Learn How to Use Bollinger Bands and Improve Your Trading Strategies

Developed by John Bollinger in the 1980s, Bollinger Bands are a widely used technical indicator that helps traders find opportunities across different sectors of financial markets. Due to how efficient and versatile it is, this indicator has become a part of many traders’ toolkits, from Forex to stocks.

This indicator consists of a simple moving average and an upper and lower band around it. It is quite accurate in keeping track of market volatility and visually helps you identify overbought or oversold levels.

At its core, these are its three main elements:

The calculation of both upper and lower bands is based on measuring the overall dispersion of data points from the average, as you can see below:

This formula allows the bands to capture volatility over the last defined periods—usually 20 days as a default for the moving average. When volatility is high, the bands widen; when volatility is low, the bands narrow down.

To effectively integrate this indicator into your skillset, you first have to understand how to set it up on your preferred technical analysis platform. My favorite platform is TradingView, which is the one we will go through here.

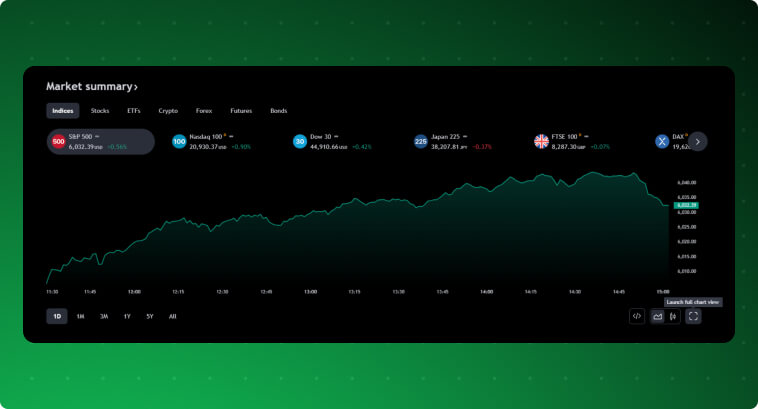

Go to TradingView and scroll down until you see a line chart below the tile Market summary. Click on Launch full chart view to open up the price chart where we will set up the Bollinger Bands.

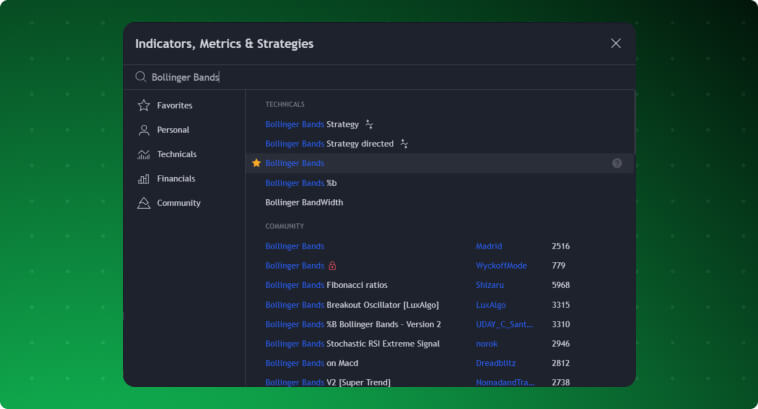

You can then click on Indicators in the upper menu and then search for Bollinger Bands on the new menu that will open up. Several options will show up. Select the one that says Bollinger Bands.

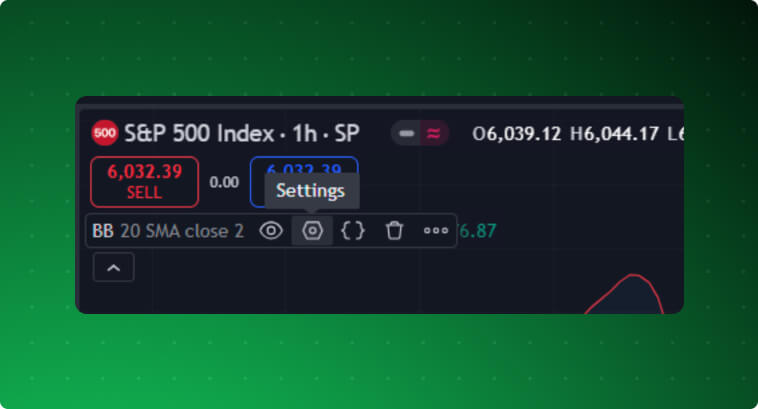

After selecting it, you will see the indicator around the candles in the chart. The red line is the upper band, the blue line is the 20-hour moving average—notice that I’m on an hourly chart in the image—, whereas the green line is the lower band.

On TradingView, you can alter the setup of the indicator by hovering your mouse on the BB indicator panel and clicking on the Settings button.

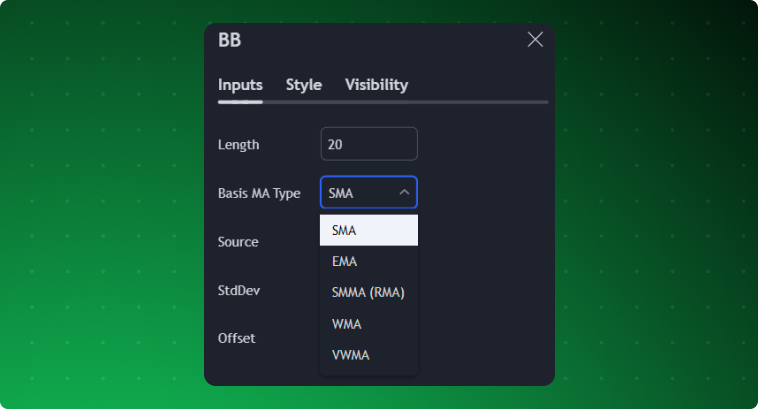

There will be three different menus available on the new window. Click on Inputs to see the indicator’s parameters.

The typical period setting for Bollinger Bands is 20, as you can see in Length. This means the bands will use the last 20 closing prices, as you see in Source, to calculate their values on candlestick charts.

By looking at the StdDev parameter, you can see the default is 2 standard deviations from the SMA for each band.

The Basis MA Type parameter allows you to use different methods to calculate the standard deviation. It can be a simple moving average, or an exponential moving average, among others. The best method depends on your trading style. Exponential moving averages give more weight to recent data points, which can be faster to capture the most recent tendencies in price action.

Trade signals will be more effective when you adapt your indicators to each market condition. Don’t hesitate to customize the features and parameters, alter the MA type, try different multipliers, or add different numbers of standard deviations to your price chart.

Assets known for being more volatile like cryptocurrencies can benefit from a shorter period length—10 or 15—, whereas longer periods like 50 may be more suitable for large-cap stocks.

If you’re a beginner, start with the default settings, as they provide a balanced view of how volatility affects the price of an asset. But over time, I recommend you learn the intricacies of each asset you usually trade and focus on tweaking the parameters for generating trading signals that reflect the asset’s behavior more accurately.

Bollinger Bands can be used for several different strategies. Traders can use this indicator for volatility trading, mean reversion trading, and the upper and lower bands as moving resistance and support levels. Below, we will explore how this indicator can give us several potential trading opportunities.

Traders typically use Bollinger Bands to keep track of market volatility. In the image below, we see a case of increased volatility when the price breaks below the lower band, which opens the opportunity for going short. On the other hand, when the price breaks above the upper band, there’s an opportunity to go long. These breakouts usually lead to explosive price movements, allowing us to make large profits. You can see how the sudden widening of the bands reflects higher volatility and larger candles.

Down below we have an example of how Bollinger Bands might reflect events. Before the 2020 pandemic, we can see that the S&P100 was on a slow, albeit uptrend. As soon as the news broke that the WHO declared Covid-19 a global pandemic, prices dropped fast. This drop resulted in a surge in volatility, reflected by the widening of the Bollinger Bands.

In a scenario like this, most traders would prefer to stay out of the market, since higher volatility results in less-predictive price action. Traders who are prone to risk-taking could open a short position to take advantage of the panic and profit from this price drop.

Step-by-Step for Beginners: Trading with Volatility Breakouts

Entries:

Additional Indicators to Avoid False Signals:

Optimal Bollinger Band Settings:

Risk Management:

Extra Tips:

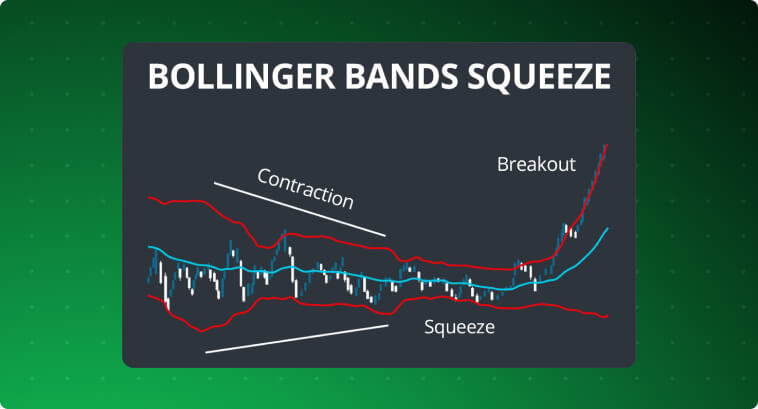

Another strategy is the Bollinger Bands Squeeze, which occurs when the width of the bands contracts as a result of market consolidation. The squeeze usually indicates that the market is gearing up for an expansion, so traders start waiting for a breakout of the upper or lower band. The image below demonstrates how this pattern works. The bands squeeze tightly together before eventually breaking out into an explosive uptrend.

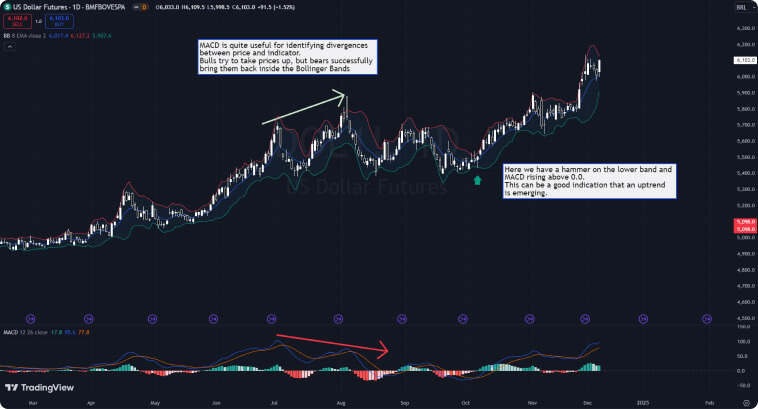

In the image below, it’s possible to see how Bollinger Bands can help you enter an explosive uptrend after a squeeze happens. Prices start to bounce around a short range, making the bands narrower. We have a bullish candle in the 2-hour chart that closes above the upper band. We can see that bears tried to take prices down but failed to do so in this candle and the next one. This pattern leads to an explosive uptrend.

Step-by-Step for Beginners: Bollinger Bands Squeeze Strategy

Entries:

Additional Indicators to Avoid False Signals:

Optimal Bollinger Band Settings:

Risk Management:

Extra Tips:

Another very straightforward way of trading with Bollinger Bands is using the upper and lower bands as moving support and resistance levels. In this approach, you will be monitoring for overbought and oversold levels. This is a strategy that works well in quieter markets, including stocks.

The image below illustrates this approach. You would typically buy when a candle closes inside the lower band right after closing below it. You would then sell when prices break through the upper band and close back below it in the next candle.

It is important to remember that this strategy, although straightforward, has to be carefully analyzed. If candles keep closing outside the lower or upper bands consistently, it doesn’t indicate that the asset is overbought or oversold. It can be a sign of a new trend emerging and you definitely want to trade in the direction of this new trend, not against it.

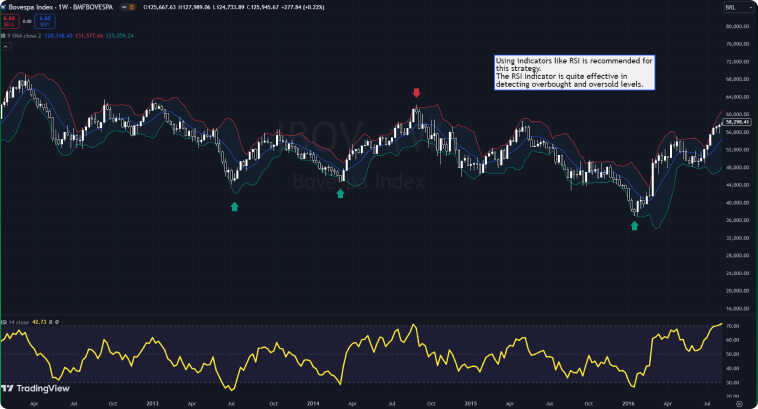

We can see an example of this strategy playing out in a real-world scenario. Prices are within a range, so Bollinger Bands are an effective way of buying when prices touch a support level and selling when they touch a resistance level—considering that the bands are moving support and resistance levels. I always suggest using an indicator like RSI for this strategy, as it gives you more clarity on overbought and oversold levels. Going long when prices touched the lower band and RSI was below 30—and going short when the opposite happened—proved to be an effective strategy here.

Step-by-Step for Beginners: Trading Overbought and Oversold levels.

Entries:

Additional Indicator to Avoid False Signals:

Optimal Bollinger Band Settings:

Risk Management:

Extra Tips:

Mean reversion is a phenomenon in financial markets that says that prices naturally return to an average level of equilibrium after explosive movements. This average serves as a magnet for prices—a point of “fair value”.

A popular Bollinger Bands strategy involves opening positions expecting prices to revert to the middle band after touching the outer bands. This reversal strategy is quite similar to using the bands as support and resistance levels, but this one is more focused on short movements, where people try to benefit from pullbacks and retracements within ongoing trends. This strategy is particularly useful for those interested in scalping in Forex trading.

It tends to be riskier, especially in intraday, and traders usually ride the market for a shorter period before cashing in the profits. The image below shows an example of intraday price action, where prices kept touching the upper band and then reversed back to the mean during an uptrend.

Step-by-Step for Beginners: Trading Mean Reversion.

Entries:

Additional Indicator to Avoid False Signals:

Optimal Bollinger Band Settings:

Risk Management:

Extra Tips:

Do Bollinger Bands work? Yes, they do! But they still have limitations. It is a rookie mistake to rely on them alone or not look into the bigger picture before opening a position. False signals are quite frequent and you want to avoid being on the wrong side of the trend.

For the most common strategies of Bollinger Bands trading, here are some important guidelines:

Remember to adjust stop losses dynamically as the market moves favorably toward your target. Avoid over-leveraging and keep risk management in mind.

Trading strategies using Bollinger Bands are effective but profitable trading usually comes from combining multiple trading tools together. Some of the most common combinations include:

Besides the RSI, MACD, and volume, there are many other indicators and strategies you can add to your toolkit alongside Bollinger Bands to identify opportunities. I highly suggest reading more about effective trading strategies to acquire in-depth knowledge on the matter and learn how you can adapt different tools and strategies to your trading system.

Bollinger Bands can also help day traders in finding opportunities in intraday charts. Most day traders use 5-minute to 15-minute charts to capture price action and react quickly to make profits. To day trade using Bollinger Bands more effectively, it is a good idea to adjust its parameters to a shorter period, such as 10. This will make the indicator more responsive to the most recent price movements. You can also try using an exponential moving average for the middle band.

In an intraday trading session, the strategies used for Bollinger Bands are pretty much the same as those used in longer timeframes. You can take advantage of price swings between the bands, looking for overbought and oversold levels, as well as look for breakouts to ride explosive trends when the bands expand when volatility increases. One of the most popular methods, however, is employing a mean reversion strategy during trends, where you go short when prices touch the upper band and make a profit when they touch the middle band.

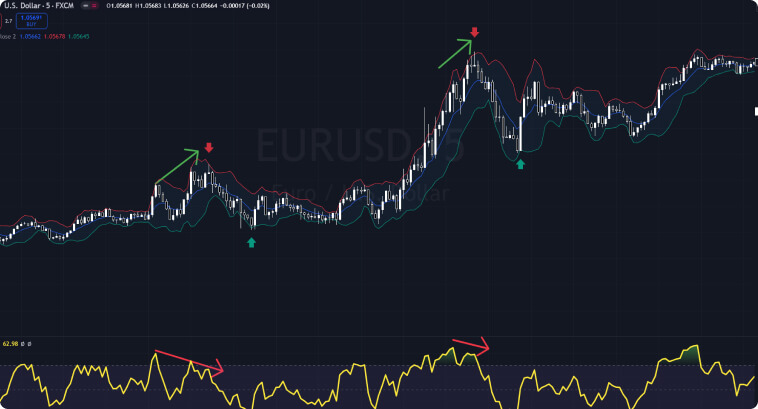

In the image below we have several examples of opportunities appearing on a 5-minute chart for the EUR/USD pair. Notice that I’m using an 8-period exponential moving average for the Bollinger Bands—to capture the most recent price action—and a 9-period for computing the RSI indicator.

Both signals for going short appear when there is a divergence between the price and RSI. Even though the price keeps reaching higher highs, the RSI doesn’t reach its previous peaks. The opportunity to short-sell happens when prices try to close above the upper band and fail plus the RSI is around the overbought level and showing divergence. On the other hand, the signals for going long appear when prices touch the lower band and the RSI is under oversold conditions—very straightforward in this case.

When it comes to day trading, the main focus has to be risk management. Considering the shorter timeframe, you have to adapt to tight stop losses to limit how much money you can lose from breaking news or unexpected events that can drive prices in the opposite direction of your trade. Position sizing also has to be more conservative. I wouldn’t recommend day trading with over 2% of the total account per trade. Use trailing stops to lock in gains as prices move favorably to your entry. You can even use indicators to help you manage trailing stops, such as moving averages, Parabolic SAR, and Chandelier Exit.