognizing and understanding this pattern can be a valuable skill for traders looking to profit from price action.

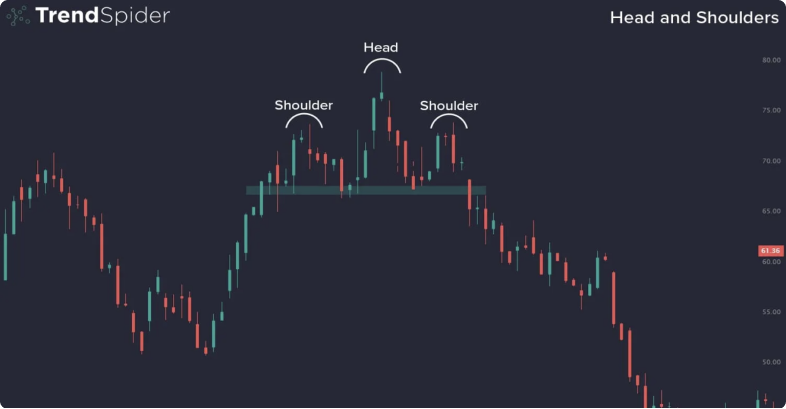

This pattern is formed over a period of time and consists of four main components: the left shoulder, head, right shoulder, and neckline. The left shoulder is formed after a significant price increase followed by a temporary decline. The head is formed when the price rises again, forming a higher peak before another decline. The right shoulder is formed when the price rises again but does not reach the height of the head, followed by another decline. The neckline is drawn by connecting the lower points of the shoulders.

The importance of the Head and Shoulders pattern is its effect as a trend reversal pattern. In a Head and Shoulders formation, a break below the neckline indicates a change from a bullish uptrend to a bearish downtrend. However, in a reverse Head and Shoulders pattern, a break above the neckline indicates a change from a bearish downtrend to a bullish uptrend. Highly skilled traders use these patterns to enter or exit trades effectively.

To use the Head and Shoulders pattern effectively, it is necessary to confirm its validity and strength. This includes looking for a clearly defined neckline and ensuring that the shoulders are roughly equal in height and width. Trading volume should also be considered, as a decrease in volume during the pattern’s formation and an increase at the breakout point can increase the reliability of the signal.

The head and shoulders is a trading pattern with a long history in technical analysis. It is widely believed to have originated from the early work of Charles Dow, the father of technical analysis and co-founder of Dow Jones & Company. Dow’s pioneering work in the late 19th and early 20th centuries laid the foundation for modern technical analysis, and the head and shoulders pattern is considered one of many concepts that evolved from his principles.

The model gained widespread recognition and theoretical grounding through the work of Richard W. Schabacker in the 1930s, and later by John Magee and Robert D. Edwards in their seminal book ” Technical Analysis of Stock Trends,” published in 1948. This book is considered a cornerstone of technical analysis and presented the Head and Shoulders pattern as a reliable tool for identifying reversals in bullish or bearish market trends. Schabacker, Magee, and Edwards detailed how the pattern reflects the psychology of market participants, emphasizing its reliability when correctly identified and confirmed.

The theoretical foundation of the classic Head and Shoulders pattern is rooted in the concepts of supply and demand, as well as market psychology. The pattern represents a tug-of-war between buyers—demand—and sellers—supply. The left shoulder is formed when buyers initially push prices higher, but sellers step in to halt the rise. The head is created when buyers make a stronger effort, pushing prices to a new high, but sellers reappear, leading to a decline. The right shoulder is formed when buyers attempt one last rally but fail to reach the previous high, indicating weakening demand and the seller’s success in reversing the buyer’s advance. The neckline, which connects the lows of the shoulders, acts as a support level. A break below this line in a Head and Shoulders pattern, or above it in an inverse Head and Shoulders pattern, signals a shift of control from buyers to sellers, or vice versa.

The psychological foundation of this pattern highlights the emotions of market participants. The movement of the price from the top of the head to the low of the right shoulder indicates a shift in sentiment from bullish to bearish as buyers gradually lose confidence and sellers gain control. Conversely, the inverse Head and Shoulders pattern signals a shift in sentiment from bearish to bullish as sellers lose their grip and buyers become more assertive.

Identifying the pattern that forms the Head and Shoulders on price charts is a critically important and often profitable skill for traders across all markets, including Forex. This chart formation consists of the typical three peaks we mentioned earlier: the left shoulder, head, and right shoulder, accompanied by a neckline that acts as a level of support or resistance. To correctly identify this pattern, you should pay attention to the following elements:

Identifying the Head and Shoulders pattern helps you watch for price action that breaks below or above the neckline. This breakout, followed by an increase in trading volume, confirms the pattern and signals a potential trend reversal.

The Head and Shoulders pattern is a technical analysis formation that accurately depicts the underlying psychology and shifts in sentiment within financial markets. Understanding this psychology helps you interpret and anticipate market movements and price action.

The Head and Shoulders pattern reflects the tug-of-war between buyers and sellers, capturing shifts in market sentiment and the forces of supply and demand. Traders who understand this psychology can use the pattern to predict trend reversals and make more informed decisions about buying or selling an asset. When you combine technical analysis with an understanding of market psychology, you can significantly enhance your ability to interpret price movements and improve your trading strategies.

To trade the Head and Shoulders pattern effectively, you need to be familiar with several strategies that you can use for both short-term and long-term moves. The key components of these strategies include identifying optimal entry and exit points, setting a stop loss and a profit target, and adapting the pattern to different trading styles, such as day trading and long-term investing.

Combining the Head and Shoulders pattern with other technical analysis tools can enhance prediction accuracy and provide more reliable signals. Volume indicators, moving averages, and RSI indicators can be very useful for confirming trend reversals and reinforcing confidence in the Head and Shoulders pattern. Let’s explore some of these applications:

Volume plays a crucial role in confirming the Head and Shoulders pattern. Volume indicators help traders assess the strength of the pattern and the likelihood of a successful breakout. In the image above, you can see that volume is higher during the formation of the left shoulder and the head, indicating strong buyer participation. However, during the formation of the right shoulder, volume begins to decrease, signaling a weakening buying pressure. When the breakout occurs, the reversal is confirmed by a visible spike in trading volume.

MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price. It consists of the MACD line, the signal line, and a histogram representing the difference between the MACD line and the signal line.

The RSI indicator is a momentum oscillator that measures the speed and change of price movements on a scale of 0 to 100. It helps identify overbought and oversold conditions.

To avoid errors and pitfalls, remember that some traders often misinterpret the Head and Shoulders pattern by identifying it prematurely or inaccurately, leading to false signals and poor entries. Do not neglect the power of indicators like volume and MACD to confirm the pattern before acting. Additionally, many traders fail to place stop-loss orders properly, increasing their exposure to risk. To avoid these mistakes, ensure the pattern is fully formed, confirm its strength with volume and other indicators, and use a stop loss slightly above the right shoulder for short positions. Effective risk management strategies include using position sizing, setting profit targets, and diversifying trades to mitigate losses.

The 1-hour CAD/JPY chart illustrates a classic Head and Shoulders trade. Here’s an analysis of why it was successful in predicting the next downward trend and how you could have profited from it:

The clear formation of this pattern and the subsequent price action make it a great example of how the Head and Shoulders trading pattern can be used to predict market movements and improve trading decisions. Proper identification, confirmation, and risk management are key components to using the Inverse Head and Shoulders pattern effectively.

The Head and Shoulders pattern remains a valuable tool for traders looking to spot potential market reversals. Its distinctive shape provides a clear visual cue that can help traders anticipate and react to market moves. Understanding and effectively applying this pattern can improve your trading strategies and allow you to make more accurate bets in both bull and bear markets. However, like all technical analysis tools, it should be used in conjunction with other indicators and within the broader context of market trends and economic factors.

As algorithmic trading continues to evolve, its impact on traditional patterns such as Head and Shoulders must be considered. Algorithmic systems, with their ability to process massive amounts of data and execute trades at lightning speed, can impact the emergence and reliability of such patterns. While these patterns may still be relevant, traders must remain vigilant and adaptive, ensuring that their strategies take into account the changing dynamics introduced by automated trading systems and machine learning. Using a combination of traditional and modern trading methods will be critical to navigating the complexities of modern financial markets.

For further understanding of the Head and Shoulders pattern, I highly recommend the ULTIMATE Head And Shoulders Pattern Trading Course (PRICE ACTION MASTERY) on YouTube by Wysetrade. This video provides comprehensive information on the pattern, including several examples and strategies for incorporating it into your trading toolbox. Continuous learning and constantly updating educational resources are essential to sharpening your trading skills and adapting to the market landscape.