The Definitions of Bollinger Bands and How to Use Them in Trading

Many traders are already familiar with an indicator composed of one moving average plus an upper and a lower band surrounding it. These are the Bollinger Bands, a powerful technical analysis tool used in stock trading and created by John Bollinger back in the 1980s.

In principle, this indicator gives us visual insights into the dynamics of price based on a certain number of periods. You can see it in the picture below and identify its core components: upper band, middle band, and lower band. These lines help us find possible overbought or oversold levels, as well as identify whether we’re dealing with high or low volatility.

Before diving into examples and strategies, we have to understand how this tool developed by John Bollinger works. Once you select the Bollinger Bands on your preferred trading platform, you will see a higher band, a lower band, and a line within these two bands. This middle line is a moving average—often a 20-day period simple moving average—and the upper and lower bands are placed at a distance of two standard deviations from the middle line.

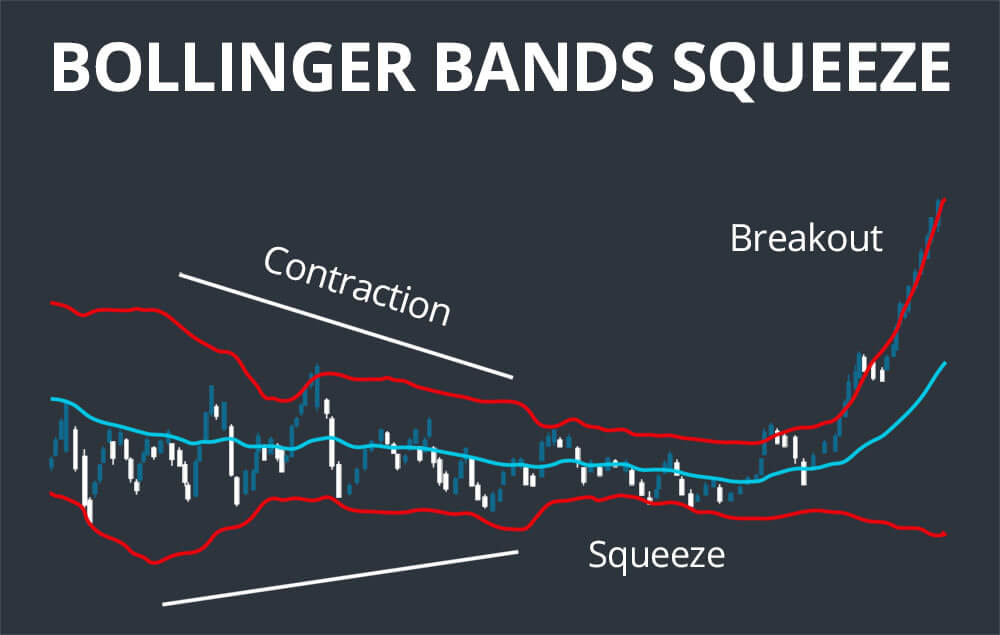

The nature of the upper and lower bands helps us measure volatility in price movements. That’s because when prices become more volatile the bands widen, whereas low volatility makes them contract.

Some people also use the bands to find overbought and oversold levels. When prices touch the upper band, many traders open short positions expecting prices to reverse to the middle line or even reach the lower line.

The Bollinger Bands Indicator is one of the most famous indicators used in technical analysis to help people make trading decisions. But do you really know how it works? Let’s explore its key components to understand how this indicator can help us read market signals.

The middle line of the Bollinger Bands is just a simple moving average. That’s pretty straightforward.

It is the average closing price over the past 20 data points. Moving averages help smooth out noise in price data and also help us identify trends more easily. With each new data point, the simple moving average value will change, reflecting current price action while still taking into consideration past price action,

Both the upper and lower bands of the Bollinger Bands indicator are calculated based on the standard deviations from the simple moving average. The standard deviation is a metric in Statistics used to measure the dispersion/variability in price data. They provide a very quantifiable sense of the volatility.

Mathematically, the bands are calculated as:

The bands automatically adjust to the degree of volatility. Whenever volatility is high, the bands expand. When volatility is low, the bands contract.

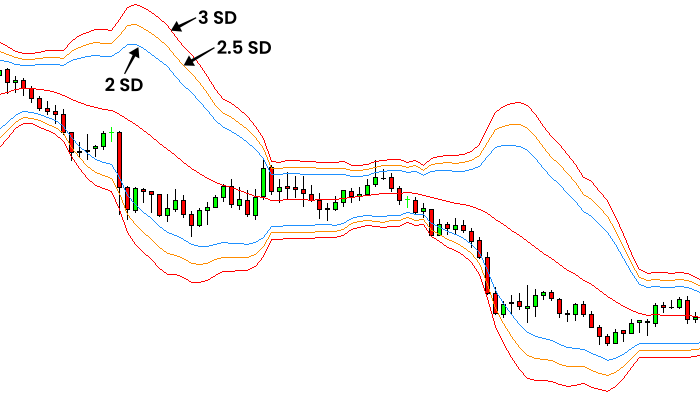

The default multiplier is 2, which captures two standard deviations from the mean. You can, however, fine-tune the indicator and change that number according to the asset you’re trading and other market conditions.

Traders use several strategies to trade securities with Bollinger Bands. Some of them include:

Chart patterns may differ a lot from market to market. Given the peculiarities of each security, you might want to adapt how you use a tool like the Bollinger Bands and try different settings. From stocks to Forex, this is how you can adapt Bollinger Bands to get the best of it across different markets:

The first mistake that beginners make is assuming that touching the upper or lower bands automatically implies we’re going to have a trend reversal. This is hardly true all the time. When prices hit a band, it can indicate that we have a very strong trend, not necessarily exhaustion. Prices can consistently touch or exceed the upper band without reversing in a strong uptrend. Using RSI or MACD as confirmation tools can help beginners avoid betting on trend reversals when there’s no reason to believe one is about to happen.

Another mistake is not adjusting the settings and trying different numbers of standard deviations. The standard settings of 20-period SMA and two standard deviations from the mean are probably not suited for every asset in the world. Some assets will probably benefit from a shorter 10-period SMA, different multipliers, or multiple standard deviations. In the image below we have an example of Bollinger Bands with three different standard deviation levels.

Another major issue is relying only on Bollinger Bands to place trades. Since Bollinger Bands are quite intuitive and straightforward, many beginners might end up believing that this indicator is all they need to succeed, which couldn’t be further from the truth. Bollinger Bands should always be combined with technical indicators like RSI, MACD, Volume Indicators, etc. Beginners should invest some time in learning the basics of technical analysis before going to live markets and learning the hard way (i.e., losing money).

Also, keep in mind that markets get extremely irrational during breaking news and relevant events. It is always a good idea to adjust the settings of the indicator when these events happen, you should definitely try different periods during strong trends. Different market conditions require different approaches, and beginners tend to find it harder to figure out when to adapt or stay out of the market completely.

The Bollinger Bands form an effective technical analysis tool developed by John Bollinger. It is intuitive and also useful, which explains why it is so popular. Since I first started in financial markets back in 2017, this indicator has been one of my favorites due to its versatility and reliability.

Bollinger Bands can help you identify buying and selling opportunities, analyze price behavior, and measure market volatility. They’re easy to adapt to different markets, from stocks to Forex, and you should definitely consider adding them to your toolkit.

To use this indicator effectively, focus on understanding its limitations and learning how to read it accurately. Be mindful that they don’t predict future prices and they should also be used with extra technical analysis tools.

You can benefit greatly from Bollinger Bands by developing a good understanding of market context, putting in some hours of practice, and including additional indicators in your analysis.