Ultimate Guide to Reversal Candlestick Patterns

Some specific formations In technical analysis are able to indicate that prices might be reaching a turning point during an established trend. These formations are called reversal patterns.

Very popular in modern-day chart analysis, Candlesticks are graphic depictions of the ongoing struggle between buyers/bulls and sellers/bears. They imprint the emotions that move prices up and down–fear and greed.

Suppose you already know how to read Forex charts or any other type of price charts. In that case, you are probably aware that these charts can reflect real-time market sentiment, one of the main reasons behind their prominence in modern technical analysis.

We will approach some of the most relevant patterns to look for when trying to identify whether a trend might be losing its strength. Besides that, we will also seek to understand how these patterns can help us find strategic entry and exit points based on reversal signals.

Technical analysts nowadays commonly apply Japanese candlesticks to their trading toolkit to get more insights into price behaviors.

In technical analysis, you evaluate the main emotions driving the market and identify trends through the observations of how prices move on a price chart, differing from Fundamental Analysis, where you analyze a company’s financial health via metrics like Earnings Per Share, Return on Equity, and Debt-to-Equity Ratio, among others. You can learn more about the key differences between these two methods of analyzing the markets by reading our blog post about technical trading vs fundamental trading.

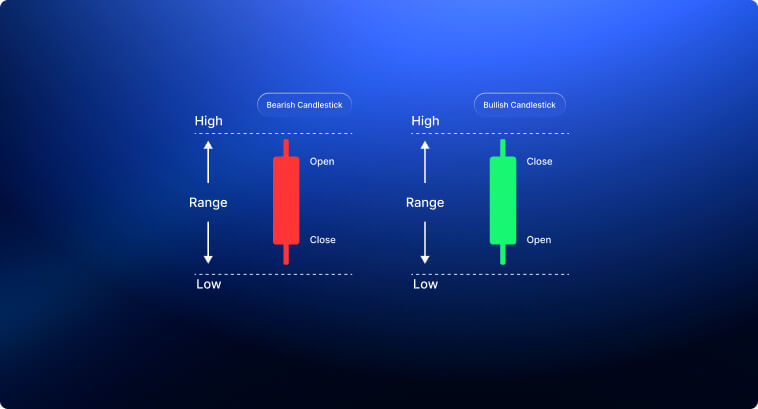

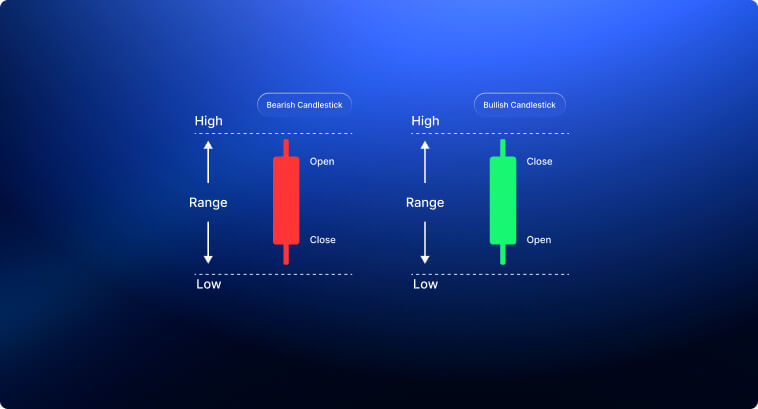

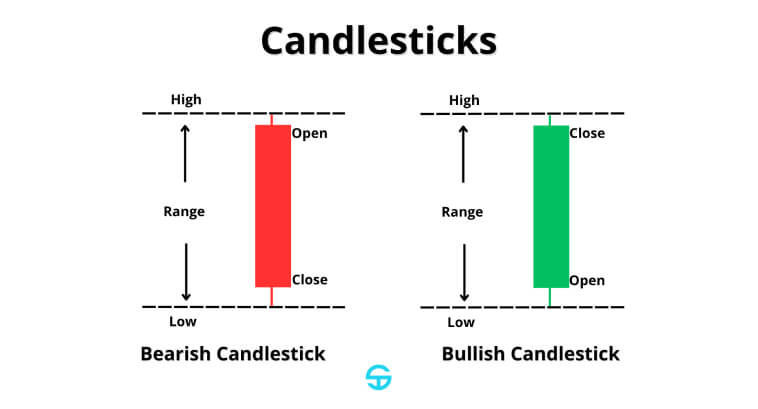

Candlesticks offer an easy way to understand how price behaves within a time period. It has four data points:

• Opening Price

• Closing Price

• High

• Low

Its body reflects the price interval between the opening and closing prices. Its shadows represent the extremes of price action within the period. The color of the candlestick represents the direction: Green/White implies Bullish movement (closing price above opening price); Red/Black implies Bearish movement (closing price below opening price).

Each candlestick gives you a story about the emotions behind the actions taken by both buyers and sellers. They can reflect feelings like indecision, extreme confidence, capitulation, or reversal. They can demonstrate a lack of dominance or indicate that one of the parties involved in the market has total control over prices.

One of the most important factors in validating candlestick patterns is volume. A spike in volume during a reversal pattern indicates high participation among market players, enhancing its confidence levels. Lower volume is an indication of low liquidity or even a lack of interest for that specific instrument or time period, making any candlestick sign much less reliable than in more crowded markets.

Well-grounded signals tend to appear when patterns form within a strong trend or around key levels of support and resistance. That’s why it is essential to combine candlestick analysis with other tools in Technical Analysis to avoid false signals.

Markets are inherently hard to predict. If we could reliably predict tomorrow’s candlestick or next year’s candlesticks, we would all be rich. Yet, some price patterns do present a higher level of confidence when it comes to identifying when the prominent trend is weakening and the opposite team might be gaining strength to make prices move in their direction.

Although these patterns are not the Holy Grail, they can still help you identify new emerging trends when combined with a deeper understanding of the broader market context and additional indicators, allowing you to find key exit points to ride the trend.

These are some of the trustworthy candlestick patterns in technical analysis you should pay attention to:

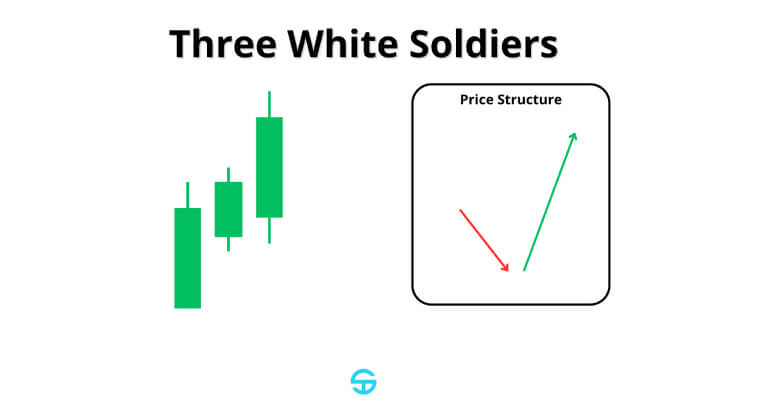

The Three White Soldiers pattern indicates bullish momentum at the bottom of downtrends. It is formed by three green/white candlesticks with long bodies that appear one after another, with each candle closing higher than the previous closing price.

This pattern demonstrates high optimism among buyers, completely overpowering sellers and weakning the selling momentum.

How to Trade: Wait for confirmation and go long after the third candlestick closes. Stop-loss levels should be right below the body of the first candle.

Success Rate: Around 60-78%, according to some studies.

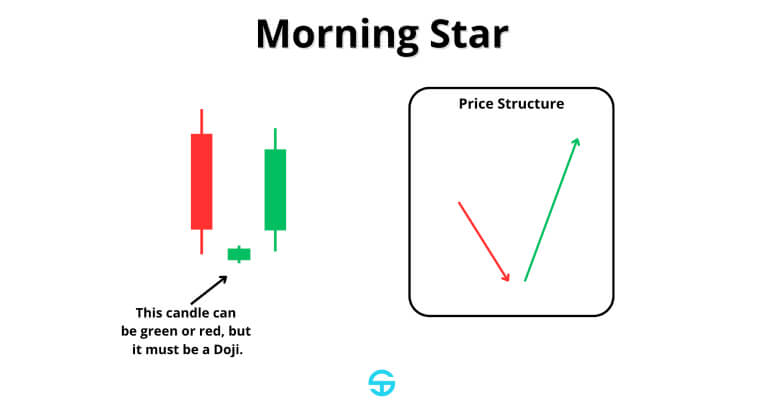

The Morning Star is a three-candlestick pattern that starts with a long, bearish candle. The body of the second candlestick is very tiny and indicates indecision among market players. The third candle is a long bullish candle that closes at least halfway into the first candle’s body.

How to Trade: Prefer formations at support levels or when other indicators like the RSI suggest oversold conditions. Buy the asset only after the third candlestick closes. The stop-loss level should be right below the lowest price of the pattern.

Success Rate: Around 65-70%. It tends to perform better on daily timeframes.

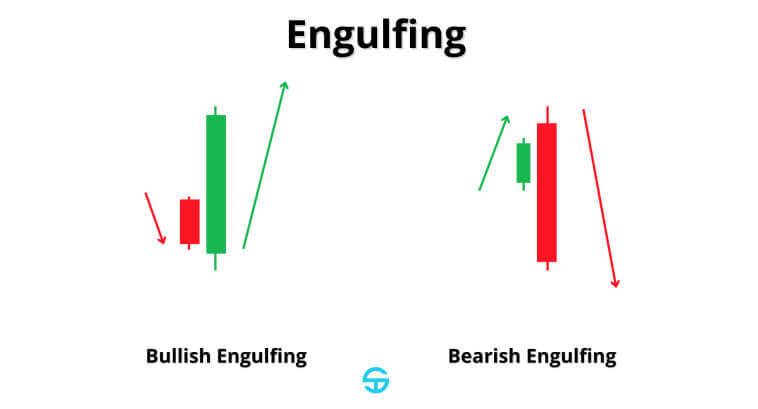

The Engulfing can be either a bullish reversal pattern or a bearish one. It forms when a candle completely engulfs the preceding candlestick, indicating a strong shift in price control.

How to Trade: Use an indicator like the RSI for confirmation of the reversal pattern by assessing oversold or overbought conditions. Pay close attention to the volume behind the formation of the second candle. A larger-than-average volume is a good sign of widespread participation.

Success Rate: 62% for the Bullish Engulfing. The Bearish Engulfing Pattern comes with a higher rate at around 80%.

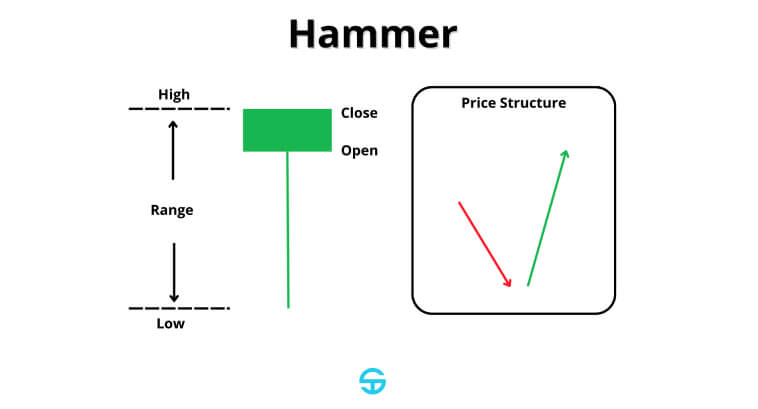

The Hammer pattern is a Bullish Pattern made up of one candlestick with a small body and a long lower shadow. It shows possible signs of exhaustion of the dominant trend, indicating that although bears were able to push prices down, bulls have gained enough strength to bring them back up close to the opening level of the period.

How to Trade: Candles resembling hammers appear all the time in a price chart. To confirm that you are in front of a Hammer Pattern, ensure that the candle appears around relevant support levels or at least when there is another indicator suggesting that the asset is under oversold conditions. Analyzing context is extremely important to avoid encountering a hammer-like candle mid-trend. The entry is right above the Hammer’s high or above the following candle’s high if it confirms the reversal. The stop-loss level is at the bottom of the Hammer’s lowest point.

Success Rate: 60-65%, according to some studies.

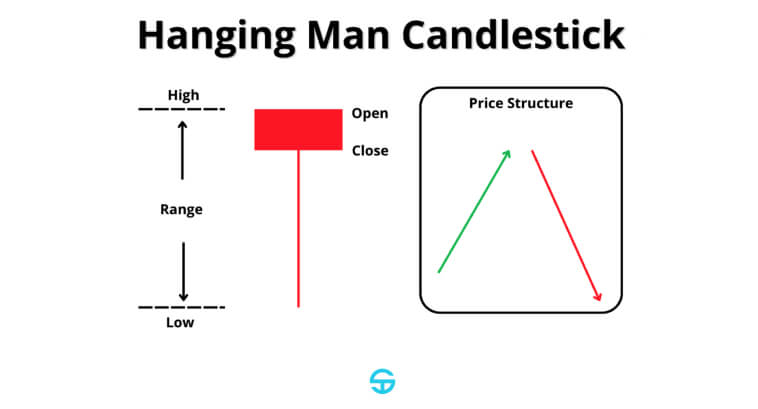

This pattern is the Bearish equivalent of the Hammer pattern. It appears during uptrends and is more relevant when it appears around resistance levels or when indicators point towards overbought conditions.

How to Trade: Confirm overbought conditions with indicators like the RSI or Stochastic. Volume spikes also help avoid false signals. The entry-level is right below the candle’s low or below the next candle’s low if it confirms the bearish momentum. Stop-loss should be above the Hanging Man’s high.

Success Rate: 55-60%.

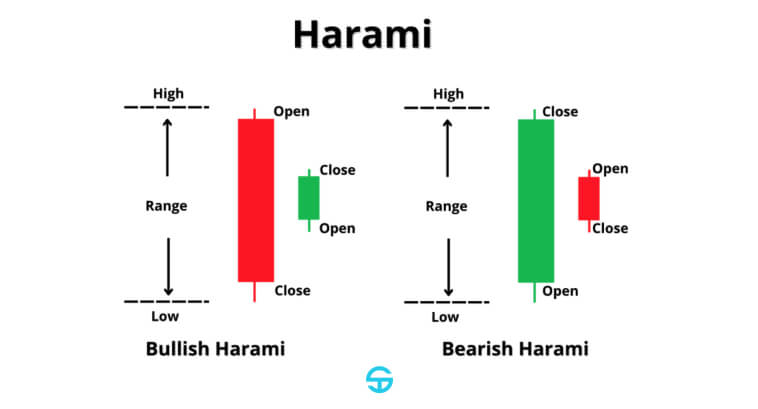

The Harami pattern is formed by two candlesticks. The first candle has a large body that can be either bullish or bearish. The second candle, more compact, must open and close within the body of the previous one. Psychologically, this pattern represents the waning momentum of the current trend and an increase of interest by the counterparty.

How to Trade: Additional indicators must be used for confirmation. This pattern can be quite powerful around key support/resistance levels or near relevant moving averages like the 200-day SMA. The entry-level can be the low/high of the smaller candle of the pattern, depending on whether it is a bullish or bearish harami pattern. The stop-loss level is at the low/high of the larger candlestick.

Success Rate: Around 52-60%.

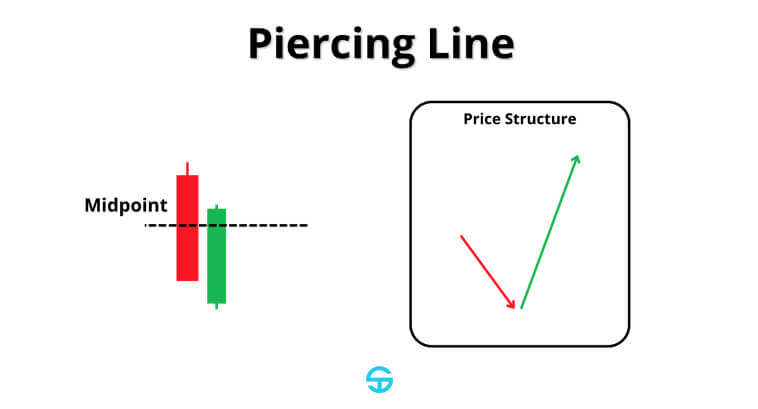

The Piercing Line is a bullish pattern that involves a green or white candlestick opening below the lower level of a red or black candlestick and closing above its midpoint.

How to Trade: Go long when the pattern completes and set a stop-loss right below the bearish candle’s lowest price.

Success Rate: 64-72%, according to some sources, with higher success rates when accompanied by a spike in trading volume and formed around support zones to confirm the reversal pattern.

Even though some candlestick patterns offer higher rates of success, some other patterns come with a larger number of limitations. Some of these patterns are easier to find on a daily basis, but you should definitely give a bit more thought before trusting them entirely.

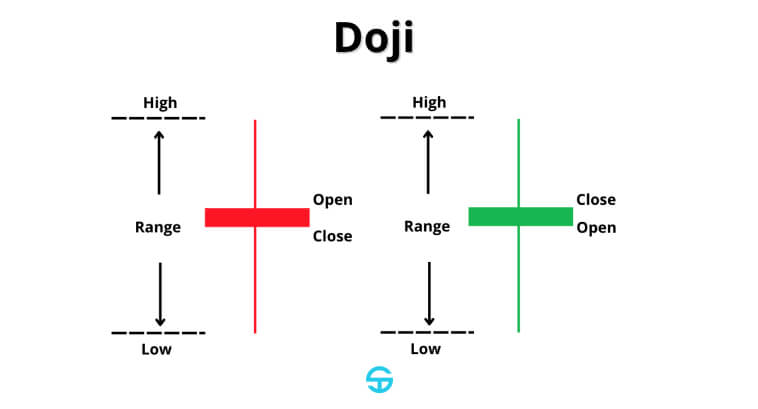

The Doji represents indecision between market players. Prices close near the opening level, showing that neither the Bulls nor Bears were able to “win” that candle.

Dojis, however, are quite frequent on a price chart, leaving a lot of space for false signals. They work best once you combine them with other indicators to help you assess the conditions of entering the trade. Dojis tend to be more reliable when they appear around support/resistance levels, where they’re more effective in indicating bullish reversal or bearish reversal.

How to Trade: If a Doji appears near a support level, the RSI indicates the asset is under overbought conditions, and a surge in volume appears, then you would have good reasons to buy at the high of the Doji, setting the stop-loss right below its lower price. The opposite logic would be applied when it appears near a resistance level.

Limitations: If analyzed in isolation, there is a high chance of false flags.

Enhancements: Use Bollinger Bands to watch closely for dynamic support and resistance levels. Dojis around the extremes of the bands might indicate good opportunities for pullbacks or trend reversals.

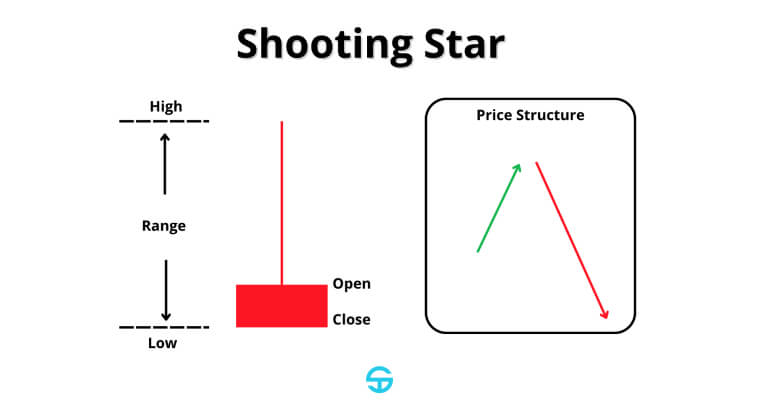

The Shooting Star is a bearish reversal candlestick pattern that features a tiny body and a prolonged upper shadow. It reflects that there might be an exhaustion in the buying momentum at the peak of an uptrend.

Similarly to the Doji, it also appears mid-trend, making it unreliable in isolation.

How to Trade: Go short when prices cross below the Shooting Star’s low and set the stop-loss above its high.

Limitations: Unreliable in isolation, with many false signals appearing mid-trend.

Enhancements: During uptrends, try to find key resistance levels and stay vigilant. Shooting Stars around these levels have more power to reverse the trend.

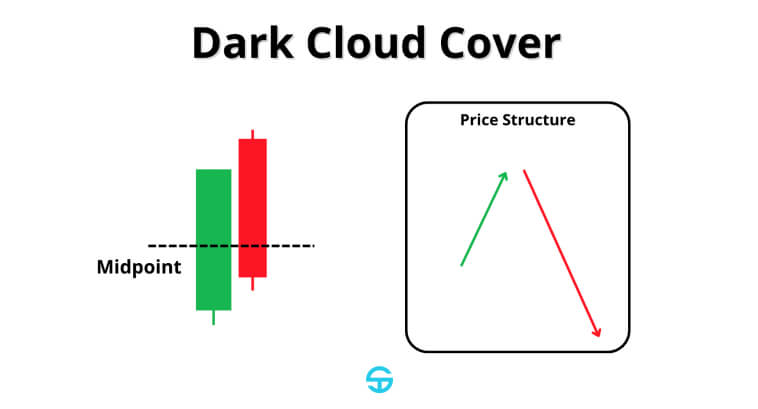

The Dark Clouds form a bearish reversal pattern that includes an initial large bullish candle followed by a black or red candle that gaps above the first candle of the pattern and closes below its midpoint.

Psychologically, the Dark Clouds represent an intense shift in momentum, with bearish forces overwhelming bullish forces at the highest point of an uptrend.

How to Trade: Go short right after the bearish candle closes below the midpoint of the first one. The stop-loss should be right above the high of the first candle or the high of the pattern.

Limitations: Dark Clouds are more efficient when there is a clear, strong, bullish trend. Avoid low-volatility markets and always use trading volume to confirm participation in the pattern.

To enhance the effectiveness of trading with patterns of candlesticks, you can use a checklist to validate their strength and confidence scores. One example could be:

• Does the pattern appear to be around important supply and demand zones, where prices might find either a support or a resistance force? (You can either focus on previous supply and demand zones, use the extremes of the Bollinger Bands, or even moving averages to find relevant points where prices might encounter opposite momentum)

• Is the pattern backed by an increase in trading volume? Is the volume higher than average? (Apply a moving average on the volume chart)

• Are there any further corroboration of the signal coming from additional tools? (Use RSI to identify overbought or oversold levels)

Candlesticks are adaptable to several trading styles and timeframes. For scalpers, short-term price charts can offer several opportunities–although candlestick patterns do lose a lot of their reliability in intraday setups, making it essential to use additional tools. Long-term investors and swing traders who prioritize daily and weekly charts can place further confidence in the patterns they encounter. Ensure you understand the different types of stock trading and how candlestick patterns trading has to be adapted to each timeframe.

You can’t go far without robust risk management. Place stop-loss levels according to the characteristics of each candlestick formation. Don’t expose more than 2% of the total account on a single operation.

Mix candlestick formations with additional techniques like trendlines, moving averages, trading volume, RSI, and Bollinger Bands to validate the robustness of the pattern and whether there is enough market context for it to be effective.

Avoid over-relying on a sole pattern of candlesticks. Don’t chase trades. Always stay vigilant of emotions that can lead to losses: fear and greed.

Reversal candlestick patterns are extremely useful to spot market shifts and changes in the dynamics between supply and demand.

When used within the context of support, resistance, and additional confirmation from technical analysis, patterns like the bullish harami pattern, bearish engulfing pattern, and others can effectively pinpoint shifts in directional momentum, giving you the chance to enter a new trend early on.

Combine candlestick pattern trading with robust risk management strategies, define clear stop-losses, and use extra tools for validation. Adapt your strategies to different timeframes and stay vigilant of your own emotions to avoid chasing trades. Mastering these patterns is all about consistently trading them with patience, focusing on learning from past mistakes, and learning how to optimize them for better performance.

What are reversal candlestick patterns, and why are they important?

These are figure formations on price charts that indicate a possible switch in direction. They are important because they help anticipate the rise of a new market trend, allowing you to find smart price levels for entering and exiting trades.

How do these patterns reflect the psychology behind price action?

Each candle illustrates the never-ending competition between upward and downward market pressures. Figures like the Shooting Star reflect buyer exhaustion, while figures like the Hammer illustrate the weakening strength of sellers. These figures imprint fear, greed, and indecision from those participating in price dynamics.

Can I trade using only candlestick patterns?

Candlesticks can give us a lot of awareness about price dynamics, but they are erratic without a broader context. Technical tools like the RSI, moving averages, and volume analysis can help you pinpoint the moments where these figures are most relevant.

Which timeframes are best for identifying candlestick patterns?

You can use any timeframe you prefer, but you can have more confidence in candlestick figures when they appear on higher timeframes like daily and weekly charts. Shorter timeframes, such as intraday charts, often generate false flags and require additional validation tools and strict risk management.

What role does volume play in candlestick pattern analysis?

Volume is extremely important for validating the figures we have studied. Higher-than-average volume suggests that there is strong interest and participation, increasing the likelihood of successful analyses.

How do I confirm the validity of a figure before entering a trade?

Use a checklist to confirm if:

1. The formation appears near an important resistance level or support zone.

2.The trading volume higher than average.

3.There is signs from other indicators like MACD or RSI.

What are the limitations of reversal candlestick patterns?

Limitations include

1. They can generate false signals, especially during low-volume or consolidating markets.

2. They are less trustworthy when not aligned with trends and/or key price levels.

3. Short-term patterns can be misleading without further validation from other techniques or indicators.

Can candlestick patterns be used across different markets?

Yes, they are versatile and can be applied to several other markets, including stocks, Forex, commodities, and cryptocurrencies.

How do I manage exposure when trading these patterns?

Define your stop-loss levels based on the figure’s structure (e.g., below the low of a Hammer or above the high of a Shooting Star). Don’t risk more than 2% of your account on a single trade, and confirm the signal with extra indicators.

Can candlestick patterns be used for long-term investing?

Yes, candlestick patterns are effective for long-term investing, especially on daily, weekly, or even monthly charts. They help investors identify potential entry points during reversals or periods of consolidation.

Are reversal candlestick patterns suitable for beginners?

Reversal candlestick patterns are an excellent starting point for beginners due to their visual clarity and straightforward interpretation. It’s highly crucial, however, to practice using them in demo accounts and study their application in combination with other indicators to get a deeper sense of how they work and avoid common mistakes.