How much money do you need to trade futures?

When it comes to the question of how much money you need to trade futures, you can honestly find two answers. Is it possible to start with $100? $50? Well, yes, you can definitely open an account with that amount of money and start from there. But the amount of money you need to start a futures trading account is not the same amount of money you need to succeed at futures trading.

In this article, we will guide you through the challenges of managing a futures trading account with a smaller amount of capital. We will cover the costs of trading futures contracts and the minimum to get started. We will also touch on the different requirements of capital according to different contract types and the realistic amount of money a trader should have to pursue their goals responsibly.

Your first challenge is the broker minimum deposit. This is the cash required to simply open an account. To be fair, this number has dramatically fallen in recent years, creating a low barrier to entry compared to what it was years ago.

Believe it or not, some of the largest futures brokers, such as NinjaTrader, have a $0 minimum deposit policy. In practice, they have no minimum amount required of you to join. You can open and fund your account with any amount you choose.

On the other hand, other brokers have minimum deposit requirements. Some firms, for example, require a $500 minimum to trade micro contracts, while others require $2,000 for e-minis.

This is the first issue for beginners with a smaller capital. While you can open a brokerage account with little money, this amount might not be enough to actually manage trades without risking blowing your account.

One of the biggest factors to take into account is the type of contract you will trade. Decades ago, trading futures required significant capital. A single contract for Crude Oil controlled 1,000 barrels, and a move of just $1 meant a $1,000 gain or lose. This market was inaccessible for most retail traders.

In order to lower the entry barrier, the industry started splitting the contracts. In practice, this move resulted in new futures products designed specifically for those who want to trade futures but don’t have a large amount of capital.

Standard contracts are the original full-sized contracts. They have the largest value of all types of contracts and might require some thousands of dollars to trade safely. E-mini contracts, such as the e-mini S&P 500, are a fraction of the size of standard contracts. Micro contracts are even smaller fractions. These e-minis and micro contracts make it possible to start trading futures while on a smaller account.

| Asset | Micro Contract | Tick Value | E-mini Contract | Tick Value | Capital/Risk Multiplier |

| S&P 500 | Micro E-mini (MES) | $1.25 | E-mini S&P 500 (ES) | $12.5 | 10x |

| Nasdaq 100 | Micro E-mini (MNQ) | $0.5 | E-mini Nasdaq 100 (NQ) | $5.00 | 10x |

| Gold | Micro Gold (MGC) | $1.00 | E-mini Gold (QO) | $5.00 | 5x |

By looking at the table, you can see that the capital needed to trade the micro version of the Nasdaq 100, for example, is 10 times smaller than the e-mini version.

Another important concept is margin. In stock trading, margin is a loan from your broker. In futures, margin is not exactly a loan. It represents the minimum amount of money you must have in your account to open and hold a position.

The margin is defined by the exchange and can be adjusted by your broker. Margin requirements vary a lot based on the asset and its expected volatility. There are two types of margin you should be aware of:

If the market moves against you and your account balance drops below the maintenance margin level, your broker will issue a margin call. This is a demand for you to deposit more money as soon as possible.

The margin call requires you to deposit enough funds to bring your account all the way back up to the initial margin level. If you fail to do so, your broker will liquidate your position and lock-in your losses.

Besides margins and minimum deposit requirements, an undercapitalized trader have to deal with additional costs:

These costs bring additional challenges. It is extremely hard to stay profitable on a budget while having to deal with commissions, fees, taxes, slippage, and many other costs. Break even becomes hard under these circumstances.

When it comes to determining a realistic starting capital, we are moving beyond the discussion of broker minimum or margin. We are discussing risk management, above anything else.

The golden rule of risk management is to never risk more than 2% of your total account capital on a single trade. Risk is not your margin, but the amount of money you will lose if your stop-loss is hit. We can use this golden rule to reverse-engineer your ideal starting capital.

So that’s your realistic answer. To trade one MES contract with a 10-point stop-loss, you must have $2,000 for a 2% risk level. If you are more conservative and use a 1% risk rule, you would need $5,000.

This is the financial value that allows you to properly manage trades and survive a sequence of bad trades, which can happen to anyone.

Your strategy determines your capital requirements.

How does capital affect your trades? Let’s take a look at two traders executing the exact same trade, but with different capital:

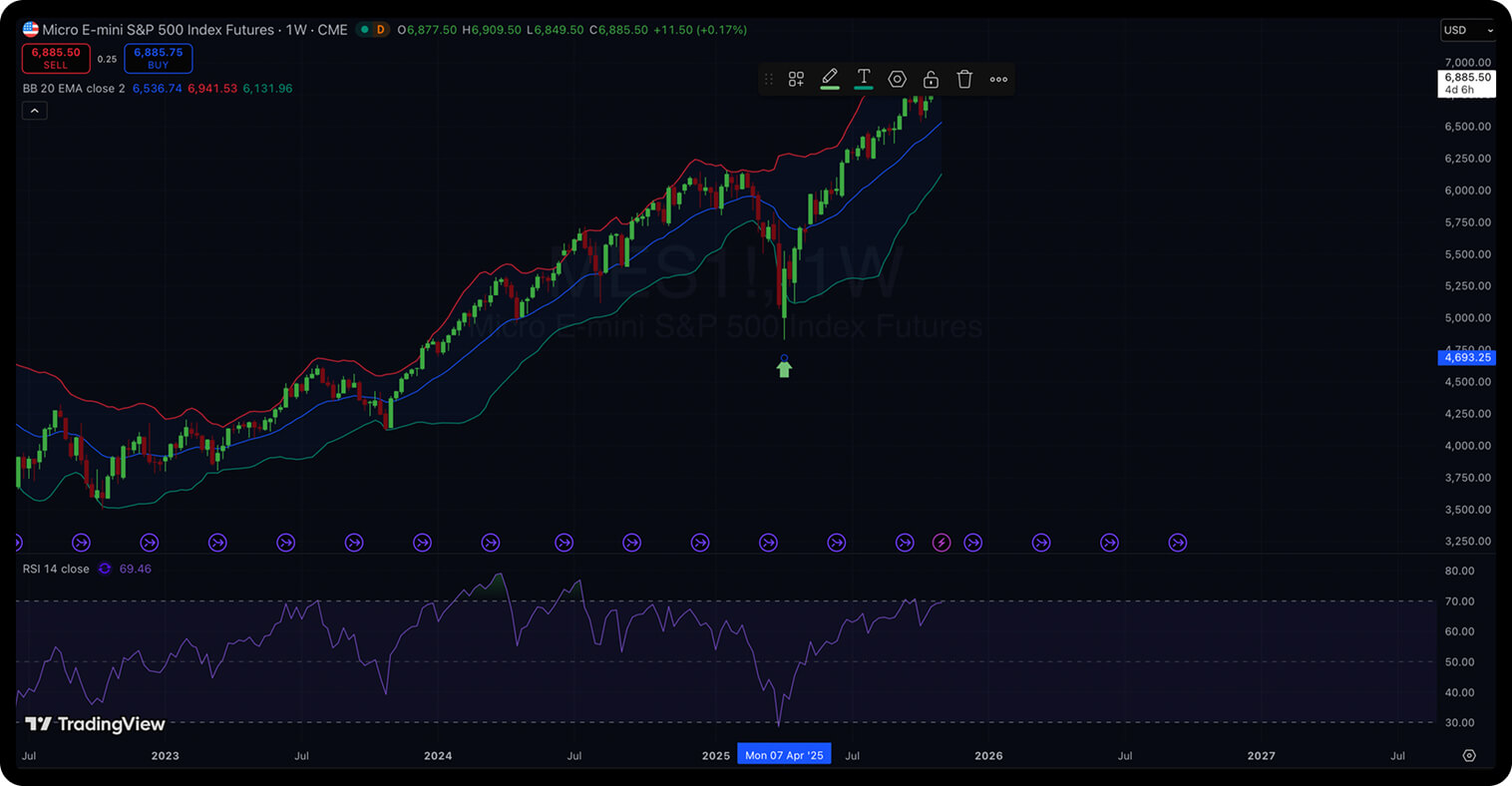

Following technical analysis, the strategy is to buy micro e-mini S&P 500 after prices bounce back from the lower Bollinger Band and RSI bounces back after touching levels below 30.

The stop-loss is 10 points. The Dollar risk is $50.

Trader A has a starting capital of $500. If the risk is $50, then that is a 10% risk. Two bad trades and this trader is down 20%, excluding additional costs and fees. This creates a huge psychological pressure. This trader is “forced” to gamble. It is hard to stick to a strategy. It is unlikely to survive in the long-term.

Trader B has a starting capital of $2,500. If the risk is $50, it represents 2% of trader’s B account. This is a much more manageable expense. Much closer to how a professional trader operates. Trader B can easily survive if this micro e-mini trade goes wrong. Not only that, but he can easily absorb a sequence of bad trades, which is not at all uncommon. Trader B has more financial and emotional stability to wait for the right circumstances and profit. Costs and fees also have a smaller weight.

Starting with too little money is a problem in futures trading. Research shows that most futures traders lose money, and undercapitalization is a primary reason.

Besides margin calls, the biggest risk is in the psychological aspect. Traders in smaller accounts usually fall into traps such as over-leveraging, which causes anxiety and stress to spike, damaging decision-making making your more fragile to volatility.

Operational costs are also magnified when it comes to small accounts. A $2 commission on a $500 account is a 0.4% hurdle. Profitability becomes much more unlikely for the undercapitalized trader.

Technically, yes. Several brokers allow you to open accounts and trade on micro contracts. However, it its unlikely to be successful with such small accounts. A realistic minimum to start with proper risk and drawdown management is closer to $2,000 to $3,000.

Not really. The $25,000 requirement is a part of the Pattern Day Trading (PDT) Rule. This rule only applies to stock and options trading in a margin account. Futures trading is regulated quite differently and is exempt from this rule.

The amount of money needed depends on your broker’s margin and your strategy. You should plan for at least $2,000 to $3,000 to trade one micro contract responsibly.

The right path is to start small while you gain insight into market conditions and dynamics. From there, you earn knowledge, experience, and increase your size.

A simple roadmap would be:

I would truly avoid funding any trading account until you check every box listed down below:

So, how much money do you need to trade futures? You can start with $100, but the truth is that such an amount is not enough to properly manage risks and learn. Without sufficient capital, even a winning strategy will fail, because you might not even be able to prove your trading plan works.

The first investment you need to make is in skill, not money. Invest heavily in learning. Prove your edge in a demo account. Once you’re ready, fund your account with a realistic, but responsible, amount of money that will give you the edge to trade like a professional, not a gambler. In futures trading, victory is found in longevity, and proper risk management is how you survive to trade another day.