The Best Indicators for Options Trading

Technical indicators are mathematical calculations built on historical price and volume of an asset. For option traders, these indicators are extremely important to forecast the future direction of price movements, identify optimal entry and exit points, as well as risk management. Using technical indicators for options trading significantly improves the decision-making process. Metrics like momentum, volatility, and trend are important allies for objective trading decisions, removing any guesswork before opening positions.

When it comes to options trading, the role of technical indicators might differ from their role in traditional stock trading. Stock traders usually use indicators to find buy or sell signals, whereas an options trader often operates in a more multi-dimensional environment where price, time, and volatility all play a role. Technical indicators don’t automatically translate to a specific action like buying a call option. These tools are used to form a hypothesis about the potential behavior of the underlying asset. This hypothesis is then filtered through options-specific data, especially implied volatility, to select the most suitable strategy, whether it’s buying a call or selling a put.

To get an effective market hypothesis, traders use a combination of some of the most popular indicators in technical analysis. Each of these indicators gives a different view of the market, from the strength of a trend to a potential reversal. The following are some of the top options trading indicators used to analyze the behavior of an asset.

Starting with the Relative Strength Index, or RSI, this is a powerful momentum indicator that compares the magnitude of recent gains to recent losses over a specified time period to identify overbought and oversold conditions. The RSI oscillates between 0 and 100 with a standard 14-period setting, while shorter periods, such as 7-9, can be used for intraday trading. When the RSI is above 70, the asset is considered to be under overbought conditions and may be preceding a price reversal, opening up a chance to consider strategies like buying put options. An RSI below 30, on the other hand, suggests oversold conditions, which opens up the opportunities for bullish strategies like buying call options.

The Moving Average Convergence Divergence, or MACD, is a trend-following momentum indicator made of three elements: the MACD line, the signal line, and the histogram. The primary signals are generated by crossovers, where a bullish crossover occurs when the MACD line crosses above the signal line, suggesting increasing upward momentum, while a bearish crossover occurs when it crosses below, indicating the strengthening of a downward momentum. For options traders, the histogram is a tool that helps measure the acceleration of a trend. When the histogram bars grow taller, it indicates that the trend’s momentum is strengthening, but when they begin to shrink toward the zero line, it serves as an early warning that the trend is slowing down. The standard setting of 12-26-9 is widely used and effective for most timeframes and asset classes, but faster settings can be used for scalping.

The Bollinger Bands indicator is a volatility indicator created by John Bollinger. It consists mainly of the middle band, usually a 20-period simple moving average, and an upper band and lower band set two standard deviations above and below the middle band. The bands provide a dynamic and visual representation of volatility levels by widening during high volatility and contracting during low volatility. This dynamic provides great insights, since one of the most common options trading strategies is based on buying options during low volatility and selling options during high volatility.

Moving averages are the most fundamental trend-following indicators that smooth out price data, helping identify the direction of market trends. The two primary types are the Simple Moving Average (SMA), which calculates an average price over a certain period, and the Exponential Moving Average (EMA), which gives more weight to recent prices, making it more responsive to new information. Moving averages can serve as dynamic support and resistance zones. Crossovers also help traders develop a strategy for entry and exit points, where a faster MA crossing above or below a slower MA opens an opportunity to go long or short.

The Stochastic Oscillator is among the best momentum indicators. It compares a particular closing price of an asset to a range of its prices over a certain period of time. It operates on the principle that an asset’s price tends to close near its highs during a bull market and near its lows during a bear market. The indicator uses a 0-100 scale, similarly to the RSI, where values above 80 indicate overbought conditions and values below 20 suggest oversold conditions. These values are used to spot potential reversals, where trades identify turning points.

Although traders use standard technical analysis indicators to watch the underlying asset, there is an entire class of indicators that is derived directly from the options market itself. These indicators provide a unique layer of analysis that is essential for enhancing your options trading skills. Let’s take a look at some of them.

Implied Volatility is the market’s forecast of how much an asset’s price will fluctuate in the future, derived directly from option prices. A high IV usually leads to expensive options, while low IV leads to cheap options. However, IV is not very useful when used in isolation. It has to be contextualized using the IV Rank, also known as IVR.

The IVR measures the current IV relative to its range over the past year on a scale of 0 to 100. A high IVR, generally higher than 50, creates a favorable condition for selling options that are historically expensive. A low IVR, usually below 25, indicates that options are cheap, creating an ideal environment to buy them (e.g., long calls/puts).

The Put-Call Ratio is a sentiment indicator that measures the trading activity of put options relative to call options, based on either trading volume or open interest. A high PCR, usually above 1.0, indicates that more puts are being traded than calls, which indicates bearish sentiment. A low PCR, usually below 0.7, indicates that there is a bullish sentiment overall. Many traders, however, use the PCR as a contrarian indicator, especially at the extremes. An extremely high PCR can indicate that bearishness is overcrowded and a bullish reversal may be imminent. On the other hand, an extremely low PCR may indicate excessive bullishness, preceding a market top.

The OI represents the number of option contracts that have not been closed, exercised, or expired. It can provide insights into the conviction behind price action when analyzed alongside price and volume. One of the strongest bullish confirmation occurs when price, volume, and OI are all rising, indicating that new money is aggressively entering long positions. On the other hand, one of the strongest bearish confirmation is a falling price with rising volume and OI. If the price is rising but OI is falling, however, it indicates the buying pressure may be weak.

The ATR is a volatility indicator that measures the average trading range of an asset. Although this indicator is not an exclusivity for options, it is primarily used for risk management in options trading. Setting a stop-loss based on an option’s price is unadvised due to the effects of time decay and changes in IV. Instead, a common approach is to set the stop-loss on the underlying asset’s price, using a multiple of the ATR to define the risk level. For a long trade, a stop could be set at the entry price minus two times the ATR. This stop level on the stock can then be translated back to an approximate exit price for the option using its delta.

The right indicator for your trading depends heavily on timeframe and goals. Choosing the best set of indicators and tools requires matching their sensitivity to your own personal trading style.

For scalping, which relies heavily on small price changes on short timeframes, usually 1 to 5 minutes, indicators must be highly sensitive, usually with custom settings to capture the intricacies of extremely-fast price action.

Considering intraday trading in longer timeframes, 5 to 30 minute charts, a more balanced approach is needed. You can either use indicators with their standard settings, or slightly tweak them. Many day traders also like to use the VWAP indicator. This indicator marks the average price an asset has traded throughout the day based on volume. When prices are above the VWAP, traders see it as sing that the market is bullish for the day. When prices are trading below it, the market is considered to be bearish.

Many options traders, however, tend to evaluate the market from a swing trading perspective, meaning positions are held for several days to weeks with the goal of capturing larger market trends while removing the short-term noise. With swing trading, most indicators can definitely be used with their standard settings, some may benefit from longer-term custom settings as well, depending on the trading system.

Below, we have a comparative table that may help you understand the differences between different time horizons, timeframe and parameters for some of the most widely-used technical indicators across markets.

| Trading Style | Timeframe | RSI | MACD | Bollinger Bands |

| Scalping | 1-5 minutes | 7-9 period. Use 90/10 levels for extremes | 3-10-16 or 5-12-9 | 10 period, 1.5 std dev |

| Day Trading | 5-30 minutes | 9-14 period. Use 75/25 levels | 12-26-9 | 20 period, 2 std dev |

| Swing Trading | 4 hours – Daily | 14 or 21 period. Use 70/30 levels | 12-26-9 | 20 or 50 period, 2 std dev |

You must not rely on a single indicator to trade. A robust trading system is created by using multiple indicators together. You filter out noise by initializing a trade only when many non-correlated indicators confirm the same market hypothesis.

Some powerful combinations include:

This is a classic combination for identifying high-probability trades. A signal occurs when price touches or moves outside a Bollinger Band and the RSI confirms the momentum is exhausted by reaching the extremes at 30 or 70. This can help you identify reversals and profit when markets return to the mean.

A MACD crossover signal is much more reliable when supported by a spike in trading volume. Higher-than-average volume indicates a larger participation behind any market move, making it less likely to be false.

You can also use a combination of options-specific indicators to get a better grasp of the market. For example, a rising PCR and a rising OI on a down swing might confirm that the bearish movement has no real conviction behind it. You can use the RSI as a technical indicator to help define your entry point under this condition.

When different types of indicators give conflicting signals, it often means the market is in a state of uncertainty. The most prudent action in this case is to wait before taking any further action. A good strategy is to follow a hierarchical view of the analysis, where the primary trend holds the most weight. Considering a situation where the RSI is overbought but the MACD remains strongly bullish, it’s typically a sign of a powerful trend, not a reversal right away. Going short under these conditions would be extremely unwise until one of the indicators starts signaling a loss of momentum.

The main key to filtering out false signals is waiting for confluence. Do not act on a single signal. A multi-condition approach is the best way to ensure you’re trading based on a high-probability setup.

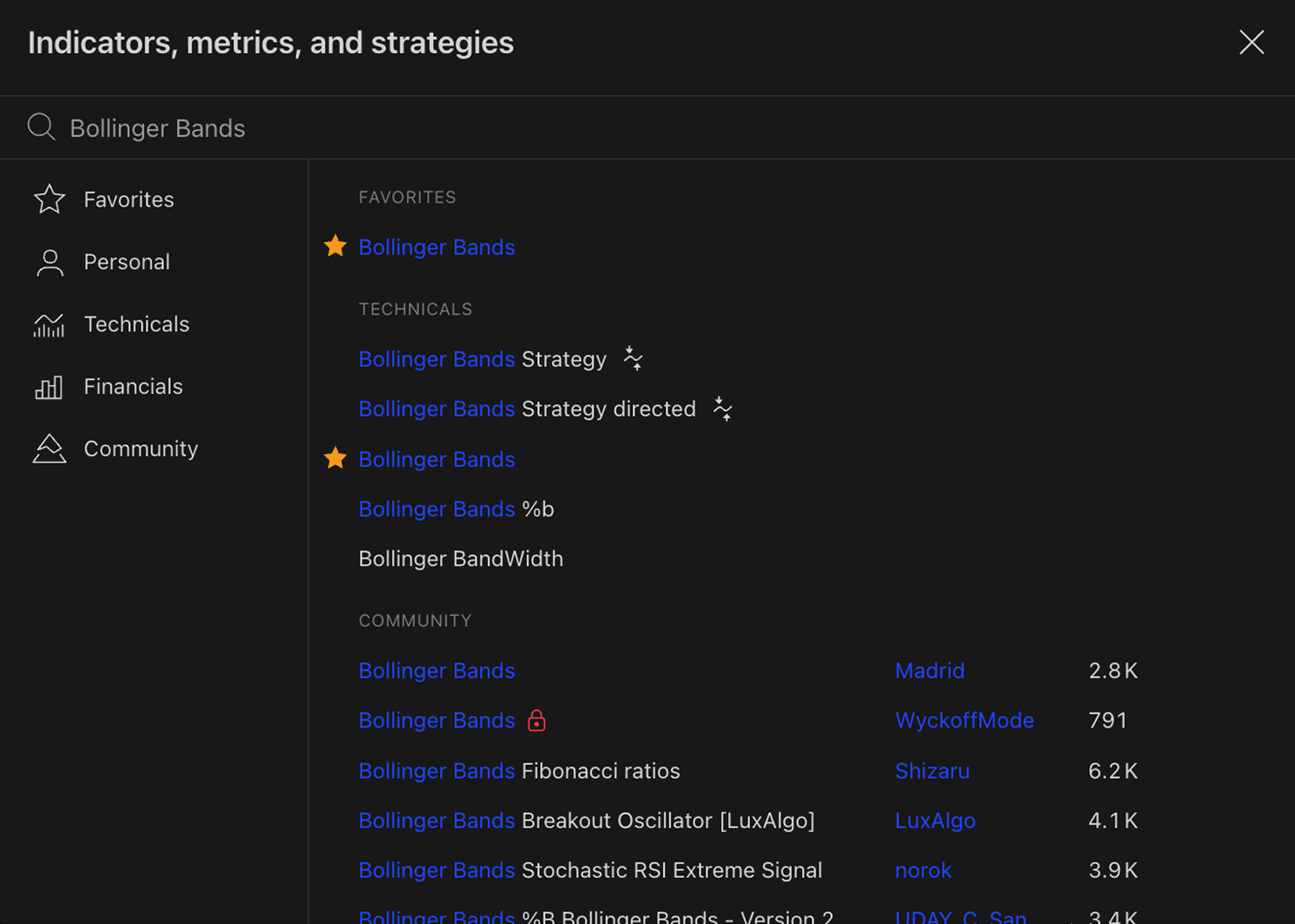

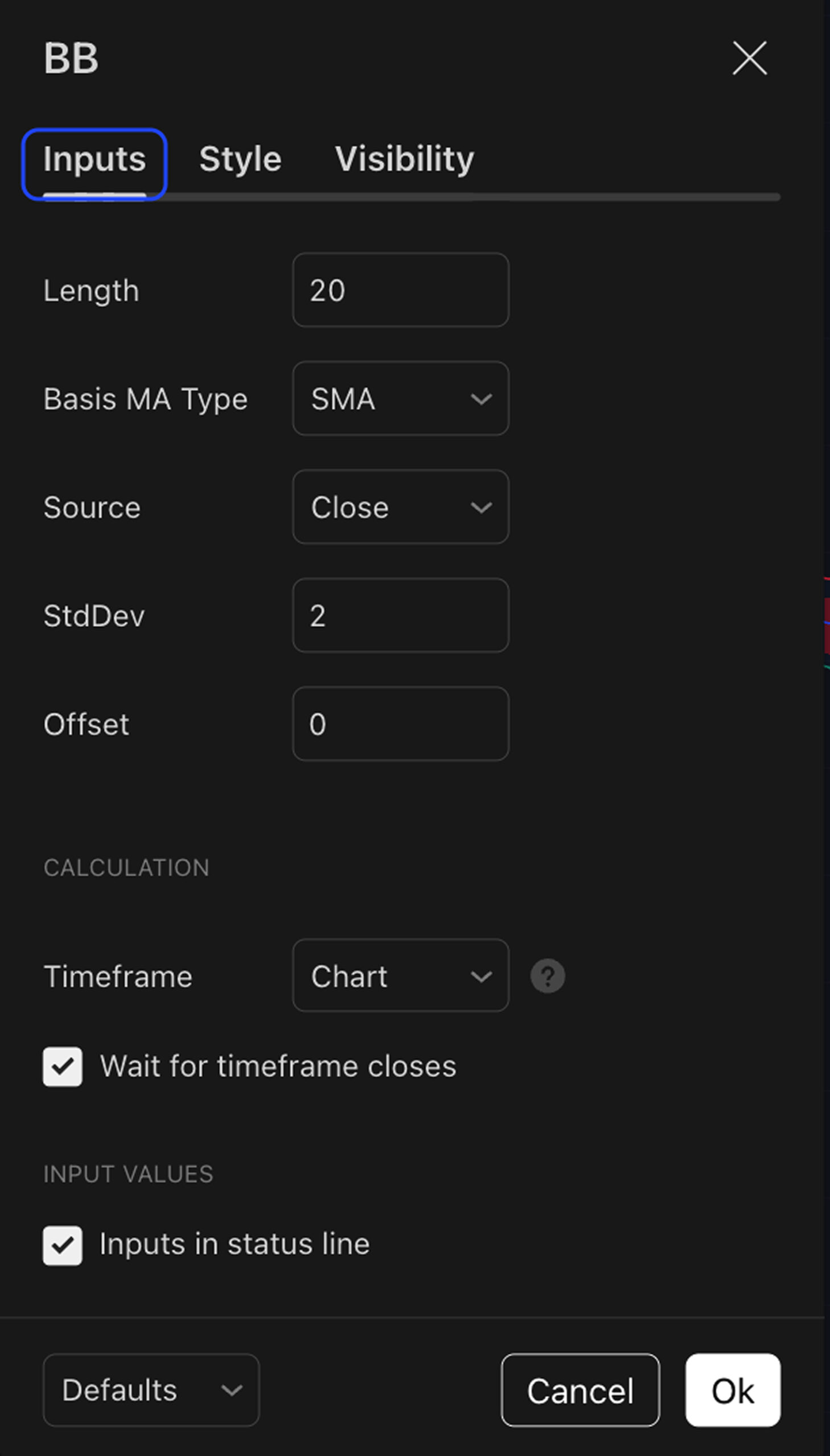

Modern trading platforms like TradingView make it extremely easy to add and customize indicators. In TradingView, you can find the Indicator menu at the top of your chart, search for the indicator you want to use and add it. To customize, you simply click the settings icon on the indicator’s title and a panel will show up where you can adjust several parameters, like period, colors, line thickness, visibility, etc.

It is important to highlight that there are no universal best settings. Optimal parameters are highly dependent on volatility levels and your trading style and strategy. It is also noteworthy that options traders have to watch for the option’s expiration, so the indicators must account for that additional factor.

Besides finding entries, indicators help traders analyze risk and manage positions more effectively. A good approach to risk management is setting stop-losses based on the underlying asset’s price action instead of the option’s premium, which is distorted by the effects of time and volatility. The Average True Range provides a dynamic measure of volatility, so it is widely used by options traders.

For example, imagine you enter a long call position with the stock at $100 and the ATR at $1.50, your stop-loss on the stock would be placed at $97 based on the ATR, since $100 – (2 * $1.50) = 97. This method helps prevent premature exits caused by IV crush or theta decay. Volatility indicators can also help determine position size. In a high-volatility scenario, it is always prudent to reduce position size to account for the larger price swings.

When trading options while using indicators based on technical analysis, one of the biggest mistakes is over-complication. Loading a chart with too many indicators will inevitably lead to conflicting signals, causing confusion and indecision. An optimal trading system would be made of 2 to 3 complementary, non-correlated indicators, such as one for momentum (RSI), one for trend (MACD), and one for volatility (Bollinger Bands).

Another mistake is ignoring the market context, especially implied volatility. An options trader might be correct about a stock’s direction but still lose money because they bought a call when IVR was at 95%, making the premium extraordinarily expensive. Always check IV Rank first. High IVR favors selling premium, while low IVR favors buying premium.

Traders also tend to misinterpret signals by using indicators in isolation or by applying inadequate settings for their timeframe. An indicator signal alone can’t be a complete trading system. Follow a methodical approach, where you have well-defined strategies, entry rules, exit rules for both profit and loss, and risk management for a better trading experience.

Using technical indicators for options trading is a bit different from using them for stock trading. When it comes to options, you must include the IVR to define a strategy, where selling premium when it is expensive and buying premium when it is cheap is the wise way to go. Besides classical technical analysis tools, you must also include the option Greeks to refine the structure of the trade and select the optimal strike prices and expirations.

Winning traders are those who can build a coherent, rule-based framework while leveraging the right combination of tools for the right conditions. This guide provides a starting point, but mastery can only come through practice, backtesting, and adapting these tools to fit your style and the market. Always remember that long-term survival in financial markets is based on constant learning, so never stop chasing new tools and concepts to add up to your trading toolkit.